Secrecy pollutes first CA cap and trade auction

by CalWatchdog Staff | November 20, 2012 11:05 am

[1]Nov. 20 2012

[1]Nov. 20 2012

By Katy Grimes

Ignoring a lawsuit filed by the California Chamber of Commerce, the California Air Resources Board went ahead with its first auction[2] of greenhouse gas allowances last Wednesday, Nov. 14. The results of the auction were announced Monday.

Despite trying to sound as if the auction was a resounding success in a media conference call on Monday, it appears that CARB’s first auction lacked a little luster.

But the overshadowing issue was the secrecy in which the auction was conducted by the state agency, and its refusal to publish any information about the bidders or the amounts they purchased.

The big secret

Several emissions trading and auction processes have taken place in other parts of the country, and most disclose more auction information, including bidder information, to improve price discovery, technology innovation and other market features.

A 2009 lawsuit was filed against the New Jersey Environmental Protection Agency over its secrecy methods in carbon auctions in the Northeast Regional Greenhouse Gas Initiative[3]. Previous requests for the identity of bidders, the price of bids and quantity and type of allowances sold to successful bidders had not been disclosed.

Experts from the University of Virginia, Resources for the Future[4] and the California Institute of Technology were hired to assist in designing the Northeast regional greenhouse gas program, RGGI[5]. They were concerned with avoiding collusion and recommended the identity of winning bidders be revealed, along with the market clearing price in the auction, the New Jersey Watchdog reported. The New Jersey Watchdog filed[6] a Freedom of Information Act request[7], and the lead reporter was the plaintiff in the case.

The California Air Resources Board has ignored requests for transparency, and instead went ahead with the closed auction. “It was designed to withstand legal challenges,” CARB Chairwoman Mary Nichols said.

The big sale

The Air Resources Board offered 23.1 million carbon allowances for 2013 trading, and 39.5 million for trading in 2015. Each credit or permit purchased allows the release of one metric ton of carbon. But the carbon credits only sold for nine cents above the reserve price of $10 per share, and far below the market price.

During the conference call, Nichols said the auction wasn’t about raising revenue, but about the cap. “Our goal is to reduce carbon at a reasonable price,” Nichols added.

According to Bloomberg[8] New Energy Finance, “Permits for the first compliance period were expected to clear between $12 and $15 a ton” in the auction..

According[9] to CARB:

* Total 2013 Allowances Available for Sale: 23,126,110;

* Total 2013 Allowances Sold at Auction: 23,126,110;

* Auction Reserve Price: $10.00

* Settlement Price Per Allowance: $10.09

Of the 39,450,000 allowances for sale for 2015, only 5,576,000 sold.

The big lie

[10]

[10]

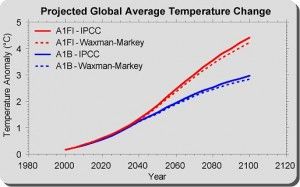

“Without a large reduction in the carbon dioxide emissions from both China and India—not just a commitment but an actual reduction—there will be nothing climatologically gained from any restrictions on U.S. emissions, regardless whether they come about from the Waxman-Markey bill [in the U.S. Congress] (or other cap-and-trade proposals), from a direct carbon tax, or through some EPA regulationsm,” a new research paper[11] by Chip Knappenberger found. “This is something that should be common knowledge. But it is kept carefully guarded.”

Zero carbon emissions from the United States will have no impact on future temperatures, which also applies equally to CARB’s cap and trade, and AB 32.

Cash for carbon

Instead of reducing carbon emissions, a business can merely purchase get-out-of-jail credits.

This flies in the face of AB 32[12], California’s Global Warming Solutions Act, the 2006 legislation signed into law to supposedly lower the state’s carbon emissions to 1990 levels by 2020. The state will accomplish this by “capping” the carbon emissions of oil refineries, utilities and power generators, and other manufacturing and industrial businesses. The amount of carbon emissions capped will decline each year.

The targeted industries must purchase carbon permits to cover their emissions over the cap. Companies which lower carbon emissions below their cap can sell extra allowances to other businesses.

Is cap and trade illegal?

The California Chamber of Commerce filed suit[13] Nov. 13 against CARB to “invalidate California’s cap and trade auction, arguing that the California Air Resources Board exceeded the authority granted to it under AB 32 in establishing the revenue raising program.”

The Cal Chamber called the carbon allowances “an unconstitutional fee,” and accused the Legislature of creating a tax out of “thin air.”

AB 32 originally only granted authority to CARB to enforce fees to recover its regulatory and administrative costs.

Part of the reason CARB was in such a hurry to get the first auction off the ground is for money. The cap and trade program won’t actually start enforcing emissions reductions until 2015.

But the Legislative Analyst’s Office projected that CARB will collect nearly $3 billion in 2013. “For 2012-13, CARB’s auctions are estimated to generate roughly $660 million to upwards of $3 billion,” the LAO reported. “The Governor’s budget for 2012–13 assumes that the state will receive $1 billion from such auctions.”

The state effectively said: Forget carbon emissions, we need the money. This was a short-term, immediate need, and financially motivated.

Black velvet

A friend made an analogy of the state’s cap and trade program and Thursday’s auction with hideous black velvet paintings. “It’s like CARB has said that everyone must purchase a black velvet painting and hang it above their fireplaces. The businesses which participated in the auction are not willing buyers.”

- [Image]: http://www.calwatchdog.com/2012/04/05/ca-energy-schemes-we-are-getting-fleeced/global-warming/

- auction: http://www.arb.ca.gov/cc/capandtrade/auction/november_2012/auction1_results_2012q4nov.pdf

- Regional Greenhouse Gas Initiative: http://www.nj.gov/dep/sage/ce-rggifaq.html

- Resources for the Future: http://www.rff.org/Pages/default.aspx

- RGGI: http://www.rggi.org/

- filed: http://newjersey.watchdog.org/files/2010/09/Lagerkvist.Mark_.OPRA_.10126.20100827.Complaint.Verified.pdf

- request: http://newjersey.watchdog.org/files/2010/09/Lagerkvist.Mark_.OPRA_.10126.20100827.Complaint.Verified.pdf

- Bloomberg: http://www.bloomberg.com/news/2012-11-14/california-carbon-futures-slip-ahead-of-first-allowance-auction.html

- According: http://www.arb.ca.gov/cc/capandtrade/auction/november_2012/auction1_results_2012q4nov.pdf

- [Image]: http://www.calwatchdog.com/2012/11/20/secrecy-pollutes-first-ca-cap-and-trade-auction/waxman-markey_fig111/

- paper: http://www.masterresource.org/2009/05/part-i-a-climate-analysis-of-the-waxman-markey-climate-bill—the-impacts-of-us-actions-alone/

- AB 32: http://www.arb.ca.gov/cc/ab32/ab32.htm

- suit: http://www.calchamber.com/pressreleases/pages/11132012-calchambersuestoinvalidatecarbscapandtradeauction.aspx

Source URL: https://calwatchdog.com/2012/11/20/secrecy-pollutes-first-ca-cap-and-trade-auction/