San Jose State Foundation Filed Fraudulent Tax Returns

By JOHN HRABE

A California State University foundation has filed fraudulent tax returns for three consecutive years, potentially jeopardizing the organization’s tax-exempt status, with the potential of criminal penalties for several university personnel, a CalWatchDog.com investigation has found.

The Tower Foundation of San Jose State University on federal tax returns for 2007, 2008 and 2009 reported zero compensation paid by the organization or any related organizations to more than a half dozen high-ranking university personnel, including the college’s president, provost, athletic director and several vice-presidents.

Associate Vice President for Public Affairs Larry Carr failed to respond to CalWatchDog.com’s request for the compensation data of university employees during the periods in question. Several documents, including a meeting agenda from the Cal State Board of Trustees, confirm that at least two employees received compensation from the university during that period in direct refutation of the tax returns.

Effective August 1, 2008, the Cal State Board of Trustees approved a salary and benefits package for then-SJSU President Jon Whitmore that included: a base pay of $328,209, an annual supplement of $25,000 from foundation sources, free housing at the university’s presidential residence, $18,775 for moving costs, $66,577 in escrow fees for the sale of his Texas residence, the choice of a university-owned vehicle or an annual vehicle allowance of $1,000 per month, CalPERS retirement benefits, an annual medical physical examination, top-of-the-line health plan, insurance programs, vacation and sick leave accruals and eligibility for the system’s transitional program for university presidents.

Despite all of these benefits provided by the university, the Tower Foundation reported that Whitmore received no compensation from the foundation or related organizations. The omission appears to be a direct effort to mislead the public as one of the benefits, the $25,000 supplemental bonus, was paid directly from foundation funds. A May 2010 San Jose Mercury News report also confirms that, “Whitmore was paid $328,209 with a $25,000 annual supplement from foundation sources.”

In addition to Whitmore, CalWatchDog.com has confirmed that Dr. Carmen Sigler received an annual salary of $240,000, effective July 1, 2008. As with Whitmore, foundation tax documents did not list any compensation for Sigler.

Compensation from Related Organizations

According to the 2009 IRS Instructions for Form 990, nonprofit executives are required to disclose compensation from the organization and related organizations. “Related organization can include nonprofit organizations… governmental units and other government entities,” the instructions read.

It would appear self-evident that the Tower Foundation of San Jose State University is related to the university. Should there be any dispute of the foundation’s awareness of the relatedness, on Page 2 of Form 990 the group stated: “The Tower Foundation of San Jose State University is organized exclusively for educational purposes of promoting and advancing the objectives of San Jose State University.”

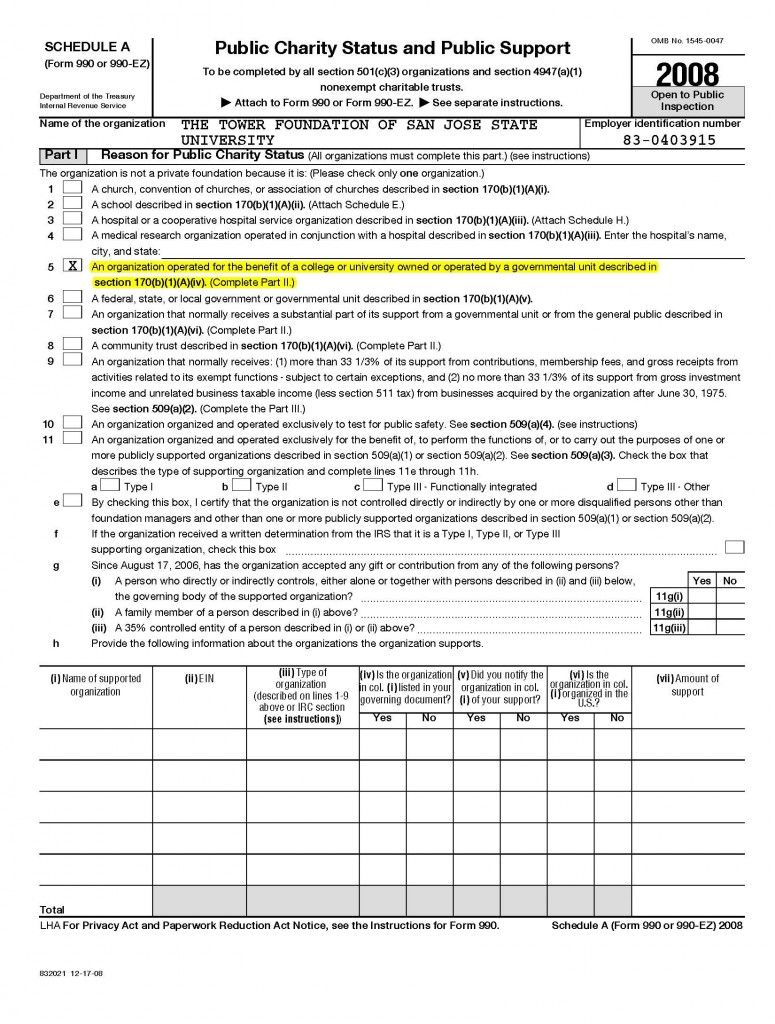

On Schedule A Part I: Reason for Public Charity Status, the group checked Box 5, “An organization operated for the benefit of a college or university owned or operated by a governmental unit described in section 170(b)(1)(A)(iv).”

