The right way, the wrong way, and the Poway of school bond financing

by CalWatchdog Staff | August 8, 2012 10:47 am

[1]Aug. 8, 2012

[1]Aug. 8, 2012

By Wayne Lusvardi

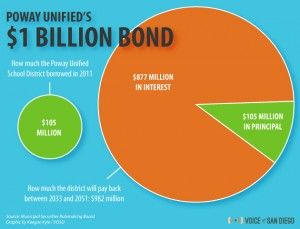

Imagine you can get in a time machine and fast-forward to the year 2032 in the Poway Unified School District, the third largest school district in San Diego County. In that year, $981 million[2] in deferred interest on a $105 million bond for school facility improvements will become due and payable. That is nearly 10 times[3] what the school district borrowed in 2012.

Imagine paying a $1 million mortgage for your one-bedroom tract home worth only $100,000 in 2012. (Typically, bonds only have to pay double what was borrowed, just like your home mortgage — not 10 times.)

By 2032, nobody can sell their home in the Poway area due to the huge property tax liens on every property. And the large proportion of over-mortgaged homes — also called “underwater mortgages” — is still depressing home values in 2032 in the Poway area. The $105 million borrowed in 2012 to improve school buildings stimulated the local economy. But, by 2032, the Poway economy is now stagnant. The largest industry is financial-disaster tourism, like in Detroit today[4].

Poway cannot attract new teachers because their pension plan is broke. Local churches have had to take over the school system so that the education of a future generation is not lost. The school board now leases the former renovated school buildings to churches for a dollar a year in rent.

No bond investors will loan funds for any public improvement project in the area, such as repaving roads or repairing broken water pipes. The burden of bond debt is too high for any more debt to be added.

Poway is a local example of present-day Detroit. Detroit still thinks that every Starbucks is an economic jobs multiplier worth $1 million and that corporate bonds for the unionized auto industry will be paid back by some federal bailout. Poway’s unionized school district is the equivalent of Detroit’s unionized auto industry.

‘Capital appreciation bond’

The mechanism in this future economic disaster is something called a “capital appreciation bond.” It is the bond equivalent of a “negative amortizing home loan” where the interest owed is just added to the loan principal for 20 years. A capital appreciation bond is worse than an interest-only loan where the repayment of the principal amount borrowed is deferred to the future in a so-called balloon loan.

In a “capital appreciation bond,” the interest just keeps growing, and both the principal and the interest become due in 20 years. By then, the $105 million originally borrowed by the Poway School District has become $981 million by 2032. And it won’t be paid off until 2052.

The official statement[5] of Poway’s School Improvement Bond makes no mention that it is a capital appreciation bond and does not disclose the terms and conditions of payment of the bonds.

Capital appreciation bonds are the 2012 equivalent of what “sub-prime loans” were to low-income borrowers and “collateralized mortgage bonds” were to lenders during the Housing Bubble of the last decade. Capital appreciation bonds are highly risky debt instruments for local governments only with tax-exempt bond financing.

The Poway Unified School District has become the local government equivalent to Lehman Bros. or Countrywide Financial. The bond houses that may fund such debt will become the new Fannie Mae and Freddie Mac. The California State Debt Advisory Commission has become the new Standard and Poors bond rating firm. Mark Saladino, the Treasurer-Tax Collector of Los Angeles County, has prepared on open letter[6] warning about capital appreciation bonds.

Poway 2032

In 2032, Poway will have become a public joke. Hedge funds were the rich man’s way to make money in risky investment markets during the Housing Bubble from 2003 to 2008. Sub-prime home equity loans were the poor man’s way to make money during the Bubble.

Now, capital appreciation bonds are the “poor community’s” way to borrow its way out of insolvency in the aftermath of that Housing Bubble. Hence the term: “the right way, the wrong way, and the Poway” or poor way.

In 2012, the Poway school district is betting that future population growth, housing development, and increases in property values will bail out what appears to be an un-payable debt. The state of Michigan has had to ban school districts from issuing such “capital appreciation bonds” for areas like Detroit ,where the old auto industry economic base collapsed. But apparently, in the economic disaster zone of California, for local government and public schools there is no such restriction.

What is worse, by 2032 the cancer of capital appreciation bonds may have spread to the gigantic Los Angeles Unified School District. Seeing what little Poway was able to do, Los Angeles may be tempted to swallow such a poison pill in the hope of curing its financial cancer.

Some 63.9 percent of voters[7] in the Poway area approved a second school improvement bond for $179 million in 2008. This would not have passed had the two-thirds supermajority vote requirement for taxes under Proposition 13 been in effect. But that was overturned by voters and replaced with a lower 55 percent voter threshold for bond financing of school building improvements[8].

Ironically, Prop 13 could have prevented the future disaster that the Poway school district is headed for. But in 2012, teacher’s unions and the Democratic Party erroneously claimed that the money problem that public schools faced was due to Prop 13.

In California circa 2012, there is the right way, the wrong way, and the Poway to bail out debt-laden communities. Foreclosures, short sales, reformed public pension and health plans, cutbacks of “categorical” jobs and political earmarks, and budget austerity rather than bailouts would be the right way. The wrong way would have been to continue with the status quo. But the Poway was to pile more debt on top of existing debt in the hope of a magical self-bailout that can only end in disaster.

- [Image]: http://www.calwatchdog.com/2012/08/08/the-right-way-the-wrong-way-and-the-poway-of-school-bond-financing/poway-unified-bond/

- $981 million: http://www.voiceofsandiego.org/education/article_c83343e8-ddd5-11e1-bfca-001a4bcf887a.html

- 10 times: http://www.nbcsandiego.com/news/local/Poway-to-Pay-Nearly-10-Times-What-it-Borrowed-Report-165216096.html

- in Detroit today: http://www.mlive.com/news/detroit/index.ssf/2010/07/detroit_links_ruin_porn_as_tou.html

- official statement: http://www.smartvoter.org/2008/02/05/ca/sd/prop/C/#text

- open letter: http://www.bondbuyer.com/pdfs/0523LA.pdf

- 63.9 percent of voters: http://www.voiceofsandiego.org/education/article_c83343e8-ddd5-11e1-bfca-001a4bcf887a.html

- 55 percent voter threshold for bond financing of school building improvements: http://www.hjta.org/faq/#prop13_7

Source URL: https://calwatchdog.com/2012/08/08/the-right-way-the-wrong-way-and-the-poway-of-school-bond-financing/