Phil Mickelson’s net state income tax increase: 83.6%!!!!!

Jan. 30, 2013

By Chris Reed

Richard Rider, the dean of the small-government/low-tax movement in San Diego County, has come up with some stunning number-crunching on his blog:

“Here’s the fact that EVERYONE (including me) initially undervalued concerning [Rancho Santa Fe pro golfer Phil] Mickelson and CA state income taxes. Starting in 2013, Mickelson’s NET state income tax has jumped 83.6%! And yes, this huge increase hits most Californians making more than $2 million income.

“Here’s why. Until 2013, state income taxes were deductible for federal income tax purposes. Starting in 2013, for the really rich, this deductibility largely goes away (as does deducting property taxes and many other deductions). For people with over $2 million of income, they lose 80% of such deductions.

“With Proposition 30 passed in November, CA has raised its income tax on the wealthy by 29%. The combined tax increase is breathtaking. Do the math, and you find that in 2011 the net CA income tax for Mickelson was 6.7%. In 2013 his net CA income tax is 12.3% — an increase of 83.6%.”

This is mind-boggling. No wonder Phil said he was contemplating “drastic changes.”

Rider makes another great point as well:

“The big taxers love to point to a bogus study by the Stanford Center on Poverty and Inequality (the name says it all regarding their objectivity) ‘think tank’ which concluded that the California 1% millionaire’s tax increase in 2005 had little or no effect on millionaire’s leaving. While the study has since been largely discredited, the magnitude of that 2005 increase vs. the 2013 CA increase is worth considering.

“In 2005, the maximum CA income tax went up from 9.3% to 10.3% for those with over a million dollar income. At the time, the CA income tax was fully deductible. With a 35% maximum federal tax bracket, that meant that the increase cost the rich a net 0.65%.

With the changes I’ve discussed, the 2013 NET CA income tax increase is 5.6% — 8.6 TIMES HIGHER than the 2005 increase. Only a fool would think that such a massive increase would still not motivate many of the wealthy to depart the ‘Golden State.’

“Parenthetically might I add that California abounds with such fools.”

And many of them inhabit the newsrooms of the Golden State.

Will the Dan Morains and George Skeltons of the world give this context when writing about state tax policy? Don’t hold your breath. They are what they are — extensions of a Sacramento establishment in which the media’s and the Democrats’ conventional wisdom are often close to identical. That conventional wisdom has long held that the key to making life in California even more glorious is even higher taxes. Groan.

Thank you, Richard Rider, for your vigilance and smarts.

Related Articles

Jobs train 3:10 to Yuma

Sept. 10, 2012 By John Seiler Yesterday Katy Grimes put up a blog, “Editorial cheerleads for Brown.” One of the

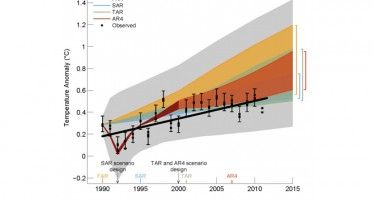

Now UN says global warming exaggerated

On our site and elsewhere, global warming/climate change defenders say almost 100 percent of “climate scientists” maintain global warming/climate change

Gov. Brown maintains sizable fundraising lead over GOP opponents

California Governor Jerry Brown begins his re-election campaign with $17 million in the bank. The incumbent Democrat governor, according to state disclosure