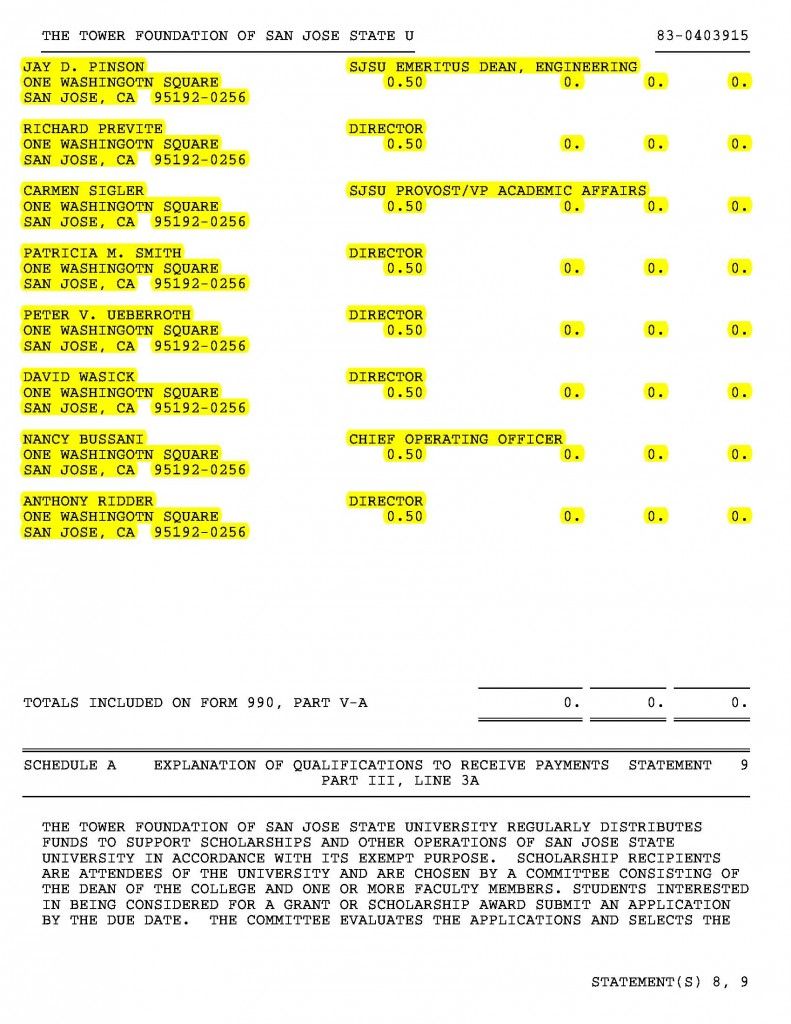

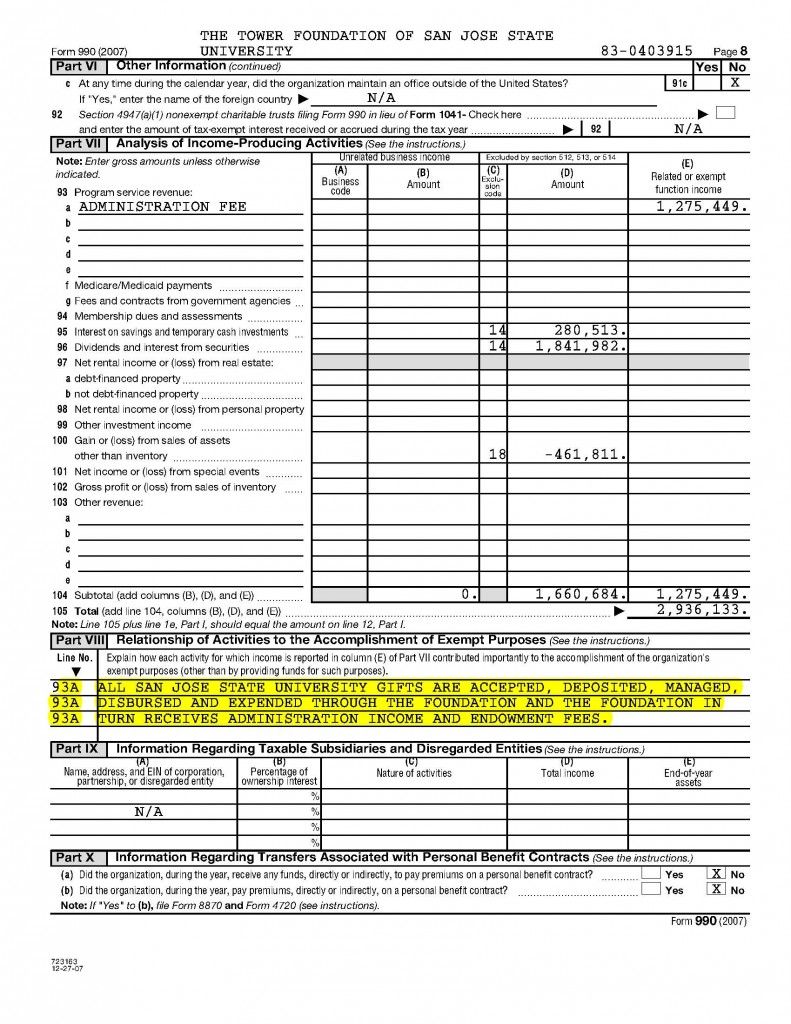

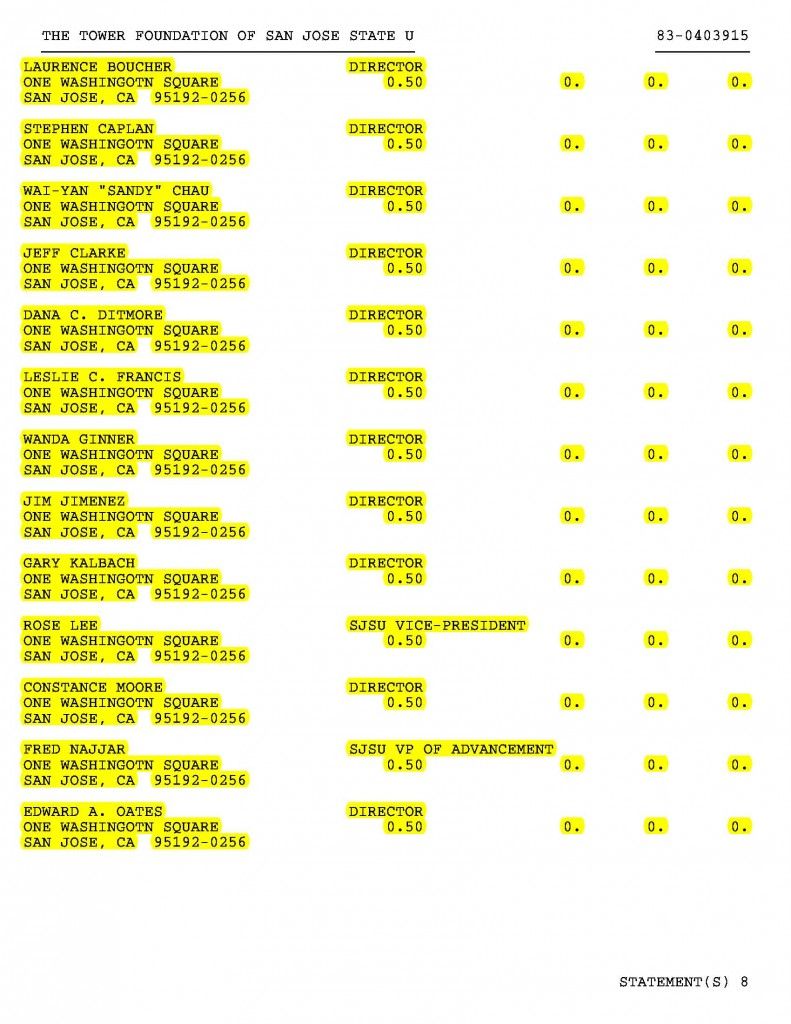

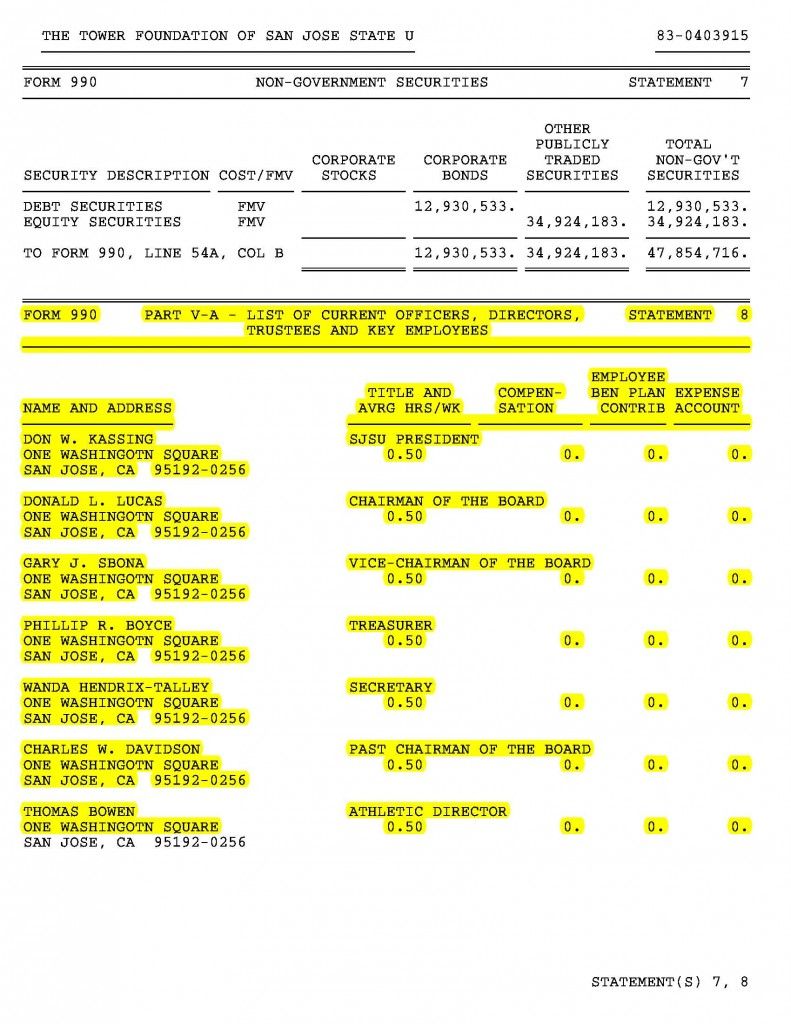

In 2007, at least seven college employees are listed as board members, trustees, directors or key employees of the foundation: Fred Najjar, SJSU vice president of advancement; Rose Lee, SJSU vice-president; Thomas Bowen, athletic director; Don Kassing, SJSU president; Jay Pinson, SJSU emeritus dean of engineering; Sigler, SJSU provost and vice president of academic affairs; and Nancy Bussani, Tower Foundation CEO. All are listed with zero compensation from the organization or related organizations.

