California Faces Decisive 2012

JAN. 4, 2012

It’s fun to gloat about our great weather when calling freezing relatives Back East on New Year’s Day. And some good things are keeping the sun shining this year.

Silicon Valley’s global technology dominance will continue in 2012. Despite the foolishness of the state, if you’re a young computer code jock from any corner of the world, Californy is still is the place you ought to be. Silicon gold. Transistor tea. Swimming pools. Entrepreneur stars. Billionaires.

It’s like Detroit was for a young engineer in the 1920s. Or Edwards Air Force Base for test pilots in the 1950s. Or Hollywood at any time for a starlet.

If that’s the place to be, then you don’t care about the government, the taxes, the regulations. Nowadays, you can run a computer business from a laptop at Starbucks while living out of your 1999 Corolla.

Indeed, the silicon boom well could bring in so much tax cash in 2012 that the calls for a tax increase will be a lot harder to make come November.

Time of Troubles

But California in 2012 also faces so many problems that many folks will break out the parkas and head for the Bad Weather States to find work.

For the good news, the record $13 billion tax increase departed Gov. Arnold Schwarzenegger signed into law in 2009 expired in 2011. It’s not returning in 2012. Although voters might approve a new tax for 2013.

The Schwarzenegger tax certainly is part of the reason why unemployment in California rose from 10.1 percent in January 2009, the month before the tax increase, to 12.5 percent in December 2010 — a 2.4 percentage-point increase.

But in January 2011, the tax increases began to fall off. In that month, Schwarzenegger’s income tax increase expired. In July, the sales tax increase expired.

That’s much of the reason why, in 2011, things got better as the tax receded. The unemployment rate fell steadily throughout the year, from 12.4 percent in January 2011 to 11.3 percent in November 2011, the latest month available.

True, the national economy improved as well, partly because of the new payroll tax cut that was just extended. But California’s unemployment, although still second-highest in the nation after Nevada, improved faster.

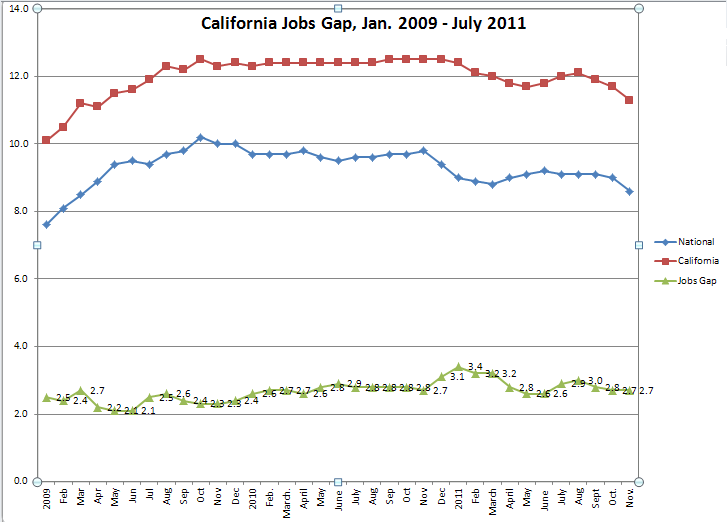

This is shown in the following graph. It uses the “Jobs Gap” calculation I came up with two years ago. Notice the green line at the bottom.

Receding ‘Jobs Gap’

In January 2011, there was a 3.4 percentage-point “Jobs Gap,” as I call it, between California and the United States as a whole. U.S. unemployment was just 9 percent, but California’s was 12.4 percent — hence the Jobs Gap.

By November 2011, U.S. unemployment had dropped to 8.6 percent. But California’s had dropped to 11.3 percent. That produced a 2.7 percentage-point Jobs Gap for November.

That means our unemployment rate improved 0.7 percentage-point faster than did the overall U.S. economy.

Throughout the year, Republicans in the Legislature remained solid, for once, in resisting tax increases pushed on them. In this case, the tax increases were advanced by Gov. Jerry Brown, the Democratic Legislature and the powerful government-worker unions.

Brown campaigned all year, pulling out every rhetorical trick for increasing taxes, such as calling his major anti-tax opponents the Four Horsemen of the Apocalypse (picture above).

Clearly, Californians enjoyed having a little more change jingling in their pockets. They used the money not just to buy more Christmas goodies for their kids. They also used it to feed their families. And some used it to invest in new business and jobs creation.

Clearly, Californians enjoyed having a little more change jingling in their pockets. They used the money not just to buy more Christmas goodies for their kids. They also used it to feed their families. And some used it to invest in new business and jobs creation.

