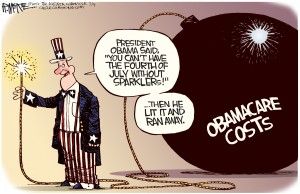

Obamacare grants exemptions for everyone but taxpayers

Feb. 5, 2013

By Katy Grimes

Obamacare is beginning to directly affect Californians’ wallets — and health. New regulations released last week from the Internal Revenue Service and the Department of Health and Human Services made it clear that spouses and children will get financially squeezed like your arm in the cuff of a blood-pressure machine. It’s all about the exemptions.

This occurs as California continues taking the lead in implementing Obamacare, officially called the Affordable Care Act. Its healthcare insurance “exchanges,” which are being set up by legislation signed by Gov. Arnold Schwarzenegger in 2010, serve as a model for exchanges in other states.

Now, according to a joint IRS/HHS statement, “Starting in 2014, the individual shared responsibility provision calls for each individual to have basic health insurance coverage (known as minimum essential coverage), qualify for an exemption, or make a shared responsibility payment when filing a federal income tax return.”

So if you sign up for a healthcare plan through an employer, you are exempted from participating in Obamacare. But if you have an employer plan available, and do not sign up, you will be taxed and penalized.

Who won’t pay

Just released is the Treasury Department’s summary of who won’t have to pay a fine if they refuse to buy federal Obamacare insurance. It is important to note that the Congressional Budget Office projects only 2 percent of Americans will actually pay the “mandatory” fine for non-participation.

According to the IRS, “Certain individuals who are not required to file an income tax return but who technically fall outside the statutory exemption for those with household income below the filing threshold.”

“HHS regulations also provide that the hardship exemption will be available on a case-by-case basis for individuals who face other unexpected personal or financial circumstances that prevent them from obtaining coverage.”

“The shared responsibility payment (IRS penalty) should not apply to any taxpayer for whom coverage is unaffordable, who has other good cause for going without coverage, or who goes without coverage for only a short time.”

IRS allowable exemptions

The proposed regulations also catalog the statute’s nine categories of individuals who are exempt from the shared responsibility payment:

* Individuals who cannot afford coverage;

* Taxpayers with income below the federal filing threshold;

* Members of Indian tribes;

* Hardship;

* Individuals who experience short coverage gaps;

* Religious conscience;

* Members of a health-care sharing ministry;

* Incarcerated individuals; and

* Individuals who are not lawfully present.

These exemptions leave only the working middle class, and those who pay income tax to pick up the tab.

Who doesn’t pay?

The half of Americans who do not pay federal income taxes will not be required to pay the “mandatory” IRS fine if they do not buy government health insurance.

Illegal aliens will not be fined.

And just in case anyone else was missed in the exemption list, the last paragraph was added to cover any other vulnerable group:

“The HHS regulations also provide that the hardship exemption will be available on a case-by-case basis for individuals who face other unexpected personal or financial circumstances that prevent them from obtaining coverage.”

“The U.S. incurred hundreds of thousands of dollars in costs, and thousands of hours of national tumult over the individual mandate, only to have it so gutted, it will now only impact 2 percent of the population,” Craig Gottwals told me; he’s an attorney and health insurance expert with BB&T–Liberty Benefit Insurances Services, Inc. “Also note that you can go without coverage for three months and not incur a fine. And one day of coverage equals a month. So really a person only needs coverage for 5 months plus one day. It makes you wonder why all that time and energy was wasted on the Supreme Court case.”

Gottwals explained how the federal health care law has been manipulated. The law now says that, as long as an employer keeps the employee’s portion of his single health care premium below 9.5 percent of the employee’s annual salary, such a portion is deemed “affordable.” However, according to Gottwals, many employers in California only contribute to the employee’s portion of the health plan premium, not for dependents who may also be on the company health plan.

Obamacare unfriendly to spouses

Gottwals said, “The question for employers and the insurance industry became, ‘What about a family of five?’”

Without being included in the employer’s contribution, the family health-care insurance coverage will be off the chart, leaving the spouse and kids to fend for themselves.

He added, “Furthermore, if the employee’s premium is deemed ‘affordable’ because it is below 9.5 percent of the employee’s W-2 wages, the non-working spouse and children will be denied access to federal subsidies to buy healthcare in the Exchanges. Hence, if the employer offers ‘unaffordable’ coverage to the spouse and kids, the spouse and kids are precluded from federal assistance.”

In a peculiar twist, earlier Obamacare regulations mandated that employers offer coverage to children, but declined to mandate that spouses be offered dependent coverage. For employers unwilling or unable to contribute to spousal healthcare, a family will be better off if the employer does not even offer healthcare to spouses at all. This is because, if the spouse is not offered healthcare, he or she can actually get a federal subsidy to buy coverage in an Obamacare exchange. Whereas, if the spouse is offered “unaffordable” coverage by an employer, the spouse is denied federal subsidy assistance. Employers are not mandated to cover spouses on insurance under Obamacare.

Marriage tax

The result will be astounding: “Family” units with a mom and dad may never marry, because if they remain separated, they will qualify for more federal assistance than the traditional nuclear family. Effectively, Obamacare imposes a marriage tax.

“All that a company has to do is make sure the health coverage is somewhat affordable for the employee, but the rest of the family is out in the cold,” Gottwals said. “This is essentially the same place we were before Obamacare was passed.”

In effect, the IRS regulations force the employee to buy insurance from the employer, or to have to pay the individual mandate penalty to the IRS.

For example, if the employer sets the employee’s total contribution under 9.5 percent of W-2 wages, but at an amount greater than 8 percent of household income, the employee has to buy the employer’s plan, but not for his family. “The government will not penalize the employee because the total cost for the health care plan through his employer is deemed ‘too expensive’ since it exceeds 8 percent of household income,” Gottwals said.

If the husband works, the family is caught between a rock and a hard place. “It can be a nasty gap which leaves the mom and kids out in the cold,” Gottwals said. “But, they won’t have to pay the penalty to the IRS as long as coverage costs more than 8 percent of household income. If it sounds complicated, it is because it absolutely is.”

Gottwals continued, “The bottom line is that less than 2 percent of the population in America will actually have to pay the Individual Mandate penalties to the IRS. If you already pay federal income tax, you’ll likely be ensnared by Obamacare. Really, only those in the middle class are being targeted for penalties under Obamacare. The plan is nearly toothless, except for the middle class penalty.”

“After the regulations issued in the last month, the plan appears to be a penalty against marriage and a message to many employers to not bother even offering healthcare to spouses. And it still leaves 460,000 kids uninsured.”

Related Articles

Salmon eating farmers along San Joaquin River

April 1, 2103 By Wayne Lusvardi As with the fish eating Jonah in the Bible story, salmon now are eating

Right-to-work states see union membership, revenues drop

With Friedrichs v. CTA pending before the U.S. Supreme Court, stakeholders and spectators alike are curious to see not only

Bee stokes phony crime wave

JULY 26, 2010 By STEVEN GREENHUT In what can only be viewed as an attempt to build public support for