New Laffer book details Reagan prosperity recipe

If you have a great recipe, keep using it. Don’t be chicken. Just ask Col. Sanders.

If you have a great recipe, keep using it. Don’t be chicken. Just ask Col. Sanders.

Why then don’t Republican candidates just follow Ronald Reagan’s successful economic recipe from the 1980s? Cut taxes; in his case, from the top income tax rate of 70 percent in 1980 to 28 percent in 1988. Keep money stable to prevent inflation. Reduce spending and regulations as much as you can. Simple.

Yet not one Republican president or candidate for the office since then has followed the Reagan recipe. President George H.W. Bush sat next to Reagan as vice president for eight years, solemnly gave his “Read my lips: No new taxes!” pledge at the 1988 GOP National Convention — then still raised taxes, crashed the economy and was booted from office in favor of Bill Clinton.

His son, President George W. Bush, did cut taxes twice — but the tax cuts expired in 2010, he imposed more business regulations through Sarbanes-Oxley and he turned Clinton’s surpluses into record deficits.

If Republicans want to return to Reaganomics, prosperity and victory at the polls, they again should return to the Reagan recipe by studying the new book, “The Pillars of Reaganomics: A Generation of Wisdom from Arthur Laffer and the Supply-Side Revolutionaries,” edited by Brian Domitrovic.” It is published by the Laffer Center at the Pacific Research Institute, CalWatchDog.com’s parent think tank.

If Republicans want to return to Reaganomics, prosperity and victory at the polls, they again should return to the Reagan recipe by studying the new book, “The Pillars of Reaganomics: A Generation of Wisdom from Arthur Laffer and the Supply-Side Revolutionaries,” edited by Brian Domitrovic.” It is published by the Laffer Center at the Pacific Research Institute, CalWatchDog.com’s parent think tank.

Laffer will be speaking about the book at Noon, Thursday, Oct. 16 at the Pacific Club, 4110 MacArthur Blvd., Newport Beach. Info here. Those attending will receive a free copy of “Pillars.”

In addition to being the major economist who helped fashion Reagan’s program, he helped design its precursor, California’s Proposition 13 tax cuts in 1978, as well as numerous other tax cuts for states, cities and foreign countries.

Laffer has been a sage source of mine since I came to California in 1987 to write editorials for the Orange County Register. A couple years ago he took his own advice and moved to Tennessee, which has no state income tax. I still can’t escape the beach.

What supply-side economics is

The first thing to understand about supply-side economics is that it is not designed to “put money in people’s pockets.” Yet that’s often how it’s described,

Rather, as its name indicates, supply-side economics emphasizes encouraging supply — that is, long-term production, doing stuff, making stuff; instead of demand — that is, buying stuff.

That’s why G.W. Bush’s early 2008 “stimulus” of $168 billion, which rebated up to $600 a person ($1,200 for a couple), didn’t prevent the economic crash that September and the subsequent Great Recession. It was a demand-side stimulus that had no long-term effect.

Supply takes place in the long term. It takes years to gear up producing such goods as cars, cell phones and equipment.

So just giving people a little more waking-around money — demand-side thinking — does nothing to encourage production, and so nothing to help the economy. Demand-side thinking usually comes from the Keynesianism most people learned in college in Econ. 101. But impoverished Haiti has plenty of demands; what it lacks is production. Conversely, Switzerland is rich because it produces — it supplies — at the highest level in the world. Not surprisingly, Haiti is a morass of high taxes and regulations, whereas Switzerland is a Lafferite free-market paradise.

Laffer Curve

Laffer Curve

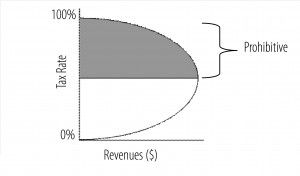

That’s where the famous Laffer Curve comes in. In the book, Domitrovic describes it:

“The Laffer Curve is a simple theoretical diagram, a bell curve…that compares tax revenues that are gained under all tax rates between 0 percent and 100 percent. At one end (the 0 percent tax rate), tax revenues are zero, at at the other (the 100 percent rate), tax revenues are also zero, because no one chooses to earn money when the government confiscates every penny. In between there is a bulge. And at one point, that bulge peaks — implying that any tax rate increase beyond it will result in lower revenue….