Under Part V-A: Current Officers, Directors, Trustees, and Key Employees, the organization checked no in response to Box 75c, which requires organizations to disclose compensation from the organization and all related organizations. The question reads:

“Do any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated employees listed in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A, Part II-A or II-B, receive compensation from any other organizations, whether tax exempt or taxable, that are related to the organization? See the instructions for the definition of ‘related organization’.”

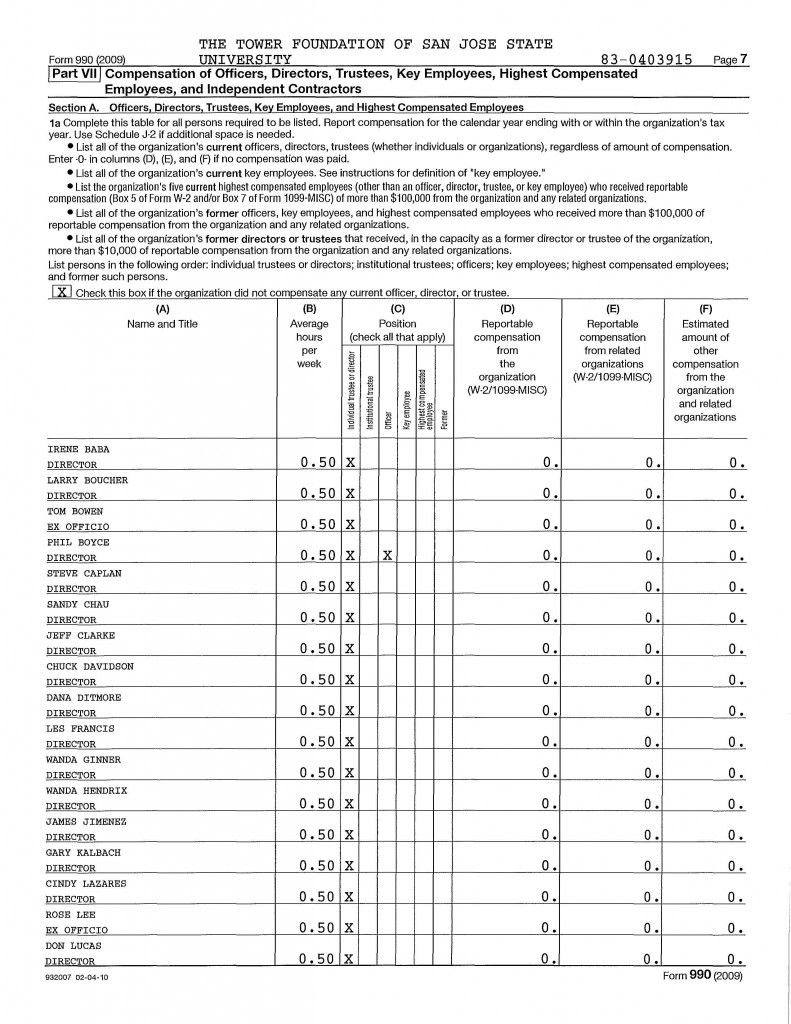

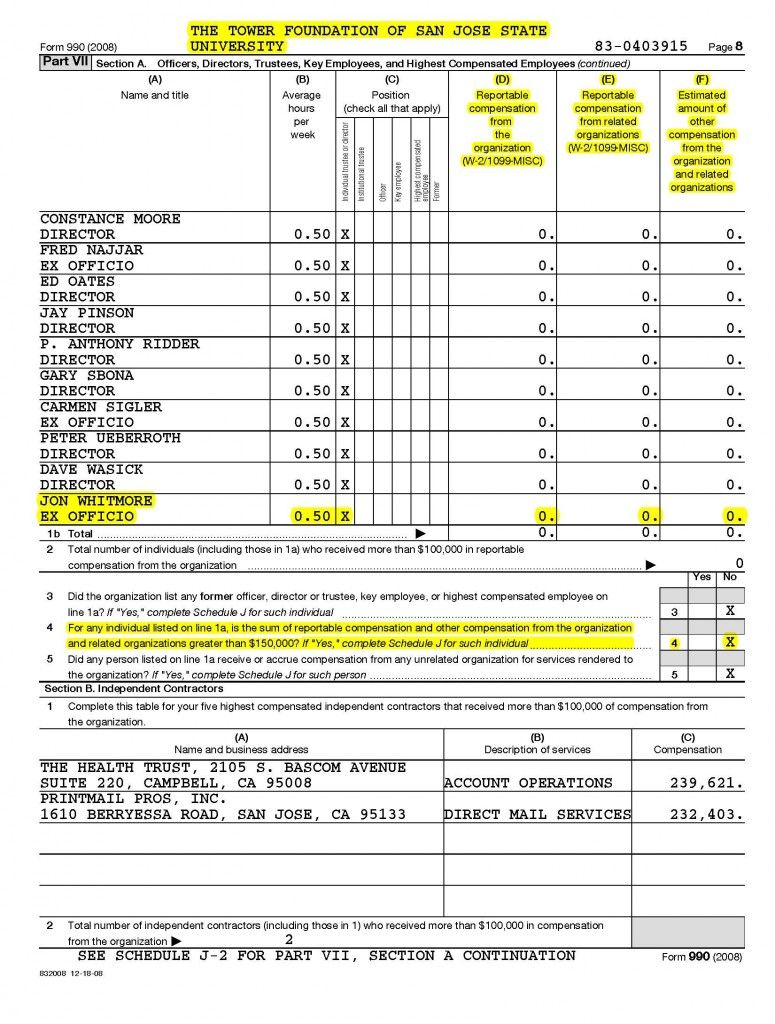

