Fund transfers are purging earmarks from state budget

By Wayne Lusvardi

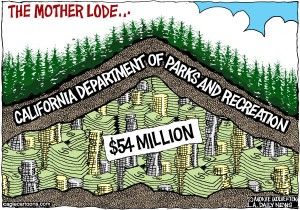

Is the scandal over the State Parks Director Ruth Coleman hiding $54 million in plain sight in a special fund account beginning to make the public aware of all the political earmarks in the state budget? And that those earmarks are being purged? Looks like it.

Back on May 23, Calwatchdog.com was the first to reveal that, from 2007 to 2012, California had a $10.4 billion decline in its general fund and a corresponding increase of $13.15 billion in its “special funds.” Special funds were being shifted into the general fund under a process of “borrowing.”

On July 10, Controller John Chiang reported that California was patching its operating budget by “borrowing” $4.3 billion from “special funds.”

On July 20 came the revelations about Coleman and the $54 million special parks fund.

By July 30, state Director of Finance Ana Matosantos reported that this borrowing from special funds was more than five times the amount from June 2008.

Are Special Funds the Same as Earmarks?

What is a “special fund?” Special Revenue Funds are an “account established by a government for a specific project” such as gas taxes for maintaining and building new highways, or park user fees.

A specific project funded with a “special revenue bond” is typically not considered a “special fund” but a “bond fund.” And federal funds for Medi-Cal or other programs run by the state, but subsidized by the federal government, are called “federal funds.” They are not special funds, even though they are also for specific purposes.

Property taxes collected by redevelopment agencies are “special revenue funds” designated for local government. But California has suspended the operation of all redevelopment agencies in the state and transferred those former “special funds” into its “general fund” for public schools.

Borrowing is another budget gimmick to make the public believe the funding accounts are segregated, when they are not. This is called “fungibility” in public finance. Tax revenues are “fungible” when they are interchangeable, or can be used to replace funds in another budget category. It is like raiding your “college savings fund” for your children or medical savings account to pay your utility bills so you can continue to operate your household.

Given the ongoing state budget deficits, funding categories in the state budget have become arbitrary and the funds are often being used interchangeably. You no longer can look at just the general fund to understand what is going on. You have to look at the special fund and the bond fund as well.

The definition of a “special fund” is almost the same as an “earmark.” Safire’s Political Dictionary defines an “earmark” as: “to set aside funds for a special project or purpose.”

A political earmark is a term commonly used to describe separate funds that individual legislators or the governor specify be directed to projects and activities that will benefit or protect particular people or job categories in their home constituencies.

$34.1 Billion Borrowed Since 2008

The July 30, 2012 report from the Department of Finance noted the budgetary loans to the generalf fund, as required under Government Code 16320. A list of the 141 loans to the general fund can be found here.

California has accumulated $34.1 billion in borrowing from other funds for its general fund from 2008 to 2011.

California will borrow $5.93 billion more from special funds for its general fund in 2012-13. The bulk of the borrowing for 2012-13 will come from deferred payments to public schools ($2.22 billion or 37.5 percent), from economic recovery bonds ($1.34 billion or 22.6 percent), and from borrowing from local governments ($2.09 billion or 35.2 percent).

A troubling aspect of the above borrowings is that California is using bonds to pay for services, not just public-works projects. Bonds have to be paid back with interest. So this is no cost savings in the final analysis. This is how New York State almost went into bankruptcy in the 1970s.

Of the $5.93 billion of total borrowings in 2012-13, only $181 million, or about 3 percent, will be borrowed from “special funds.”

State Budget Purging Special Fund Earmarks?

Under Assembly Bill ABX-4-2 (2009), the portion of the State Education Budget that funded “categorical programs” was deregulated. This meant that political earmarks to protect certain non-essential jobs were eliminated. It became the responsibility of each local school district — not the state Legislature — to decide what ancillary jobs needed funding. Core teachers were not affected by this deregulation. Deregulating “categorical funds” saved public school budgets and didn’t adversely affect poor students.

Is the state general fund deficit compelling the state to also deregulate many of its special funds by “borrowing” just as school “categorical programs” had to be deregulated?

“Borrowing” funds designated for public schools sounds like “robbing children.” But is this transfer of funds what has already been authorized under AB-X-4 to deregulate school funding for ancillary jobs programs?

Raiding Highway Funds Only 1 Percent of Borrowings

It is interesting to note that “raiding” transportation funds has only amounted to less than 1 percent of all the “borrowings” over the last five years. Ninety-nine percent of the “borrowings” have come from cutbacks in non-essential public school jobs programs, cutbacks in local governments such as redevelopment, deferred Medi-Cal costs, deferred public employee retirement payments to Cal-PERS, and state payroll deferrals. The state is still functioning despite all these “borrowings.”

Outstanding Amounts Borrowed from 2008 to 2011

| Source | Outstanding Amount Borrowed from 2008 to 2011(in billions of dollars) | 2012-13 Impact |

| 1. Deferred payments to schools and community colleges | $10.43 billion | $2.22 billion |

| 2. Economic recovery bonds | $6.263 billion | $1.34 billion |

| 3. Loans for special funds | $4.290 billion | $181 million |

| 4. Unpaid costs to local governments, schools and community colleges for state mandates | $5.055 billion | $0 |

| 5. Underfunding of Prop 98 | $2.756 billion | $0 |

| 6. Borrowing from local government under Prop 1-A | $2.095 billion | $2.09 billion |

| 7. Deferred Medi-Cal costs | $1.659 billion | $0 |

| 8. Deferral of state payroll costs from June and July | $759 million | $0 |

| 9. Deferred payments to Cal-PERS | $524 million | $0 |

| 10. Borrowing from transportation funds Prop 42 | $334 million | $83 million |

| Total | $34.165 billion | $5.93 billion |

| Source: http://www.dof.ca.gov/reports_and_periodicals/documents/General_Fund_Loans_and_Obligations_July-2012.pdf | ||

Related Articles

Video: Can CA tax its way to prosperity?

California taxes are going up, but according to Americans for Tax Reform’s Grover Norquist, the new revenue isn’t going solve

Other cities could follow Sac utility measure

Feb. 15, 2010 By KATY GRIMES In the first of its kind in the state, the Sacramento County Taxpayers League

CA legislators join vote to end federal shutdown

The 16-day federal government shutdown is over, and America’s borrowing limit has been raised following an 81-19 vote in the