California voters OK 63% of tax measures

by CalWatchdog Staff | June 8, 2012 10:33 am

[1]June 8, 2012

[1]June 8, 2012

By Chriss Street

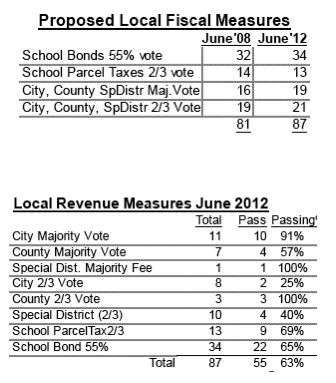

Local voters approved 63 percent — or 55 of the 87 — local tax, bond or fee measures on the June 5, 2012 California primary ballot, according to Michael Coleman[2], the creator of CaliforniaCityFinance.com[3]. Majority vote measures fared much better than supermajority votes requiring two-thirds approval to pass special taxes and bonds. Fifteen of the 19 majority-vote measures passed (79 percent). But only 18 of the 34 supermajority vote taxes passed (53 percent).

For schools, voters favored approval by 66 percent; that’s compared to 45 percent for non-schools.

Analysts will not get much direction from these local election results in trying to handicap the mood of voters to pass Gov. Jerry Brown’s $8.5 billion tax increase initiative[4] this November. Even though a balanced budget is constitutionally required to be approved by June 15, it was just reported[5] that the leadership in the Legisalture still refuses to cut $2 billion in social spending to meet Brown’s budget proposal, which itself appeared to analysts already to have a $4 billion deficit.

The results below confirm that voters support their own local schools. But it is unclear if they will tax themselves more for the benefit of the state.

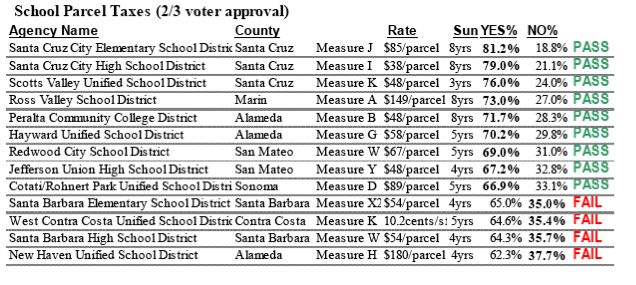

School Parcel Taxes

Of the school parcel taxes measures requiring a two-thirds supermajority, nine the 13 passed (69 percent). All received well over 60 percent yes votes.

[6]

[6]

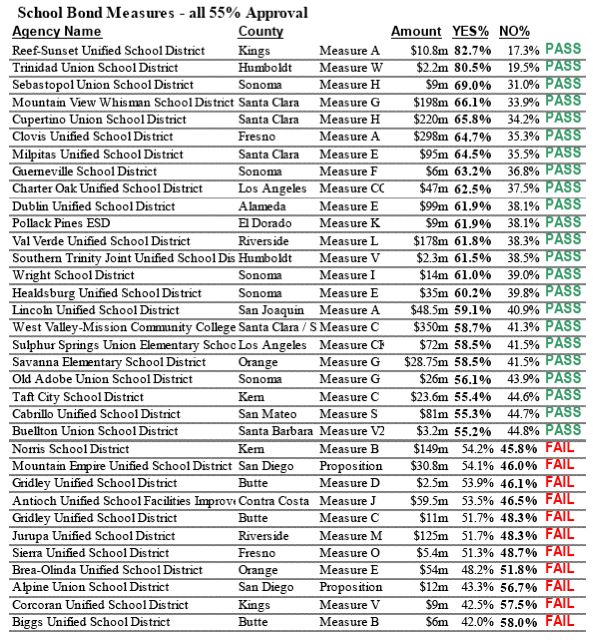

School Bonds Requiring 55 percent Approval

Of local school bond measures requiring only the the 55 percent threshold passed, 23 of 34 passed (77 percent). They will raise $1.9 billion.

[7]

[7]

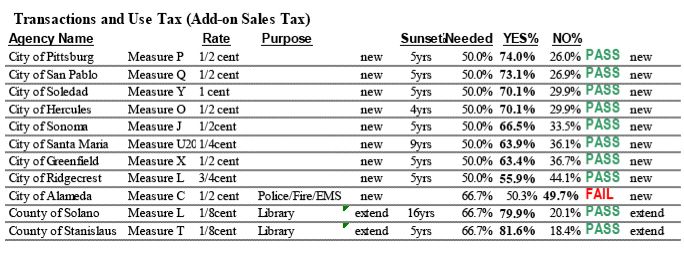

Local Add-On Sales Taxes

For use sales-tax add-ons, eight of nine cities were approved (89 percent). Only the City of Alameda failed, because the earmarking of the use of the tax required a two-thirds majority approval. Since 2001, about 60 percent of measures to increase general purpose local sales taxes have passed, but only 36 percent special sales tax increases requiring a two-thirds majority vote have passed.