For 2012, Californians know they will enjoy the whole year without a state tax increase. That’s the good news.

The bad news is that state tax increases hang over 2012 like the Sword of Damocles (pictured at right). And at the national level, no one knows who will be president in 12 months, or what his economic policies will be.

Short-Term Thinking

But as my colleague Steven Greenhut noted, if things continue to get a little better (but not a lot better), people likely will forget that state has some big structural problems.

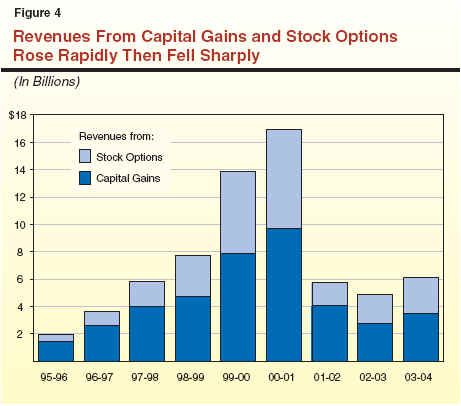

One is an over-reliance on the income and capital gains taxes that flow like Niagra Falls during boom times, but dry up during bad times. This was analyzed in a 2005 report by the Legislative Analyst, “Revenue Volatility in California.”

The following chart from the report shows what happened:

Note how tax revenues from both stock options and capital gains soared during the dot-com boom of the late 1990s, then crashed when the dot-com boom burned into the dot-com bust.

The chart stops before something similar happened during the real-estate bubble of the mid-2000s, which burst in 2007.

The volatility shows the folly of increasing taxes on “the rich.” During boom times, that seems to work. The Silicon Valley boys rake in the cash. The government skims off 10.3 percent of it — or 12.3 percent if Brown’s proposed new tax increase is enacted. The state then blows all the money.

Then the stock market crashes, as in the dot-com crash, and the revenues stop flowing in. But the spending remains at the high level from the boom. Then calls for more tax increases flow in.

This volatility often is used as a reason to attack Proposition 13, which limits increases in property taxes to 2 percent per year. Usually this comes in the form of pushing for a “split roll” on property taxes, with Prop. 13 applying only to home ownership, not business property.

The argument is that soaking business property is a lot more stable than relying on the ups and downs of the stock portfolios of Silicon Valley gearheads.

But once Prop. 13 is breached for business property, it soon would be breached for wealthy homeowners, then for everyone. Prop. 13 remains the bulwark of tax sanity in a state otherwise locked in an asylum basement.

Overspending

But the real problem is not that, in each boom, the state overspent. Governors, legislators and the powerful government-workers unions never learn. They always assume that the good times will continue rolling forever.

During the height of the dot-com boom, Gov. Gray Davis increased general-fund spending 15 percent in fiscal 1999-2000 and another 15 percent in 2000-01. And during the height of the real estate bubble, Gov. Arnold Schwarzenegger increased general-fund spending 15 percent for fiscal 2005-06 and another 10 percent for 2006-07.

If we have even a modest recovery in 2012, there’s every reason to believe that Gov. Jerry Brown will spend all of it, too, putting nothing away for a rainy day — or a bust. He blew his chance a year ago to put California’s fiscal house in order. He should have pushed for a state version of the flat-tax he proposed in his 1992 presidential bid, a restoration of the Gann Limit on spending he championed 30 years ago, or both.

Fortunately, a spending limit similar to Gann is being advanced and could be on the November ballot.

Brown wasted 2011 on his tax-increase obsession. And he is planning on doing the same in 2012. His State of the State address and budget proposal this month will be geared to push his tax increase.

Tax Increase 2012?

For political junkies, in addition to the presidential election, 2012 looks to be a battle royale on tax increases in California. Not just Brown, but several others are pushing new assaults on taxpayers.

Brown wants $7 billion for schools and public safety.

There’s the Think Long committee’s short-sighted proposal to boost taxes $10 billion, combined with some reform of the tax structure to address revenue volatility. Made up of billionaires, the committee might better spend its time reviving, and booking a gig on, “Lifestyles of the Rich and Famous.”

Molly Munger wants $10 billion for education and deficit reduction.

And the California Federation of Teachers is seeking a $6 billion tax on millionaires.

There will be others.

Maybe the millionaires and billionaires who favor tax increases should just cough up the cash voluntarily and spare the rest of us an election and higher taxes on the middle class.

More Cuts Needed

What often is overlooked is that more waste easily could be a wrung from the wasteful state budget. Start with cutting all the über–Politically Correct college and university courses that cost millions while advancing anti-intellectualism on campus, as Stan Brin described last week.