“Laffer…had used the curve often in the classroom, as a teaching tool. Then in December 1974, he sketched the curve on the restaurant napkin before two high staffers of the Gerald Ford administration, Donald Rumsfeld and Richard B. Cheney, along with his friend, Wall Street Journal editorialist Jude Wanniski.”

Alas, Ford did not embrace supply-side tax cuts, the economy continued to stagnate and in 1976, voters canned him for Jimmy Carter.

Laffer himself notes others before him said something similar. The earliest apparently was 14th century philosopher and sociologist Ibn Khaldun, who wrote in words Reagan sometimes quoted:

“It should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments.”

What Laffer invented was the graph that dramatically shows how the Laffer Curve works.

Laffer also details two previous supply-side tax cuts that boosted the economy. The first was by presidents Warren G. Harding and Calvin Coolidge in the 1920s, when the top federal income tax rate dropped to 25 percent from 77 percent. The second was by presidents John F. Kennedy, who touted them before his 1963 assassination, and President Lyndon B. Johnson, who signed the tax-cuts into law in 1964. Yes, Democrats can cut taxes, too.

Basically, the Laffer Curve is just common sense. If you tax something at 100 percent, nobody will pay the tax. If you tax something at 0 percent, no tax will be collected. The art of the Laffer Curve is finding the right recipe in between — that is, 1 percent to 99 percent tax rates — that maximizes both economic growth and tax revenues.

LBJ-JFK tax cuts

The LBJ-JFK tax cuts, and how they were enacted, are described in detail in the fourth volume of Robert Caro’s magisterial biography of LBJ, “The Passage of Power: The Years of Lyndon Johnson.” Unfortunately, Caro, although brilliant on the biographical and political aspects, doesn’t “get” why supply-side economics works, or the connection to Reagan’s tax cuts.

Here’s Laffer’s explanation:

“The 1964 tax cut reduced the top marginal personal income tax rate from 91 percent [!] to 70 percent by 1965. The cut reduced lower-bracket rates as well. In the four years prior to the 1965 tax-rate cuts, federal government income tax revenue, adjusted for inflation, had increased at an average annual rate of 2.1 percent, while total government income tax revenue (federal plus state and local) had increased 2.6 percent per year. In the four years following the tax cut these two measures or revenue growth rose to 8.6 percent and 9.0 percent, respectively. Government income tax revenue not only increased in the years following the tax cut, it increased at a much faster rate in spite of the tax cuts.

“The Kennedy tax cut set the example that Reagan would follow some 17 years later. By increasing incentives to work, produce and invest, real GDP growth increased in the years following the tax cuts, more people worked and the tax base expanded. Additionally, the expenditure side of the budget benefited as well because the unemployment rate was significantly reduced.”

And click this audio YouTube for JFK’s own 1962 explanation of his tax cuts.

Reagan deficits

Didn’t Reagan’s tax cuts increase the deficits? Yes, but the economy grew even faster than the deficits; and in his eight years in office, federal revenues actually increased 75 percent — from $517 billion in 1980, the year he was elected, to $909.2 billion in 1988, his last year in office. (See p. 24 here for this and the data below.) It’s like taking out a higher mortgage on a newer home after getting a raise.

Moreover, Reagan’s deficits came about for one reason: He was increasing defense spending to break the back of the demonic Soviet Union. It was a one-time deal. It worked when the Berlin Wall fell in 1989, a couple months after the Gipper left office. The deficits also were dropping fast, from $221 billion in 1986, to $150 billion in 1987 and $155 billion in 1988.

The reverse side of the Laffer Curve — that tax increases often make things worse — also was proven when Reaganomics was abandoned by President Bush with his 1990 “read my lips” tax increases. Instead of the deficits going down, the Bush tax-increase recession zoomed them back up — doubling to $289 billion in 1992.

What about the Clinton boom of the late 1990s? Didn’t he increase taxes in 1993? Yep. But after the Gingrich Republican Congress was elected in 1994, Clinton worked with the GOP to sharply cut capital gains tax cuts. It was Reaganomics with an Arkansas accent.

