Tax hikes would harm CA economy

by CalWatchdog Staff | August 17, 2010 11:27 am

[1]

[1]

AUGUST 17, 2010

By JOHN SEILER

Do tax hikes fix budgets? That was the subject of an article I wrote[2] last month here on CalWatchDog.com.

The question is critical as the California Legislature and Gov. Arnold Schwarzenegger, still unable to pass and sign a budget a month and a half into the 2010-11 fiscal year, contemplate another round of tax increases[3].

The evidence seemed to be negative, at least for large tax hikes: That they don’t increase revenues, but rather can decrease them – at least sometimes. In particular, I looked at the effects of Gov. Pete Wilson’s then-record tax increase increase of $7 billion in 1991. Here are the numbers I used:

Fiscal Yr. Amount %Change

1991-92 : $42,026

1992-93 : $40,946 : -2.1%

1993-94 : $40,095 : -2.1%

1994-95 : $42,710 : +6.5%

1995-96 : $46,296 : +8.4%

The revenues actually dropped for two fiscal years in a row, in fiscal 1992-93 and 1993-94. And revenues only picked up again in fiscal 1994-95, as the Wilson tax increases expired.

In the comment section for the article, a reader wrote a rebuttal:

I enjoyed your article, but you fell prey to the common misconception about the 1991 tax increases – that the tax increases caused aggregate revenues to fall. In fact, tax revenues would have been much lower without the tax increases. While the tax increases did not produce as much revenue as they had been expected to when enacted, they still produced additional revenue that made a significant contribution to closing the deficit. Similarly, you assert that revenues increased a few years later because the tax increases expired – this is really explained by the resurgence of the economy. Most economists will tell you that state level tax changes are too small relative to the economy to be such a driving force….

He referred me to a 1993 report[4] on the matter by the Legislative Analyst, which wrote:

As the figure shows [in the LAO report], General Fund revenues are expected to decrease by $1.1 billion in both 1992-93 and 1993-94. Most of this weakness in the performance of state revenues can be attributed to the weak performance of the state’s economy. Several recent or pending tax changes also are contributing to these revenue reductions:

* The passage of Proposition 163 in November 1992, rescinding the 1991 application of the state’s sales tax to “snack” foods and bottled water.

* The reinstatement of the net operating loss (NOL) deduction as of January 1, 1993.

* The termination of the state’s temporary 1/2 cent sales tax on July 1, 1993.

In contrast to the Proposition 163-related revenue losses, which occur in both 1992-93 and 1993-94, the reinstatement of NOL deductions and the termination of the temporary sales tax rate primarily affect 1993-94 revenues. That is, the General Fund revenue estimates for 1993-94 have been reduced by approximately $1.8 billion to account for these tax changes, which more than explains the overall decline of $1.1 billion. In the absence of these scheduled tax changes, revenue collections would actually increase by about $700 million over 1992-93.

Actually, it also could be assumed that, had these taxes remained on the books, they could have damaged the economy even more. In particular, the 1991 “snack” food tax was onerous to grocery and convenience stores. Nobody could remember whether it taxed nuts and exempted candy – or the other way around. It certainly increased the paperwork such stores were forced to use.

Indeed, the LAO noted that the budget documents of Gov. Pete Wilson had anticipated much higher revenues than actually came in. So the working assumption at the time was that higher taxes would bring higher revenues – when the opposite happened. The LAO wrote:

Over the past several years, the economic forecasts contained in the Governor’s Budget, and those developed for the May Revision, have been consistently wrong as to the timing of the state’s recovery from recession. In each case, recovery was projected to have already begun or be “just around the corner,” and the budget’s revenue forecasts were based on this assumption….

For 1991-92, the budget forecast that General Fund revenues would total $45.8 billion, including approximately $2.8 billion of revenue enhancements. Actual revenues for 1991-92 amounted to $42.0 billion, including about $6 billion of major revenue enhancements.

Thus, this initial estimate was about $7 billion too high. For 1992-93, General Fund revenues were initially projected at $45.7 billion, and now are forecast to come in at $40.9 billion, or $4.8 billion lower. (No major revenue enhancements were included in either figure.)

The 1993 study also came before the worst of the taxes, the income tax surcharge, expired in 1995 – the year, as I explained, the economy started to boom.

Tax signals

As Nobel economics laureate Friedrich Hayek showed, prices are “signals”[5] to consumers. Taxes are a type of “price.” So, if the tax “price” rises, especially under a supposedly anti-tax Republican administration, then the signal is: there is no restraint on taxes, now or in the future.