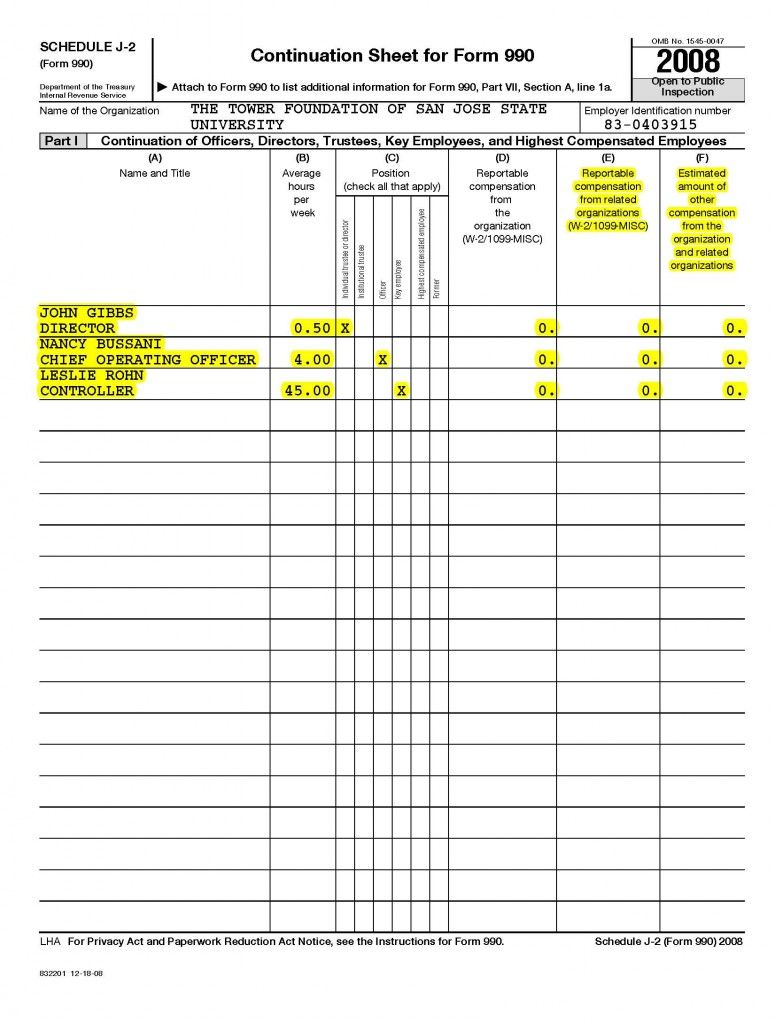

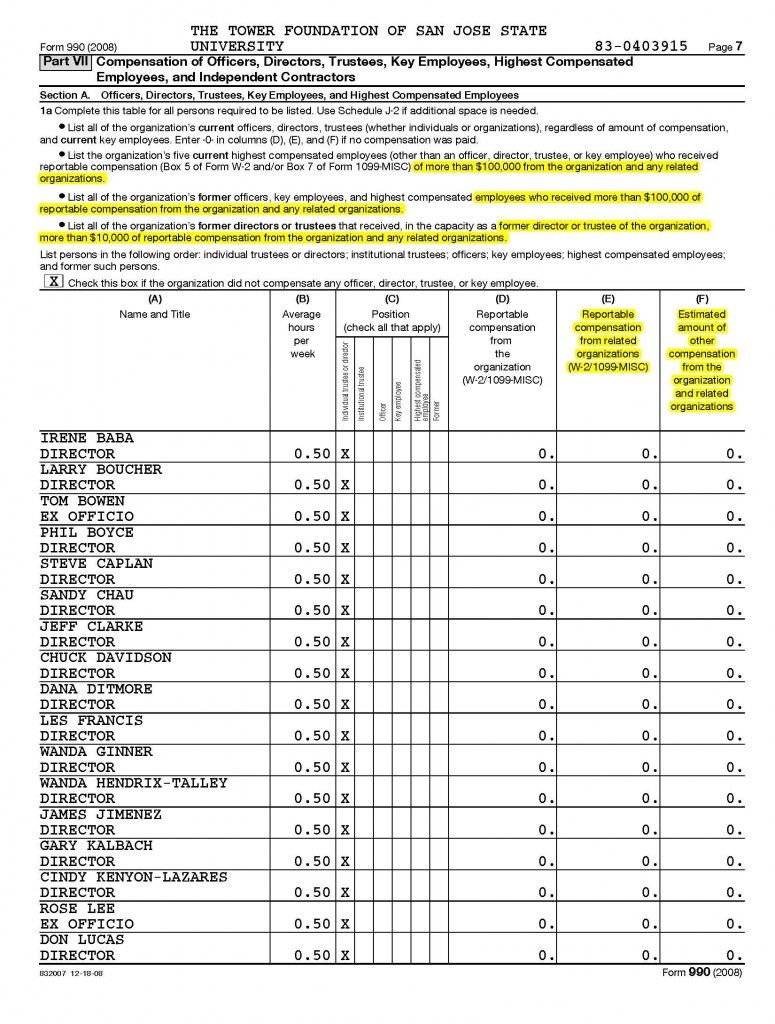

In 2008, the Tower Foundation again listed zero compensation for all members of the board. Under Part VII Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors, the organization was warned with three separate instructions of the requirement to disclose compensation from the organization and all related organizations:

* List the organization’s five current highest compensated employees (other than an officer, director, trustee, or key employee) who received reportable compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the organization and any related organizations.

