Tax Foundation: CA has fourth-highest state taxes

by John Seiler | March 11, 2015 12:56 pm

The newest figures just released by the Tax Foundation show California continues to be one of the highest-taxes states in the country. According to “Facts & Figures 2015: How Does Your State Compare[1]?” the Golden State now ranks fourth-highest for taxation. The only states with higher taxes are Connecticut and New Jersey, tied for the highest; and New York in third place.

The newest figures just released by the Tax Foundation show California continues to be one of the highest-taxes states in the country. According to “Facts & Figures 2015: How Does Your State Compare[1]?” the Golden State now ranks fourth-highest for taxation. The only states with higher taxes are Connecticut and New Jersey, tied for the highest; and New York in third place.

A big problem was pointed out to CalWatchdog.com by Esmael Adibi, A. Gary Anderson Center for Economic Research and Anderson Chair of Economic Analysis at Chapman University: Three of our Western States competitors make the Top Ten list of the least-taxed states: Nevada in third place, Utah in 9th and Texas in 10th.

Overall, the state with the least taxes is Louisiana, followed by Mississippi, South Dakota and Tennessee.

Adibi pointed out that California’s high rank derives largely from it having the highest personal income tax in the country, 13.3 percent at the top marginal rate after voters passed Proposition 30[2] in 2012. “Prop. 30 really pushed us over,” he said.

He added that, despite the Proposition 13[3] tax limitation measure, California ranked only 14th-best for property-tax collections. If property here cost less, then California would rank much higher. “But property is so expensive, the taxes paid equal the tax rate times the amount you pay for the property,” he calculated.

California also scored low on the overall 2015 State Business Climate Index, with third-worst business climate. Worst of all was New Jersey, followed by Connecticut.

That’s similar to the finding of CEO Magazine’s survey of CEOs[4], who have ranked California the worst state in which to do business for eight straight years.

And the Kosmont-Rose Institute Cost of Doing Business Survey found[5], “California dominates the list of the most expensive cities, with a total of 12 cities – nine in Southern California and three in the San Francisco Bay Area. Los Angeles and the San Francisco Bay Area are the two most expensive metropolitan areas in the western United States.”

Leaving the Golden State

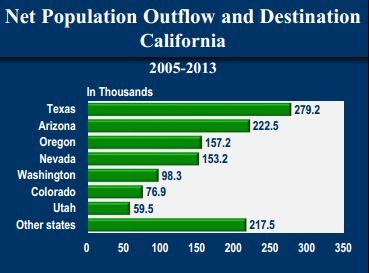

“There’s no question high taxes at least affect some people on whether to stay in California or move to a state with lower taxes,” Adibi pointed out. He provided CalWatchdog.com a chart showing “Net Population Outflow and Destination” for California. “Net” means both those coming into the state and those leaving.

“There’s no question high taxes at least affect some people on whether to stay in California or move to a state with lower taxes,” Adibi pointed out. He provided CalWatchdog.com a chart showing “Net Population Outflow and Destination” for California. “Net” means both those coming into the state and those leaving.

From 2005 to 2013: 279,000 Californians left for Texas, 222,500 for Arizona, 157,200 for Oregon, 153,200 for Nevada, 98,300 for Washington State, 76,900 for Colorado and 59,500 for Utah; all other states were 217,500.

Rankings

Some other rankings from the Tax Foundation “Facts & Figures”:

- Sources of California state and tocal tax collections: 28.1 percent from property tax, 22.3 percent general sales tax, 30 percent individual income tax, 4.3 percent corporate income tax and 15.3 percent all other taxes.

- Federal aid as a percentage of general state revenue: 25 percent. The national average is 30 percent. That is, California is a “donor state,” it pays more into the federal government than it gets back.

- State individual income tax receipts per capita: $1,750, ranking fourth; Connecticut was highest, at $2,174.

- State and local sales tax rate: 7.5 percent, highest of any state. (Some local governments add to that.)

- State gasoline tax rate per gallon: 45.39 cents, second highest. Pennsylvania is highest, at 50.50 cents.

- State spirits excise tax rate, per gallon: $3.30, 39th highest; California is Wine Country. The highest was Washington State, at $35.22.

- Like most states, California exempts groceries from the sales tax. The highest grocery sales tax is Tennesse’s, at 5 percent.

- California does not have a state inheritance tax, or “death tax.” The highest state rate is Washington State, at up to 20 percent.

- California state and local debt is $11,094 per capita, 8th highest. At the top is New York, at $17,405.

- Facts & Figures 2015: How Does Your State Compare: http://taxfoundation.org/sites/taxfoundation.org/files/docs/Fact%26Figures_15_web.pdf

- Proposition 30: http://ballotpedia.org/California_Proposition_30,_Sales_and_Income_Tax_Increase_%282012%29

- Proposition 13: http://ballotpedia.org/California_Proposition_13_%281978%29

- survey of CEOs: http://www.realclearmarkets.com/articles/2014/03/21/california_ceos_rate_it_worst_us_business_climate_for_8_years_running_100963.html

- found: http://www.kosmont.com/2014/03/07/california-cities-remain-high-cost-but-los-angeles-mayor-proposes-relief-for-business/

Source URL: https://calwatchdog.com/2015/03/11/tax-foundation-ca-has-fourth-highest-state-taxes/