Prop. 30: Why it hurts CA teams’ chances of signing LeBron James

by Chris Reed | June 26, 2014 11:15 am

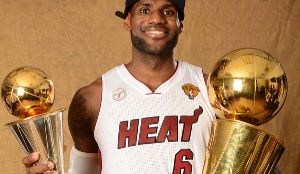

NBA superduperstar LeBron James’ decision this week to opt out of his contract with the Miami Heat has led to intense speculation over where the four-time regular-season MVP and two-time NBA Finals MVP might end up.

NBA superduperstar LeBron James’ decision this week to opt out of his contract with the Miami Heat has led to intense speculation over where the four-time regular-season MVP and two-time NBA Finals MVP might end up.

The current conventional wisdom is that he’s likely to end up back with the Heat. Under NBA rules intended to help teams keep their stars, he can make the most guaranteed money with Miami — a five-year, $129 million deal, averaging $25.8 million a year. Other teams can offer him at most a four-year, $96 million deal (average: $24 million a year).

But in 2010, the last time LeBron was a free agent, he didn’t take the maximum available from his old team, Cleveland, or even from Miami. He took less money because he wanted to join a team ready to make championship runs, and that’s just what happened with the Heat, which made the finals four straight years, winning twice.

So what are the loaded teams this time around? Two teams jump out — the Los Angeles Clippers and the Houston Rockets, which each have two of the 20 or so best players in the league to team with LeBron.

Millions more available in Houston, Miami

But if money is at all a factor for LeBron — not just his salary but how much of a tax bite he faces on his estimated $42 million in annual endorsements — than Proposition 30 is going to hurt the Clippers’ chances badly.

The sting of Prop. 30 on high earners first was highlighted by a sports story in January 2013, when golfer Phil Mickelson said he was considering leaving[1] Rancho Santa Fe and San Diego County because of high taxes. Another San Diegan, small-government crusader Richard Rider, subsequently explained why Mickelson had reason to grouse[2]:

“Here’s the fact that EVERYONE (including me) initially undervalued concerning Mickelson and CA state income taxes. Starting in 2013, Mickelson’s NET state income tax has jumped 83.6%! And yes, this huge increase hits most Californians making more than $2 million income.

“Here’s why. Until 2013, state income taxes were deductible for federal income tax purposes. Starting in 2013, for the really rich, this deductibility largely goes away (as does deducting property taxes and many other deductions). For people with over $2 million of income, they lose 80% of such deductions.

“With Proposition 30 passed in November, CA has raised its income tax on the wealthy by 29%. The combined tax increase is breathtaking. Do the math, and you find that in 2011 the net CA income tax for Mickelson was 6.7%. In 2013 his net CA income tax is 12.3% — an increase of 83.6%.”

Because of this huge bite, assuming James’ endorsements remained at $42 million, if he played for the Clippers and made $24 million, he would face a 51 percent effective tax rate on his $66 million in income, meaning he would take home a little bit more than $32 million.

Clippers fans can blame CA Dems if LeBron stays away

If he played for Houston, in a state that has no income tax, his 39 percent effective tax rate on $66 million in income means he would take home a little bit more than $40 million. That’s only slightly less then he would make if he returns to Miami, in another state that has no income tax. In Florida, his 39 percent effective tax rate on $67.8 million in income means he would take home about $41.4 million.

If he played for Houston, in a state that has no income tax, his 39 percent effective tax rate on $66 million in income means he would take home a little bit more than $40 million. That’s only slightly less then he would make if he returns to Miami, in another state that has no income tax. In Florida, his 39 percent effective tax rate on $67.8 million in income means he would take home about $41.4 million.

Now obviously this is a simplistic calculation of his taxes, which would be subject to other factors, especially given the complex ways many states target the income of visiting pro athletes. But the bottom line is pretty inescapable: Houston and Miami have huge advantages over the Clippers on the money front.

LeBron James may not care about how much money he makes at this point in his life. And one of his very best friends[3], Chris Paul, is a superstar point guard with the Clippers, where the coach is Doc Rivers, another LeBron favorite.

But if his decision is a close call and he doesn’t choose the Clippers, it’s fair to give some of the blame to Proposition 30 and the confiscatory policies of the California Democratic Party.

- considering leaving: http://www.realclearsports.com/2013/01/21/mickelson_039drastic_changes039_due_to_taxes_108924.html

- reason to grouse: http://riderrants.blogspot.com/2013/01/mickelsons-ca-net-income-tax-rate-going.html

- very best friends: http://espn.go.com/blog/truehoop/miamiheat/post/_/id/15836/at-crossroads-james-paul-aided-each-other

Source URL: https://calwatchdog.com/2014/06/26/prop-30-why-it-hurts-ca-teams-chances-of-signing-lebron-james/