* List all of the organization’s former officers, key employees, and highest compensated employees who received more than $100,000 of reportable compensation from the organization and any related organizations.

* List all of the organization’s former directors or trustees that received, in the capacity as a former director or trustee of the organization, more than $10,000 of reportable compensation from the organization and any related organizations.

In addition to the above instructions, two separate columns call for the disclosure of compensation from related organizations: Column E: Reportable compensation from related organizations (W-2/1099-MISC) and Column F: Estimated amount of other compensation from the organization and related organizations.

Najjar, Lee, Bowen, Pinson, Sigler and Bussani are again listed as members of the board or key employees. Additionally, two new university personnel are listed as having received zero compensation from the organization or related organization. Then-university President Whitmore is listed for the first time, after he replaced Kassing as college president. Leslie Rohn, the organization’s controller, is also indentified as a key employee who worked an average of 45 hours per week for the foundation.

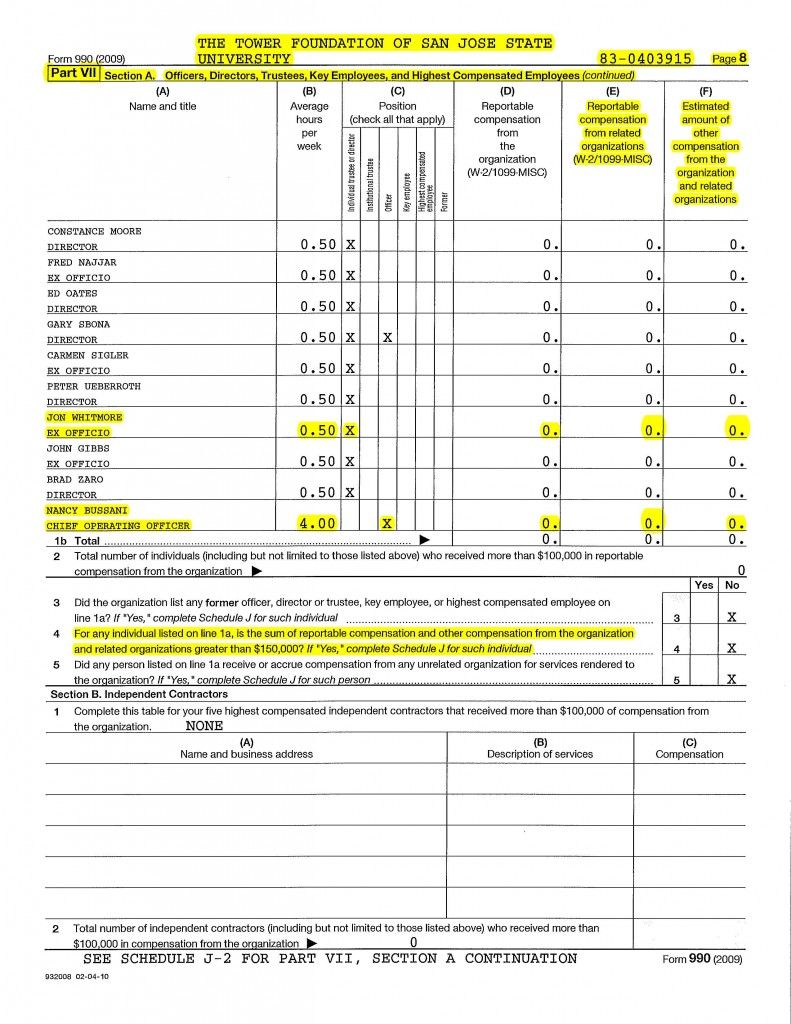

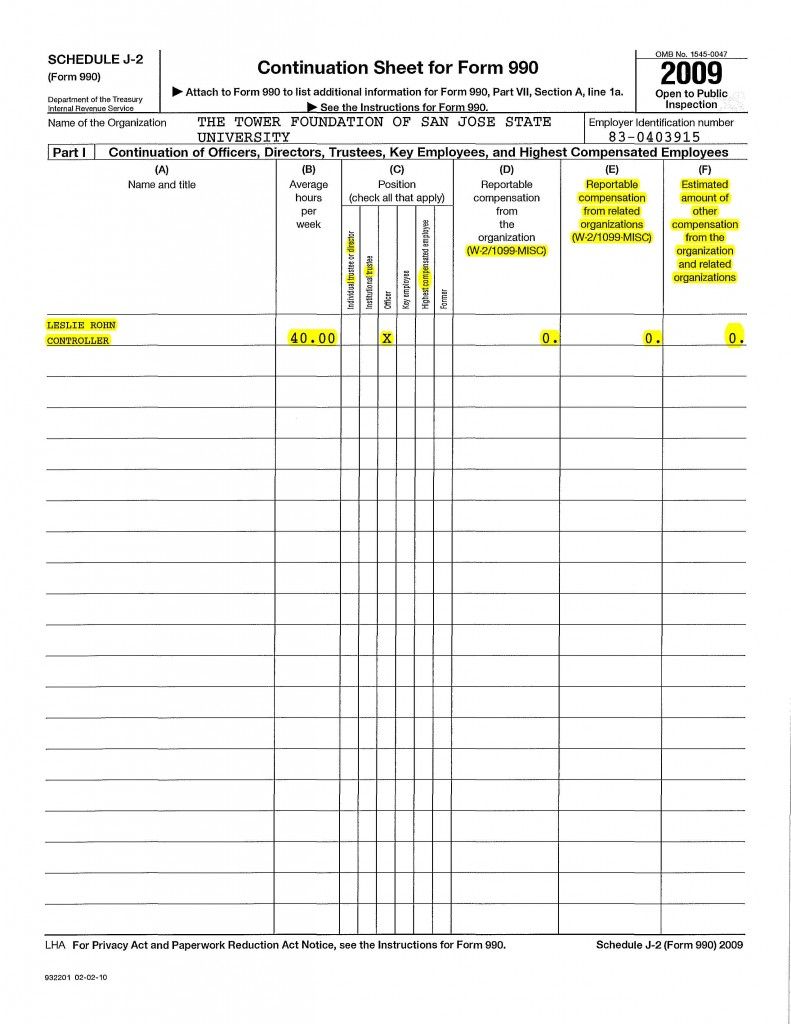

In 2009, Najjar, Lee, Bowen, Sigler, Bussani, Whitmore and Rohn all weare listed again as having received zero compensation from the organization or related organizations. Whitmore resigned as president in 2010 to take over as CEO of ACT, Inc.

Foundation Board Members Reviewed the Documents

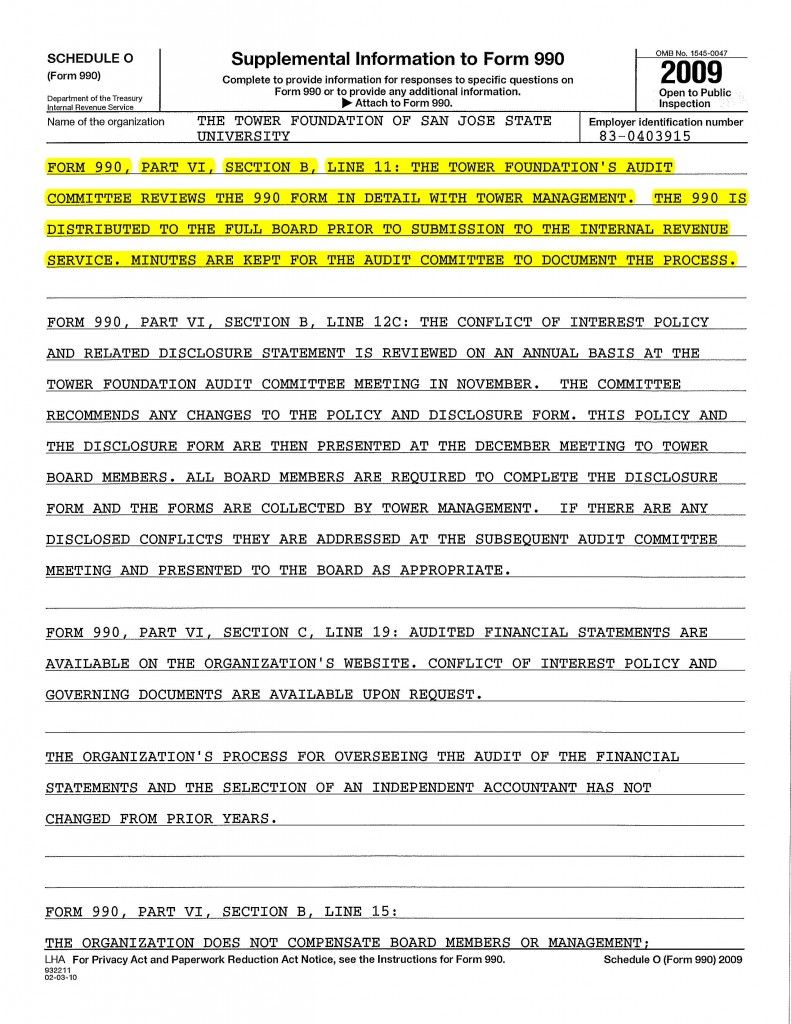

Schedule O of Form 990 describes in painstaking detail the foundation’s thorough review process before the 2009 tax return was submitted to the IRS:

“Form 990, Part VI, Section B, Line 11: The Tower Foundation’s audit committee reviews the 990 form in detail with tower management. The 990 is distributed to the full board prior to submission to the Internal Revenue Service. Minutes are kept for the audit committee to document the process.”