And the Cal State system is so top-heavy that it actually has more administrators than professors. Reports Michael Barone:

“Take the California State University system, the second tier in that state’s public higher education. Between 1975 and 2008, the number of full-time faculty members rose by 3 percent, to 12,019 positions. During those same years, the number of administrators rose 221 percent, to 12,183. That’s right: There are more administrators than teachers at Cal State now.”

Forced to slash budgets, Cal State, instead of cutting administrative bloat, increased student tuition 9 percent.

No wonder kids are graduating college with $100,000 or more in debt. It’s party time for administrators but indentured servitude for the student-serfs — who also must pay high taxes if they remain in the state. What a racket.

Next, pension reform is essential — and not just the tinkering around the edges proposed by Gov. Brown.

As the latest Stanford University study shows, the state’s pension liability has soared to $497.9 billion. Unless something is done to cut that amount, even taxing millionaires 100 percent won’t be enough to reduce budget deficits.

Schools for Scandal

And something needs to be done about the state’s failing schools, which score close to the bottom on standardized tests. For example, on the 2011 National Assessment of Educational Progress, California scored 46th among the states in fourth-grade reading, 49th for eight-grade reading, 46th on fourth-grade math and 48th on eight-grade math.

For the high-tech center of the universe, that’s just appalling. If the state had its act together, it would act like the owner of an 0-16 NFL team and fire the whole management. But teacher and administrator contracts don’t allow that.

Still, some reforms are advancing. Charter schools remain popular. And my friend Martha Montelongo has featured several reformers on her Gadfly Radio show, Tuesday nights at 8:00 pm on LaTalkRadio.com, in which I usually participate.

Martha recently featured Yolie Flores, a former reform member of the school board of the Los Angeles Unified School District. Flores now is CEO of Communities for Teaching Excellence, which promotes putting parents and kids ahead of unions and administrators, while emphasizing effective teaching.

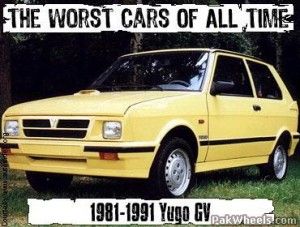

All of the major tax-increase proposals are aimed at boosting school spending. But with the schools so broken, it’s like buying used Yugo and installing a new digital navigation system in it.

All of the major tax-increase proposals are aimed at boosting school spending. But with the schools so broken, it’s like buying used Yugo and installing a new digital navigation system in it.

Moreover, despite claims to the contrary, California school spending has risen in recent years. A 2010 Pepperdine University study showed that school spending actually soared 21 percent from fiscal 2003-04 to 2008-09.

And the extra money went for administrators, not teachers. For example, in 2008-09, Oakland Unified spent a generous $12,946 per pupil. But just 35 percent of that went to classroom instruction, with 65 percent going to administration.

The schools have administered programs to get kids off junk food and slim down. But it’s the schools themselves that are gorged with fat administrative staffs.

As with colleges and universities, wasteful administration has devoured budgets. More taxes would only feed the beast.

Perhaps 2012 will be the year that reforms by Flores and others will be demanded by parents and forced on sclerotic school systems.

The Radiant Future

California is supposed to lead the world into a Radiant Future, to use a Leninist phrase. That certainly was the boosterism promoted by Gov. Schwarzenegger as he “terminated” the state’s problems by making them worse. Well, at least that poseur is gone. But under him, California’s middle class shrank to less than half the population, as the state nosedived toward Third World status.

The problem in 2012 is that the state government, like the U.S. government, is refusing to acknowledge that its past mistakes have caused today’s discontent. Past budget splurges should require whatever budget cuts are necessary to get out of the red and back to the black. Taxes should be streamlined along the lines of Art Laffer’s flat-tax idea.

Instead, the state is stuck in a “Back to the Future” nightmare in which a revanchist Gov. Brown tries to recreate the Atari Democrat technofuturism of his salad days as governor three decades ago.

But the reality of the here and now in 2012 is of most Californians struggling to keep a grip on middle-class hopes and dreams as the government keeps pounding them down into the ranks of the unemployed and the homeless.

Related Articles

AG Brown Learns New Language

Katy Grimes: The Howard Jarvis Taxpayers Association won a decisive battle yesterday when a state judge ordered the ballot language

Ivanpah morphs into gas-solar hybrid

This is Part 2 of a two-part series on the Ivanpah solar plant. Part 1 is here. As its name implies, the Ivanpah

With move to ‘Super Tuesday,’ California looks to increase influence on presidential primary

In an effort to bolster its relevance during the next presidential election, Gov. Jerry Brown has signed a new law