Split-roll property tax would hit small business hard

by CalWatchdog Staff | February 18, 2013 9:58 am

[1]Feb. 18, 2013

[1]Feb. 18, 2013

By Wayne Lusvardi

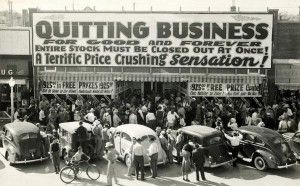

The attacks on Proposition 13 never seem to end. The 1978 tax-cut initiative’s enemies, such as former Assembly Speaker Willie Brown[2], conjure up a misleading image of large corporate owners of commercial real estate dodging taxes by selling commercial properties through “stock transfers.” They call for a “split roll” that would increase taxes on commercial property, while leaving residential property tax at current rates (for now).

The reality is that 97 percent of businesses in California are small. And small commercial properties are not sold by stock transfers. Moreover, stock transfers of large commercial properties are only a tiny fraction of the 3 percent of large commercial properties in the state.

Neither politicians nor the public seem to have an understanding how hard changes in Prop. 13, increasing property taxes, would hit small commercial properties with low tax-assessed values:

* A small mom and pop store or restaurant on a 5,000 square-foot lot could be hit with a combined added split roll property tax up to $6,250 per year.

* A family-owned small office building on a typical 10,000 square-foot lot could be facing up to $12,500 in added taxes per year.

* A 3,000 square-foot historical home leased for offices on a 12,000 square-foot commercial-zoned lot in a primed downtown location could experience $15,000 in added property taxes; or about half of the existing net office rent.

* An older convenience store and gas station on a 15,000 square-foot lot could face up to $18,750 in added property taxes.

* An older family-owned grocery store on one acre of land could incur up to $54,450 in added property taxes.

Demolished

In each of the above-described properties, the only way to afford the property tax increase would be to demolish the older, under-improved buildings and construct new, multi-story apartments, condominiums or offices. This may be highly speculative. Thus, taxes on sales of older commercial properties could occur.

Just as senior citizens on fixed incomes had to sell their homes for taxes in 1975 prior to Prop. 13, small businesses with older structures would likely have to sell, as they would be unable to pay the higher taxes. This is because property taxes are assessed on the highest and best use of commercial land, not on its existing use.

Theoretically, such older properties are under-assessed for property taxes. But in the real world, such properties may be the only current economic use other than letting the land remain vacant.

Ending Prop. 13 for older structures on commercial-zoned land also would end one of the favorite public policies of many liberal elites: historical preservation. Without the lower tax assessment afforded under Prop. 13, many historical properties would have to be demolished, replaced by three to five floors of condos, apartments, offices or mixed-use residential projects.

The only other alternative would be for small commercial property owners to insulate their properties from such higher taxation by signing 100-year land leases or leasing their properties to non-profit agencies that have property-tax exemptions. This strategy might escape the higher taxes, but it also would lead to disinvestment and the deterioration of the commercial building stock.

Under-assessed?

There is a perception problem that commercial property owners are under-assessed when it comes to property taxes as a result of Prop. 13. Many single-family property owners believe they are being overtaxed and that businesses should pay their fair share of taxes.

However, an impartial 2008 study[3] by economists Jose Albero and William G. Hamm found that commercial properties were assessed at 60 percent of their market value and residential properties at only 53 percent. The study estimated that a split-roll property tax alone would result in the loss of 86,000 to 152,400 jobs; and 48,700 families, or about 170,450 people, would migrate out of the state for economic reasons. That would equate to California losing the population — and the tax base — of a city about the size of Santa Rosa, Santa Clarita or Oceanside.

Nonetheless, homeowners that more recently bought their homes and pay full taxes often feel that any under-assessed properties are shifting added taxes onto them.

With their new supermajorities in the Legislature, Democrats already are taking aim at Prop. 13. As the Mercury News reported[4], “‘It is time for a fix, because Proposition 13 is broken,’ said Assemblyman Tom Ammiano, D-San Francisco, who plans to introduce a bill … aimed at forcing businesses to pay higher property taxes.”

If the tax increase is passed, it will hit small businesses the hardest. A small commercial property owner by the name of “Maureen” in Contra Costa County described her plight in a comment left on the Political Blotter of the ContraCostaTimes.com for Dec. 5, 2012:[5]

“We have owned a small piece of commercial property for several years. The rent on this property is our only livelihood. We are not a corporation. If the split roll goes through either our 2 renters pay more rent (who are already doing badly) or we lose our property to the state, as we won’t be able to afford the taxes. In either case we all lose.”

“Maureen” goes on to explain that it will also be apartment renters — not just big corporations — that will be affected by the ending of Prop. 13 for commercial properties:

“[W]e bought the property in 1979. Because this is land it is an unusual piece of property as there isn’t much land in our area. Not only will we become victims of the state but our renters will [be] out of a place to rent for their needs (as there will be no other available) & will also go under.

“I know several other people in the same boat who are definitely not wealthy people. Our property taxes will probably go up 4 or more times to about $30,000/year. This is 1/2 the rent we collect. Our renters can’t afford to pay more. You do the math. The renters at trailer courts & apartment buildings will find their rent will increase for the most part. Read the Pepperdine University report [6]which says minorities & female owned businesses will suffer the most from the impact & that is just the beginning.”

This is the reality of the battle over Prop. 13. It’s not the “big corporations” that would pay, but the small property owners, the backbone of the economy and jobs creation.

Estimated tax increase on underimproved

commercial-zoned land due to split-roll property tax

| LOWAdded$25 per Sq. Ft. LandTax Assessment

@1 percent tax rate |

TYPICALAdded$40 per Sq. Ft. Land Tax Assessment @ 1 percent tax rate |

HIGHAdded$125 per Sq. Ft. Land Assessment@ 1 percent tax rate | |

| Mom & Pop Store – 5,000 Sq. Ft. Land | $1,250 | $2,000 | $6,250 |

| Old Family Owned Office Bldg. 10,000 Sq. Ft. Land | $2,500 | $4,000 | $12,500 |

| Historical 3,000 Sq.Ft. Office on 12,000 Sq. Ft. Lot | $3,000 | $4,800 | $15,000 |

| OlderConvenience Store – 15,000 Sq. Ft. Land | $3,750 | $6,000 | $18,750 |

| OlderFamily-Owned Grocery Market1-acre Land | $10,890 | $17,424 | $54,450 |

- [Image]: http://www.calwatchdog.com/2012/03/13/four-new-california-cities-might-dissolve/quitting-business/

- such as former Assembly Speaker Willie Brown: http://www.calwatchdog.com/wp-admin/post-new.php

- 2008 study: http://www.cbpa.com/documents/split_roll_final_report.pdf

- Mercury News reported: http://www.mercurynews.com/california-budget/ci_22277585/california-democrats-signal-they-want-reform-proposition-13

- ContraCostaTimes.com for Dec. 5, 2012:: http://www.ibabuzz.com/politics/2012/12/06/a-new-push-for-split-roll-property-taxes/

- Pepperdine University report : http://sbaction.org/sbAction/Pepperdine%20-%20Split%20Roll.pdf?1=1

Source URL: https://calwatchdog.com/2013/02/18/split-roll-property-tax-would-hit-small-business-hard/