Gold standard

People sometimes say I write too much on the importance of the gold standard to stabilized money. But it is important as the means to stabilize the dollar and prevent inflation. Briefly…

The book includes a Laffer essay from 1980, “The Case for a Gold-Backed Dollar,” that resonates just as much today. Reagan, and especially Paul Volcker, the chairman of the Federal Reserve Board at the time and a Democrat, actually took Laffer’s advice and pegged the dollar to about $350 an ounce. That policy continued after Alan Greenspan became Fed honcho in 1987, until 2001. Unfortunately, after 9/11, Greenspan inflated the dollar, a policy continued under his successor, Ben Bernanke, driving gold up to as high as $1,800 an ounce.

Wonder why prices are rising? That’s it. Inflation takes about 15 years to work through the economy.

In 2012, Bernanke began stabilizing the dollar again at about $1,200 an ounce, a policy Janet Yellen, who became Fed chairman this year, has continued — a positive, Lafferite development.

“A properly designed program should have as its initial goal the stabilization of prices generally at or near their current level,” Laffer wrote in 1980. “Stated simply, a workable system of gold/dollar convertibility must not permit the economy to experience wrenching adjustments because of changes in gold….

“Based upon his posturing since the late 1960s it is, in my opinion, quite conceivable that Volcker could actually lead the search for a new order.”

That’s just what happened.

Back to Reagan

Back to Reagan

I highlighted Laffer’s writing. But “Pillars” also includes contributions by the late Warren Brookes, George Gilder, Charles W. Kadlec, Stuart J. Sweet, David Booth, Jeffrey Thompson and Reagan administration economist Bruce Bartlett.

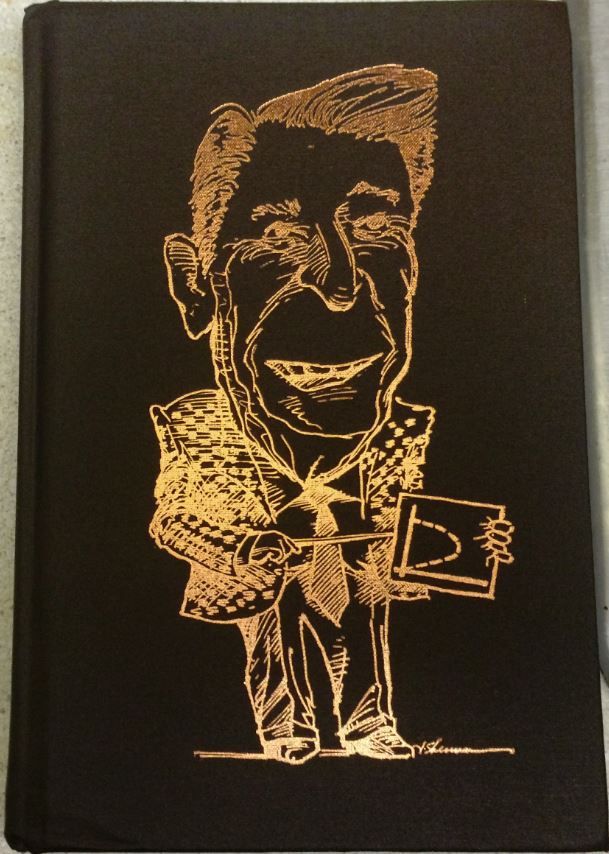

When you remove the dustjacket, the book cover shows a good-as-gold engraving of Reagan holding a drawing of the Laffer Curve. My iPhone snapshot is nearby. In these digital days, it’s still great to read a beautifully crafted physical book — 1980s style.

In conclusion, if Republicans finally want to get their act together and start not just winning elections, but governing for prosperity, they should start with this book. The Reagan prosperity recipe worked — and can work again.

Related Articles

‘No justification to build’ high-speed rail

April 18, 2012 By Katy Grimes The official recommendation is out from the Legislative Analyst’s Office – High-speed rail should

California Joblessness 2nd Worst

John Seiler: California’s unemployment rate for November stayed the same, at 12.4%, placing it second worst in the nation; tied

Schwarzenegger’s Bizarre Analysis

Steven Greenhut: I love it when politicians have their chance in power, squander their opportunities, then spend the rest of