By contrast, when the signal is that the tax “price” is dropping, then businesses know they are free to plan, grow and create jobs. That’s especially true under Democrats, normally tax increasers.

A good example is what happened under President Bill Clinton. He increased taxes in 1993. As the LAO’s report noted, in the section The “Clinton Factor”:

In effect, the DOF [California Department of Finance] anticipated that taxpayers would choose to accelerate the realization of some capital gains (including stock options) and other income into 1992, earlier than originally planned, in order to avoid the potentially higher 1993 federal tax rates. Based on information from December and January PIT [personal income tax] collections, it appears that the acceleration adjustment was appropriate.

The first Clinton years were days of economic stagnation. But notice what happened next. Bill Clinton’s 1996 capital gains tax, worked out with the Republicans then running Congress, cut the top cap gains rate from 28 percent to 20 percent. The signal: invest in business and jobs creation, and your profits will be taxed less – yes, even under a Democrat. Corollary: that tax won’t go up, even under a Democrat. The Dot-Com boom ensued.

The Florida and Texas experience

To get more perspective on taxes in the early 1990s, I called up budget offices in the Florida and Texas governments. These are the two states most like California: they’re in the Sun Belt; are first (California), second (Texas) and fourth (Florida) in population; major industries are in high-tech and tourism; and they have large and diverse immigrant populations, especially of Latinos.

The big difference: Texas and Florida don’t have an income tax, so they didn’t increase it. California’s top rate, by contrast, was 9.3 percent, and was boosted to 10.3 percent.

Here are the numbers for Texas’ “General Revenue Fund.” (Fortunately, in 1991 Texas changed its accounting. So from that year on, for our purposes, the numbers are consistent. Source: Texas Fiscal Size-Up[6].)

Fiscal Yr. Amount %Change

1991 : $27.2 billion

1992 : $29.4 billion : +7.9%

1993 : $33.4 billion : +13.8%

1994 : $35.8 billion : +7%

1995 : $37.0 billion : +3.5%

Florida showed something similar for its “Summary of Legislative Appropriations” (Source: Florida budget document sent to me by the state Legislative Appropriations System/Planning and Budgeting Subsystem):

Fiscal Yr. Amount % Change

1991-92 : $28.9 billion

1992-93 : $31.7 billion: + 9.7%

1993-94 : $35.5 billion: + 12.0%

1994-95 : $38.8 billion: + 9.3%

1995-96 : $39.1 billion: + 0.8%

Both Texas and Florida suffered from the same national recession as did California in the early 1990s. Yet that recession staggered them much less. The reason seemed to be that their tax structure – especially the lack of state income taxes – was more favorable to businesses than was California’s.

John Seiler, an editorial writer with The Orange County Register for 20 years, is a reporter and analyst for CalWatchDog.com[7]. His email: [email protected][8].

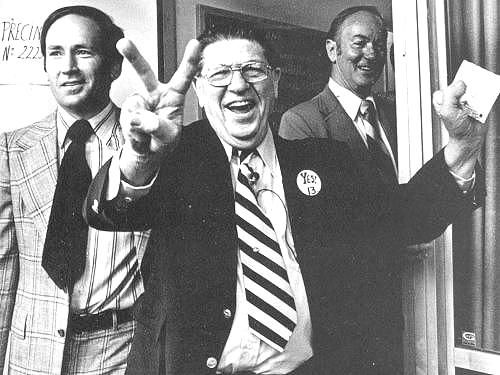

- [Image]: http://www.calwatchdog.com/wp-content/uploads/2010/08/HowardJarvis_e8f65.jpg

- an article I wrote: http://www.calwatchdog.com/2010/07/21/do-tax-hikes-fix-budgets/

- ontemplate another round of tax increases: http://www.vcstar.com/news/2010/aug/16/tax-hike-plan/

- a 1993 report: http://www.lao.ca.gov/analysis/1993/pandi_93_3_4.pdf#page=3

- prices are “signals”: http://www.auburn.edu/~garriro/e4hayek.htm

- Source: Texas Fiscal Size-Up: http://www.lbb.state.tx.us/Fiscal_Size-up_Archive/Fiscal_Size-up_2002-2003_0102.pdf

- CalWatchDog.com: http://www.calwatchdog.com/2010/06/21/2010/02/28/2010/02/21/

- [email protected]: mailto:[email protected]

Source URL: https://calwatchdog.com/2010/08/17/tax-hikes-would-harm-ca-economy/