Restored Gann Limit Would Balance Budget

by CalWatchdog Staff | March 25, 2011 12:01 pm

[1]MARCH 25, 2011

[1]MARCH 25, 2011

By JOHN SEILER

The problem with Calfornia’s $25 billion budget deficit is that state spending gushed upward in three wild splurges. I’ll list them here. As I do, recall if your pay was increased each year anything near as much as the California budget. Probably not.

The first splurge is one people often forget. When Gov. Pete Wilson’s 1991 tax increases expired in 1994, California finally joined the national economic recovery — two years late. Revenues recovered. And he spent the money. Expenditures rose 8 percent a year for four years straight fiscal years: 1994-95 through 1997-98. Then, in 1998-99, revenues went up another 9 percent.

The second splurge was when Gov. Gray Davis was elected in 1998. For his first two budgets, for 1999-2000, he increased spending an incredible 15 percent. And for 2000-2001, he splurged with an increase of an even more incredible 17 percent.

Spending rose from $57.8 billion in 1998-99, the year before Davis became governor, to $78.1 billion in 2001-02, his second year in office. It was a 20.3 billion increase in spending in just two years — a 35 percent.

That was during the dot-com boom, when we were told — I remember this well — that “the new high-tech economy” would never go back into recession and “the business cycle has been repealed.” Then the dot-com bust hit.

The third splurge of wild spending was after Davis was recalled and Gov. Arnold Schwarzenegger was elected on promises to “tear up the credit cards” of state deficit spending and “blow up the boxes” of government waste. He lied. His 2005-06 budget spiked spending upward 15 percent. And his 2006-07 budget added another 10 percent spending increase. That was during the real estate boom, when we were told that “the new investment economy” would go forever upward and “the business cycle has been repealed.” Then the whole thing collapsed like a cheap card table.

Calculating Gann

Now, here’s the question: What if the Gann Limit had been in effect during this period?

The Gann Limit on state spending was passed by state voters in 1979[2]. It was supported by then-Gov. Jerry Brown, again today’s governor. It limited spending to the increases in inflation plus population growth. It effectively was repealed by voters in 1990.

Here’s the process:

1. Let’s go back to 1993-94 budget and use it as our Baseline Budget. General-funding for that fiscal year was $39 billion.

That’s the last budget before the three Wilson-Davis-Schwarzenegger budget splurges. If you remember, how was California then? A pretty good place, all considered. The schools were funded, the poor helped and government got adequate revenue.

There was even a state surplus (remember those?) of $1.1 billion. That surplus was a substantial 3 percent of the budget. It was a rainy-day fund.

2. Allow spending increases of the rise in population plus inflation. The population in California [3]increased about 19 percent from 1993 to 2011.

As to inflation, using the Inflation Calculator of the U.S. Bureau of Labor Statistics[4], we find that $100 in 1993 equals $153.16 in 2011. So that’s a 53 percent inflation increase.

3. Add the two together: 53 percent inflation plus 19 percent population increase = 72 percent combined increase.

The Baseline Budget we’re using, for fiscal 1993-94, was $39 billion. Increase that by 79 percent and we get $70 billion. ($39 billion X 1.79 = $70 billion.)

Jerry’s Budget

Gov. Brown’s January budget proposal amounted to $86 billion[5]. To reach that, he’s asking for tax increases of $12 billion.

But if those taxes are not imposed, then he would have to cut another $12 billion, bringing the budget down to $74 billion.

That $74 billion still would be higher than the $70 billion that, as our calculations have shown, would be spent if the state had followed the Gann Limit the last 18 years — instead of going on the three Wilson-Davis-Schwarzenegger spending splurges.

One solution to the budget impasse, then, would be to go back to that 1993-94 state Baseline Budget. Just increase every item in that budget by 79 percent — a hefty sum by itself — and the budget would be balanced. With a $4 billion surplus.

Fundamentally, what the Gann Limit did was to allow spending to grow only as fast as it could be supported by the underlying tax base. Other states don’t need a Gann Limit because their governments are more prudent. The California government’s historical imprudence, as shown by the above brief fiscal history of the past two decades, can only be restrained by statute.

