CA Bond Payments Crowd Other Spending

by CalWatchdog Staff | May 5, 2011 9:48 am

[1]MAY 5, 2011

[1]MAY 5, 2011

By WAYNE LUSVARDI

A recent Internet headline read: “California bond sold for 9 percent – NOT a Typo!”[2] The inference was that this could be the harbinger of much prophesized skyrocketing bond interest rates and municipal bond defaults in California. Reality is simpler than that.

The reality is that municipal bond rates are actually falling. This good news does not necessarily mean that bond markets anticipate California’s budget deficit or pension tsunami[3] will be resolved. It is merely a function of supply and demand in the bond markets.

State and local governments in California have stopped borrowing in recent months. Thus, there has been a short supply of municipal bonds placed into the financial markets. And as anyone can tell you from taking an Econ. 101 course, a lack of supply means a lack of competition in investment markets for investor dollars. Bond issuers don’t have to pump up interest rates to attract buyers. This translates into lower interest rates.

Rates Have Fallen

Reported Wall Street Journal[4] in “A Lack of Supply Feeds Rise in Munis,” municipal bond rates have actually fallen: to 2.79 percent to 3.21 percent on 10-year bonds. Albeit California bond rates appear higher than that. California credit default swaps, used to insure bonds, are also reported to have fallen from costing $270,000 to $175,000 for a $10 million bond issue.

But, you say, what’s the story about that 9 percent bond interest rate?

Well, the story is told in America City and County magazine[5] by Michael Pietronico, chief executive officer of New York-based Miller Tabak Asset Management. The story is that this was an apparent rushed issuance of bonds by a panicked California redevelopment agency before the state may shut down redevelopment agencies across the state. The bonds were rated Triple B (BBB) as “junk bonds,” apparently because the issuing agency may have had no actual imminent redevelopment project. That made for a reported “tough sell.”

MunicipalBonds.com[6] reports the ten most active California bond issues for May 4 averaged 5.48 percent interest rate (5.5 percent median). The bond issues ranged from a low of 2.37 percent for a University of California System bond to a high of 8.01 percent for a Richmond Joint Powers Authority bond. Richmond is a city known to have a history of troubled finances. So there are “weak spots” in the California bond market, but thus far not any indications of a system-wide meltdown, as predicted by many.

California continues to have the lowest bond rating of the states mainly because it has not resolved its structural budget deficit or long-term pension obligations. But this writer has been one of the few in reporting that California bond defaults are likely to be spotty; and that monetary inflation intentionally created by green energy mandates and regulations are actually a bigger risk than bonds. As pointed out recently by noted economist John Mauldin, inflation is just another way of saying “default.[7]”

California didn’t default on its bonds during the Great Depression of the 1930’s. But it had to be bailed out by the federal government, which took over the Central Valley Water Project[8] because California could not find any buyers for its bonds.

Water Tax

The pull back of state and local governments in California from borrowing may be the reason a coalition of environmentalists has recently floated SB 34 – the California Water Resources Investment Act[9]. It is an attempt to impose a tax on all retail water usage, rather than financing proposed Delta water system improvements with a consolidated Water Bond proposed for the 2012 ballot, which would be financed with bonds.

The fear is that taxpayers won’t pop for yet another water bond at the ballot box after spending over $14 billion on water bonds in recent years, with next to nothing to show for it except debt. Another fear is that state and local governments are going to have to shift from borrowing to a “pay-as-you-go” system for financing infrastructure in the future to avoid putting any pressure on the fragile state general fund budget.

So the good news is that the sky is not falling on the municipal bond market in California. The bad news is that California is still in effective default on meeting its general-fund budget and future pension obligations, as well as intentionally pumping up prices by increasing water and power rates through various green energy and air quality policies.

So, hurrah. California can likely meets all its constitutionally required obligations to pay the interest on its bonds, provide funds for public schools under Proposition 98, provide a slush fund for schools under AB 813 “Incentive Funding,” and meet pension and retiree medical obligations!

But what will be left after that for a social safety net, the courts and the rule of law, is an unanswered question. The modern day equivalent of the Roman proverb, “while Rome burned, Nero fiddled,” may end up: “While California burned from closed courtrooms and an inability to afford running its air conditioners in its model energy-efficient buildings energized by green power, Gov. Moonbeam made his obligatory bond payments.”

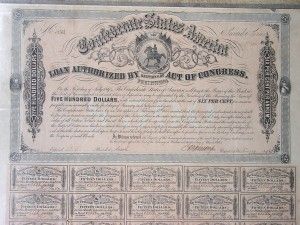

- [Image]: http://www.calwatchdog.com/wp-content/uploads/2011/05/Confederate-Bond-2.jpg

- “California bond sold for 9 percent – NOT a Typo!”: http://capoliticalnews.com/blog_post/show/8457

- pension tsunami: http://pensiontsunami.com/

- Wall Street Journal: http://online.wsj.com/article/SB10001424052748704322804576303063224766314.html?mod=WSJ_hp_LEFTWhatsNewsCollection

- America City and County magazine: http://americancityandcounty.com/admin/finance/municipal-bond-image-20110427/index.html

- MunicipalBonds.com: http://california.municipalbonds.com/bonds/report/

- inflation is just another way of saying “default.: http://www.calwatchdog.com/2011/04/29/inflation-means-california-default/

- Central Valley Water Project: http://en.wikipedia.org/wiki/Central_Valley_Project

- SB 34 – the California Water Resources Investment Act: http://www.calwatchdog.com/2011/04/29/sb-34-creature-crawls-from-delta-lagoon/

Source URL: https://calwatchdog.com/2011/05/05/ca-bond-payments-crowd-other-spending/