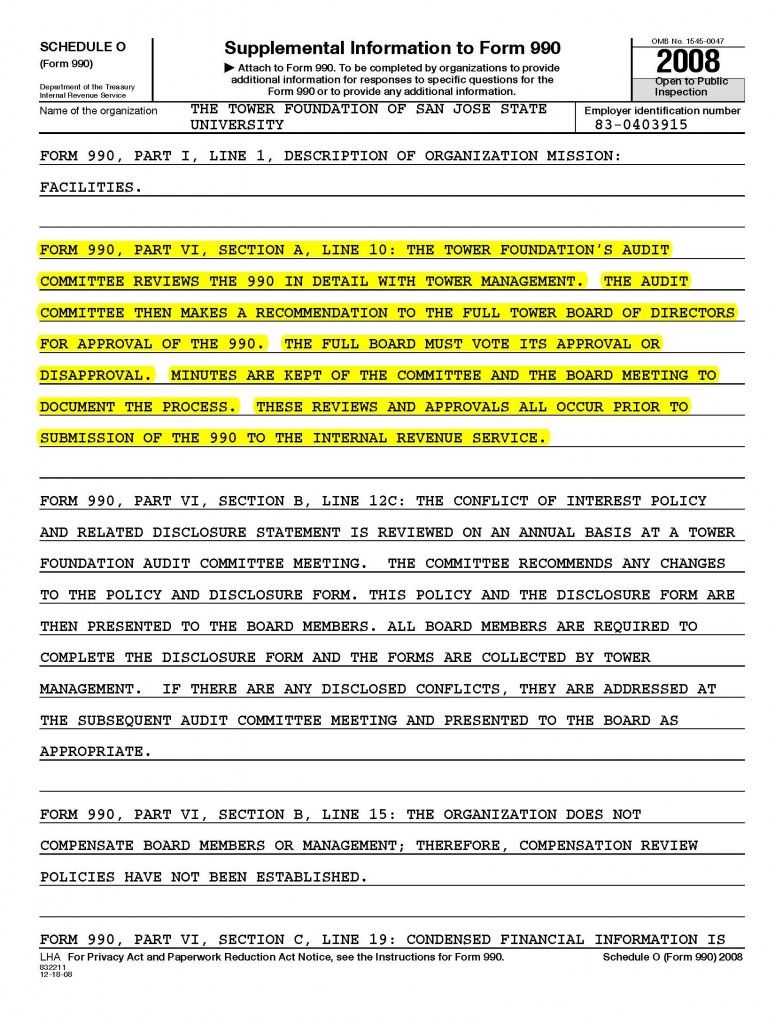

In 2008, the board described a similar review under Schedule O:

“On Form 990, Part VI, Section A, line 10: The Tower Foundation’s audit committee reviews the 990 in detail with Tower management. The audit committee then makes a recommendation to the full tower board of directors for approval of the 990. The full board must vote its approval or disapproval. Minutes are kept of the committee and the board meeting to document the process. These reviews and approvals all occur prior to submission of the 990 to the Internal Revenue Service.”

In 2009-10, the Tower Foundation’s board included luminaries in business, accounting, government and finance. Among the board’s directors: Les Francis, a senior executive with Washington Media Group and former chief of staff to U.S. Transportation Secretary Norman Mineta; Wanda Ginner, a semi-retired CPA; Wanda Hendrix, treasury manager with the East Bay Municipal Utilities District; Peter Ueberroth, former Major League Baseball commissioner and U.S. Olympic Committee chairman; Sigler, former San Jose State University provost; Gary Sbona, owner of the business recovery firm Regent Pacific Management Corporation; Cindy Lazares, the co-founder of the Shilling & Kenyon accounting firm; Edward Oates, a co-founder of Oracle Corporation; and Gary Kalbach, a founding partner of El Dorado Ventures.

Moreover, an outside accounting firm, Sensiba San Filippo, LLP, provided assistance with preparing the 2008 and 2009 tax returns. The firms describes itself as “one of the largest regional tax and accounting firms in the country.” In the company’s corporate brochure, it boasts of providing clients with “a clear understanding of the accounting and tax regulations and trends specific to their segment.”

Federal Tax Fraud Penalty: Three Years in Prison and a $250,000 Fine

Federal law imposes harsh penalties for “presenting” information that is “false as to any material matter” on a federal tax return. Title 26 USC § 7206 specifies penalties of up to three years in prison and a $250,000 fine for fraud and false statements. University personnel would have been aware that the information was false because they received hundreds of thousands of dollars every year in salary and benefits.

Foundation board members may also be liable as federal regulations stipulate that individuals may be charged “whether or not such falsity or fraud is with the knowledge or consent of the person authorized.”

According to the IRS, nonprofit organizations that fail to properly file tax returns for three consecutive years are subject to an automatic revocation of their tax-exempt status. “Section 6033(j) of the Internal Revenue Code automatically revokes the exemption of any organization that fails to satisfy its filing requirement for three consecutive years,” the IRS website explains.

San Jose State’s misleading executive compensation comes one day after the CSU Board of Trustees approved pay increases for the two new college presidents at Fullerton and East Bay. “I’m just sorry we can’t pay them more because of the policy we adopted,” CSU Trustee Roberta Achtenberg said at yesterday’s meeting, the Los Angeles Times reported. This week, the Cal State Chancellor’s Office also announced plans to close spring admissions at most campuses and reduce enrollment by 25,000 students because of budget cuts.

Last July, the board approved a new $400,000 annual base salary for the new president of San Diego State University, Elliot Hirshman, while simultaneously approving a new round of tuition hikes. However, CalWatchDog.com has reported extensively on how base salary is only a fraction of total executive compensation.

The San Jose State University Foundation is the third campus foundation to report one set of numbers to the IRS and another figure to the public. Earlier this month, CalWatchDog.com revealed that Cal State Los Angeles President James Rosser reported $515,612 in annual compensation to the IRS for the 2009-10 tax year. In at least five instances, Cal State officials have falsely claimed or implied Rosser’s compensation was nearly $200,000 less, or an annual base salary of $325,000.

This week, CalWatchDog.com first reported that the California State University Office of the Chancellor understated the annual compensation of San Francisco State University President Robert Corrigan by as much as $52,787.

On March 12, the California State University system falsely claimed to have received a 2012 Sunshine Award, which recognizes “the most transparent government websites in the nation.”

In 2004, Cal State tuition was $2,334 per year. This fall, incoming freshmen will fork over just under $6,000.

———————————————————

San Jose State Foundation Tax Documents:

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Related Articles

Lawmakers calling Gov. Brown’s bluff on Prop. 30 revenues

Jan. 8, 2013 By Katy Grimes On the first day of the new legislative session on Monday, two Republican lawmakers

Uncertain CA community colleges eye tuition cuts

Little was heard about president Barack Obama’s call, in his last State of the Union address, to make community college

Munger’s Tax Increase Doesn’t Add Up

MARCH 14, 2012 By WAYNE LUSVARDI Molly Munger’s proposed $10 billion school tax for the Nov. 2012 ballot had to