[8]

[8]

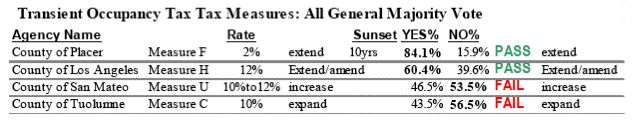

Transient Hotel Occupancy Taxes

Two of the five ballot measures to increase or expand hotel Transient Occupancy Taxes passed (50 percent).

[9]

[9]

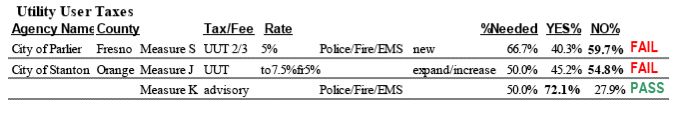

Utility User Taxes

Of the two utility user tax measures on the ballot, both failed. An “advisory” vote in Stanton on how to spend the money passed, but was irrelevant.

[10]

[10]

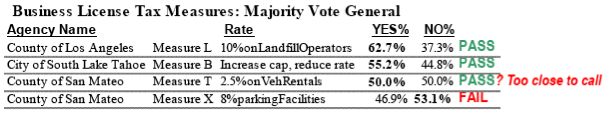

Business License Taxes

Two of the four business license tax increases passed, one failed, and a third, San Mateo Vehicle Rentals, is still too close to call.

[11]

[11]

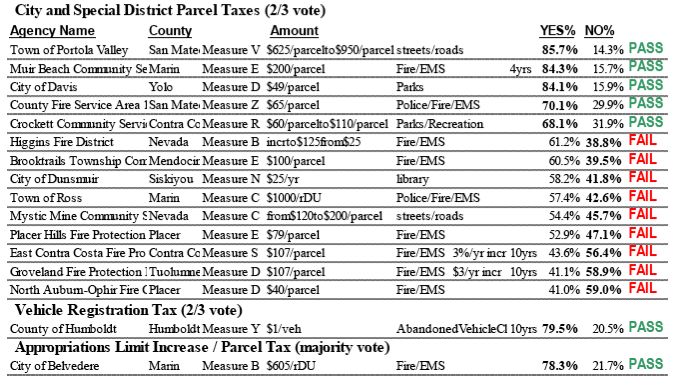

Parcel City and Special Taxes

Only four of the 14 of the city parcel and special district parcel tax increases passed (29 percent). Proposition 13 requires two-thirds supermajority approval.

[12]

[12]

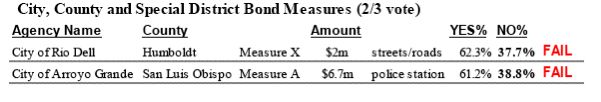

General Obligation Bonds

Both cities that attempted to gain the two-thirds voter approval to issue general obligation bonds failed. By comparison, over the last 12 years, about 50 percent of the general obligation bond measures have passed.

[13]

[13]

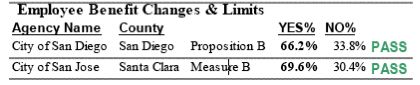

Employee Benefit Changes

Both of the public employee pension reform proposals passed with big majorities.

[14]

[14]

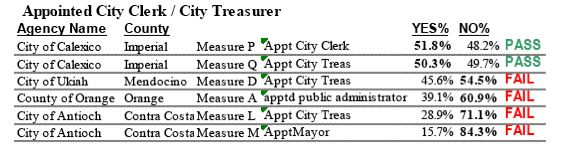

Appointed City Clerk, Treasurer, Administrator

Orange County’s Measure A failed. It was a proposal to have the Board of Supervisors appoint the county public administrator, who protects the assets and manages the affairs of residents of the county who die with no known heirs, will or executor. Also failing were efforts to deny voters the right to elect the city clerk and city treasurer in Ukiah and Antioch. But Calexico approved similar measures.

[15]

[15]

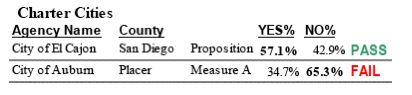

Charter Cities

Voters in El Cajon approved the establishment of a city charter, but voters in Auburn turned down charter city status.

[16]

[16]

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-1/

- Michael Coleman: http://www.publicceo.com/2012/06/local-revenue-measures-in-california-june-2012-preliminary-results/

- CaliforniaCityFinance.com: http://californiacityfinance.com/

- Gov. Jerry Brown’s $8.5 billion tax increase initiative: http://abclocal.go.com/kabc/story?section=news/state&id=8657276

- reported: http://blogs.sacbee.com/capitolalertlatest/2012/06/gov-jerry-brown-legislators-2-billion-apart-on-budget.html

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-2/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-3/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-4/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-5/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-6/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-7/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-8/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-9/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-10/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-11/

- [Image]: http://www.calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/street-12/

Source URL: https://calwatchdog.com/2012/06/08/california-voters-ok-63-of-tax-measures/