Otherwise, the general fiscal and economic collapse of the state, which has been much worse than at the national level, will only.

* * *

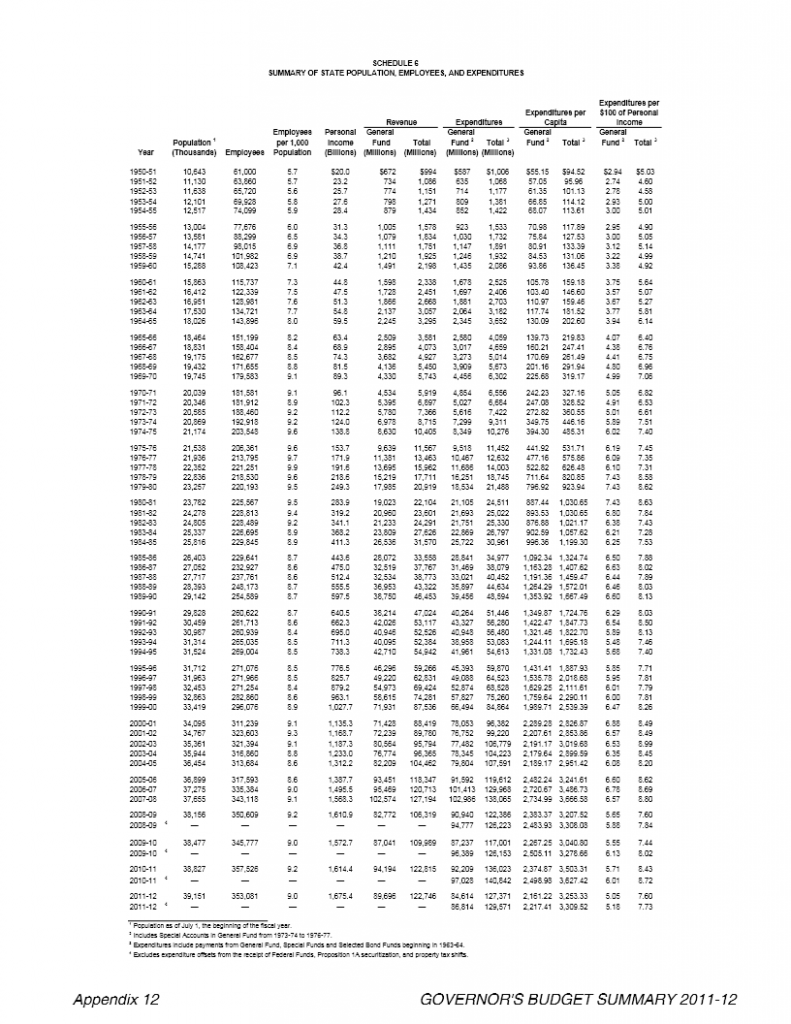

Source: The numbers all were taken from Gov. Brown’s January budget proposal, which is available here[6]. Flip to Schedule 6, which is on Page Appendix 12. I have copied the page below. The column used is Expenditures/General Fund.

[7]

[7]

- [Image]: http://www.calwatchdog.com/wp-content/uploads/2011/03/Old_Faithful-Gusher-wikipedia.jpg

- passed by state voters in 1979: http://www.caltax.org/member/digest/July2000/jul00-9.htm

- population in California : http://en.wikipedia.org/wiki/California#Population

- Inflation Calculator of the U.S. Bureau of Labor Statistics: http://www.bls.gov/data/inflation_calculator.htm

- to $86 billion: http://articles.latimes.com/2011/jan/10/business/la-fi-budget-business-20110111

- available here: http://www.ebudget.ca.gov/pdf/BudgetSummary/FullBudgetSummary.pdf

- [Image]: http://www.calwatchdog.com/wp-content/uploads/2011/03/2011-Budget-Schedule-6.xps_.png.1.png

Source URL: https://calwatchdog.com/2011/03/25/restored-gann-limit-would-balance-budget/