Willie Brown wants to gut Prop. 13

By Wayne Lusvardi

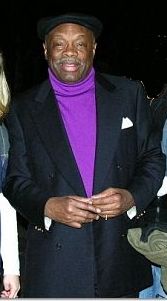

Willie Brown just reminded us why in 1990 voters passed term limits largely to move him out of his seat as California Assembly-Speaker-for-Life.

Brown wrote that Prop. 13 should be reformed by “cleverly” by making “a racehorse look like a donkey.” But Brown must take California homeowners and small business persons to be dumb mules. Everyone knows that you can’t make a racehorse out of a donkey.

Brown switched college majors from mathematics to a degree in political science. He should have stuck with the numbers. Reforming Prop. 13, the 1978 tax limitation measure, won’t favorably change the mathematics of property taxation for government. To the contrary, it is likely to make it worse. Even if Prop. 13 was reformed, it would likely result in lower property tax revenues for public schools and cities in a recession than if it was left alone.

In California, 97 percent of businesses are small businesses. They are being hammered with a 50 percent increase in the lowest-tier of electric rates from AB 32, 15 percent higher water rates, new storm water taxes in Los Angeles County and an Obamacare surcharge of $5,000 to $8,000 per employee. Eliminating Prop. 13 would be another hammer blow.

Businesses not escaping paying their fair share of taxes

Property owners should beware the misinformation in Willie Brown’s call for a split-roll property tax. Currently under Prop. 13, all property is reassessed in value only upon sale.

Under a split-roll tax, residential properties would continue under that system. But commercial properties would be reassessed at least every three years.

Brown infers that big corporations are getting away without paying their fair share of property taxes when they merely change title to commercial property. Brown is a lawyer and knows that merely changing a title is not considered a “transfer” or “sale” under existing law. And any changes to the law would likely end up being overturned by the courts, as they have in the past.

Proposition 13 is one of the most adjudicated laws in California history. A practical review of whether a property transfer meets the criteria of being considered a “sale” under Prop. 13 can be found here.

Brown’s goal is to change public perception

Then why do politicians like Willie Brown keep banging a loud drum in the media about commercial properties getting away with avoiding property reassessments by transferring “the stock in the company that owns the property”? And why does Brown continue to propagate the myth that property taxes disproportionately fall on homeowners instead of commercial property owners? The most impartial study conducted in California found that commercial properties pay more of their fair share of property taxes than residential properties.

Such facts don’t matter to politicians like Brown because their argument is for political purposes, not for rational argument. It is the symbol of wealthy big corporate commercial property owners being stingy that Brown wants to fabricate. A falsehood told often enough is often believed to be true. And the mainstream media no longer view their job as correcting the erroneous statements of those who are for raising taxes in California.

The apparent objective is to get a split roll property tax on the books even if it doesn’t raise revenues and mostly impacts small businesses. Once a split roll property tax is on the books, Willie Brown will again say that it is “unfair” that businesses have their property taxes reassessed every three years and residential properties do not. Then they will take a case through the courts calling for “tax fairness.” And legislators will shift the blame onto the courts for eliminating Prop. 13 protections for all residential properties.

Related Articles

Study lobbies for more spending

JUNE 28, 2010 By LAURA SUCHESKI A report released Thursday from the left-leaning California Budget Project spells bad news for

Another Taxing Tax Levy

JULY 22, 2010 By KATY GRIMES Senator Gloria Romero, D-Los Angeles, is sponsoring a tax bill that the California Chamber

Incentives eyed to spur job growth

Feb. 18, 2010 By KATY GRIMES In spite of the federal stimulus money invested in California, unemployment is still in