Economics curriculum bill changes one word in education code

by CalWatchdog Staff | April 2, 2013 10:44 am

April 2, 2013

By Katy Grimes

[1]

[1]

SACRAMENTO — A one-word change in the state education code is going through the cumbersome legislative process at the state Capitol.

Is the bill necessary? The one-word answer is “no.”

The bill, as adopted in the Assembly Education Committee, will not make any changes other than altering the word “preparedness” to “literacy,” as it pertains to economics curriculum in the state education code.

Why run a bill?

Assemblyman Roger Hernández, D-West Covina, thinks kids in California should be required to take an economics class in high school. This sounds laudable, but high school economics is already required for graduation.

Hernández has authored a bill to “improve financial literacy instruction” in high schools statewide.

“The growing negative effects of financial illiteracy, such as the housing mortgage crisis and a low national savings rate, have spurred the need for financial literacy education. As of now, California does not have an official state policy or educational plan for the teaching of financial literacy,” said Hernández on his website.

AB 166[2] sounds like a good idea, so I tried to talk to Hernandez Monday about it in the Assembly. But he shook his head “no” and sat at his desk after he read my note handed to him by the Assembly Sergeant.

California Education Code

Actually, the State Department of Education[3] already lists one semester of economics as required for high school graduation.

Specifically, the statute says:

“A pupil shall complete all of the following while in grades 9 to 12, inclusive, in order to receive a diploma of graduation from high school: (1) At least the following numbers of courses in the subjects specified, each course having a duration of one year, unless otherwise specified: (A) Three courses in English. (B) Two courses in mathematics. (C) Two courses in science, including biological and physical sciences.

“(D) Three courses in social studies, including United States history and geography; world history, culture, and geography; a one-semester course in American government and civics; and a one-semester course in economics.

If economics is already required, why does it need to be added to the state education code?

“School Districts will continue to have discretion on what they teach,” according to Primo Castro with Hernandez’s office. “AB 166 will not change common core [4]standards. At the moment, economics is required, but school districts have discretion what they choose to teach our students in school. AB 166 will provide the framework and encourage school districts to teach financial literacy in the classroom.”

Castro sent the fact sheet for AB 166, which explains, “California does not have an official state policy or educational plan for the teaching of financial literacy.”

But the education code specifies economics be taught to high school students.

“AB 166 would improve California student’s financial literacy skills and help protect them from predatory lending, credit card fraud and other deceptive practice,” Hernandez’s fact sheet says.

Research from the Council for Economic Education, one of the bill’s sponsors, found that “students from states where a financial education course was required had the highest reported financial knowledge and were more likely to display positive financial behaviors and dispositions.”

The Council for Economic Education, which has been around for more than 60 years, “is the leading organization in the United States that focuses on the economic and financial education of students from kindergarten through high school. Our mission has been to instill in young people the fourth ‘R’ — a real-world understanding of economics and personal finance,” their website[5] says.

So why does the Legislature need to mandate yet another high school course for graduation?

Probably because economics is not always taught. The code is interpreted to allow discretion to school districts.

Yet the California Department of Education website[6] already offers a page titled, “Grades K-12 Financial Literacy Resources: Resources for individuals interested in financial literacy for kindergarten through grade twelve students.” The page includes many links to financial literacy resources, including budgeting, debt management, building personal wealth, and practicing sound money skills for life.

“The growing negative effects of financial illiteracy, such as the housing mortgage crisis and a low national savings rate, have spurred the need for financial literacy education for California students,” according to the bill analysis. “The Washington, DC-based Jump$tart Coalition for Personal Financial Literacy [7]reports that its 2008 survey[8] of high school seniors revealed that ‘The financial literacy of high school students has fallen to its lowest level ever.'”

It is unclear why a survey from 2008 is the only standard used for AB 166.

“The survey covered issues ranging from savings and investment to personal debt and credit, and, on average, high school seniors answered 48.3,” the bill analysis said. “California Jump$tart reports 46 states have personal finance standards in various forms, but only 13 of those states include personal finance instruction as part of their K-12 graduation requirements. Jump$tart did not report whether students in states with financial literacy standards or required coursework scored higher than other students on the survey.”

A simple semester course in high school on Nobel Prize-winning economist Milton Friedman [9]would probably be the best curriculum.

Friedman said, “So that the record of history is absolutely crystal clear. That there is no alternative way, so far discovered, of improving the lot of the ordinary people that can hold a candle to the productive activities that are unleashed by a free enterprise system.”

A good place to start would be his TV series, “Free to Choose.” The first part is here:

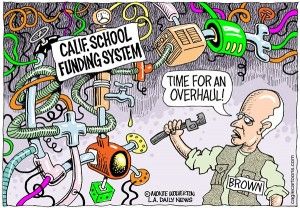

- [Image]: http://www.calwatchdog.com/2013/01/02/education-funding-overhaul/calif-education-funding-cagle-jan-2-2013/

- AB 166: http://totalcapitol.com/?bill_id=201320140AB166

- State Department of Education: http://www.cde.ca.gov/ci/gs/hs/hsgrtable.asp

- common core : http://www.cde.ca.gov/re/cc/tl/whatareccss.asp

- website: http://www.councilforeconed.org/resource/national-standards-for-financial-literacy/

- California Department of Education website: http://www.cde.ca.gov/eo/in/fl/finlitk12.asp

- Jump$tart Coalition for Personal Financial Literacy : http://www.jumpstart.org

- 2008 survey: http://www.jumpstart.org/10-22-2008-jump$tart-survey-shows-student-lack-knowledge-about-credit-reports.html?searched=2008+survey&advsearch=oneword&highlight=ajaxSearch_highlight+ajaxSearch_highlight1+ajaxSearch_highlight2

- Milton Friedman : http://www.nobelprize.org/nobel_prizes/economics/laureates/1976/friedman-autobio.html

Source URL: https://calwatchdog.com/2013/04/02/economics-curriculum-bill-changes-one-word-in-education-code/