CA ‘Wall of Debt’ hits $1,126,200,000,000.00

by CalWatchdog Staff | May 8, 2013 11:01 am

[1]May 8, 2013

[1]May 8, 2013

By Ed Ring

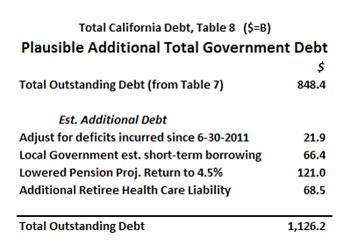

A new study by the California Public Policy Center, “Calculating California’s Total State and Local Government Debt[2],” estimates state and local government debt is somewhere between $848 billion and $1.126 trillion. This is the first attempt we’ve ever seen by anyone to provide an estimate.

Small wonder. If Californians understood that their local city councils, school districts, redevelopment agencies, special districts, county supervisors and state legislators had managed to put them on the hook for more $80,000 of debt per household, they might vote down the next new taxation or bond measure that appears on the ballot. Imagine how much debt this equates to per taxpaying household.

Quoting from the study’s summary, here are the categories of government debt confronting Californians:

“When, along with the $27.8 billion ‘Wall of Debt,’ long-term debt incurred by California’s state, county, and city governments, along with school districts, redevelopment agencies and special districts are totaled, the outstanding balance is $383.0 billion. The officially recognized unfunded liability for California’s public employee retirement benefits — pensions and retirement health care — adds another $265.1 billion. Applying a potentially more realistic 5.5% discount rate to calculate the unfunded pension liability adds an additional $200.3 billion. All of these outstanding debts combined total $848.4 billion. By extrapolating from available data that is either outdated or incomplete, and using a 4.5% discount rate to calculate the unfunded pension liability, the estimated total debt soars to over $1.1 trillion.”

According to a Wall Street Journal editorial from April 29, “Debt and Growth[3],” former White House economist Larry Summers is suggesting that “the U.S. should borrow even more money today because interest rates are low.” Summers is not alone. But hasn’t America heard this song already, and quite recently? What happened to all those homeowners who borrowed money because the payments were low, then suddenly realized they owed more money than they could ever hope to pay back?

There is cruel hypocrisy at work here. Low interest rates mean people saving for retirement cannot hope to amass a nest egg big enough to earn a risk-free return sufficient to live on. Yet the government worker pension funds engage in massive risk in a desperate attempt to earn 7.5% per year, so government workers can enjoy pensions that a private sector worker would have to save millions to match. If they fail to get that 7.5%, taxpayers make up the difference.

Unfunded liabilities

As shown in the CPPC study, for every 1.0 percentage point the projected rates of return for the pension funds drops, the debt confronting Californians increases by $100 billion. The “official” estimate for this shortfall, acknowledged by the state controller, is $128 billion. If you drop that projected 7.5% rate to 5.5%, add another $200 billion to the unfunded liability. Do you think that’s still too high? If those pension funds only earn 4.5%, add another $126 billion to the unfunded liability for pensions.

And why shouldn’t pension funds only earn 4.5% in today’s debt saturated, aging society, where 30 year treasury bills are offering a paltry 2.8%, and a 30 year fixed rate mortgage is down to 3.25%? With all this nearly free money around — courtesy of our government that spends far to much to borrow at any decent rate of interest — where on earth will CalPERS and the other pension funds invest their money with the expectation of getting 7.5% per year?

It’s important to emphasize that the CPPC study employed transparent logic, documenting all their assumptions. Just using the official numbers, California’s state and local governments still owe $648 billion. And of that amount, $265 billion or 41%, represents the officially recognized unfunded liability for government retiree health care and pensions. Another $8.0 billion on top of that is for pension obligation bonds — and most of the data available are nearly two years old. By now, how many more of those have been issued by our financially crippled cities and counties? And how much more of the rest of this borrowing — that other $373 billion in bonds for myriad projects administered by countless government agencies — went to cover personnel costs, or pay “prevailing wages.”

As noted in the CPPC study, there is a case to be made for “good debt.” This is government investment in infrastructure such as roads, bridges, water treatment plants, aqueducts or ports; or to fund research into medicine, energy, agriculture and other scientific endeavors. Government borrowing for infrastructure and scientific research provides a return to taxpayers in the form of new amenities — ideally amenities that will lower the cost of living and improve the quality of life.

But you don’t have to be a raging libertarian purist to criticize the borrowing that has stuck California’s taxpayers on the hook for a cool trillion dollars. Because well more than half of the money owed has nothing to do with infrastructure, or research, or anything else that might pay dividends to society at large. Most of the money owed by California’s state and local government agencies is to pay unionized government workers rates of compensation that most private sector workers can only dream about.

If you accept the CPPC study’s higher estimate, $1.12 trillion, then $663 billion is explicitly for public employee benefits, and countless additional billions in bond proceeds undoubtedly went to pay personnel costs. As noted in my article, “What If Every Worker Made What City of Irvine Workers Make?[4]”, if every worker and retiree in California enjoyed the total compensation packages enjoyed by a typical worker employed by the City of Irvine, it would be necessary to double California’s gross domestic product in order for enough money to exist to pay them. In other words, it’s impossible. But if you can’t afford something, borrow.

A way out?

There is a way out. As explored in my articles, “Bi-Partisan Solutions for California[5]” and “The Prosperity Agenda[6],” there is abundant land in California, and abundant energy resources. California should have the most affordable housing and the cheapest electricity in the United States, instead of the most expensive. Public policies designed to encourage land development and energy development would decisively lower the cost to live in California, which would make public employee compensation reform a palatable option, even to those affected by it.

Ed Ring is the executive director of the California Public Policy Center and the editor of UnionWatch.org[7].

- [Image]: http://www.calwatchdog.com/2013/05/08/ca-wall-of-debt-hits-1126200000000-00/high-california-debt-estimate/

- Calculating California’s Total State and Local Government Debt: http://californiapublicpolicycenter.org/calculating-californias-total-state-and-local-government-debt/

- Debt and Growth: http://online.wsj.com/article/SB10001424127887323528404578451110581429072.html?mod=hp_opinion

- What If Every Worker Made What City of Irvine Workers Make?: http://unionwatch.org/what-if-every-worker-made-what-city-of-irvine-workers-make/

- Bi-Partisan Solutions for California: http://unionwatch.org/bipartisan-solutions-for-california/

- The Prosperity Agenda: http://unionwatch.org/the-prosperity-agenda/

- UnionWatch.org: http://unionwatch.org/

Source URL: https://calwatchdog.com/2013/05/08/ca-wall-of-debt-hits-1126200000000-00/