CA considers state pot bank

by James Poulos | August 4, 2015 10:25 am

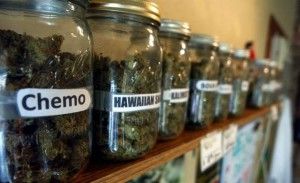

[1]Grappling with the regulatory challenges faced by liberalizing marijuana laws, California officials floated the idea of a state-run bank for the cannabis industry.

[1]Grappling with the regulatory challenges faced by liberalizing marijuana laws, California officials floated the idea of a state-run bank for the cannabis industry.

The plan, which would have struck many observers as outlandish just a few years ago, arose in response to a big practical problem. On the one hand, going forward, marijuana won’t be getting any more illegal in the Golden State; the industry is set only to expand. On the other, the federal government has signaled that, because marijuana is still illegal at the federal level, it does not plan to clear pot businesses for banking.

Tax and save

For that reason, the State Board of Equalization met at the behest of State Tax Board member and Democrat Fiona Ma. Ma claimed it’s unsustainable for the marijuana economy to stay “in the shadows,” according[2] to CBS Sacramento, with California banks and credit unions afraid of federal consequences if they try to provide services:

“Ma believes legal marijuana businesses should have the same access to banks as any other businesses. She would like to see the creation of a state-run bank where cannabis businesses could make cash deposits and electronic transfers to the Tax Board.”

The idea quickly gained bipartisan traction. Calling the situation “dangerous all around,” another board member, Republican George Runner, told[3] the Los Angeles Times of “one dispensary that brought a bag filled with $200,000 into the Sacramento district office.”

“Cash-only operations are also more difficult for the board to audit because these businesses do not have access to the same banking documents, Runner said. He argued that letting banks offer services to marijuana businesses would streamline the auditing process — and increase compliance to tax law.”

One key reason why the impetus for change has come from the tax board was easy to understand: the gray market powering the marijuana economy has long been too hard to tax. “A recent study of Ma’s San Francisco-based district that stretches across 23 counties found just 35 percent of the medical marijuana dispensaries paid sales taxes,” the Sacramento Bee noted[4], “totaling about $27 million last year.”

Possible legislation

In the meantime, legislators in Sacramento have indicated that they may throw their weight behind this or a similar policy. “State lawmakers are considering a resolution that would urge the president and Congress to support legislation allowing banks and credit unions to serve state-legalized marijuana businesses,” according to the Times.

Congress has also begun to take some action. “Last week, the U.S. Senate Appropriations Committee passed an amendment allowing banks to serve marijuana sellers in states where the drug is legal,” the Bee reported[5]. This month, the Federal Reserve Board “denied an application by a Colorado credit union seeking to provide banking for the pot industry.”

Federal hurdles

“Some of those things the banks are obligated to consider are going to disqualify a lot of local dispensaries, perhaps all of them. California has been unable to draft legislation that provides any statewide licensing scheme. There’s no state mechanism for licensing a medical marijuana business, let alone getting permission to operate one. I can see a lot of banks looking at this language and saying we can’t verify you are duly licensed and registered.”

- [Image]: http://calwatchdog.com/wp-content/uploads/2015/08/Pot-dispensary.jpg

- according: http://sanfrancisco.cbslocal.com/2015/08/01/california-officials-consider-state-run-bank-to-serve-the-pot-industry/

- told: http://www.latimes.com/local/la-me-pot-banking-20150801-story.html

- noted: http://www.sacbee.com/news/politics-government/capitol-alert/article29685532.html

- reported: http://www.sacbee.com/news/politics-government/capitol-alert/article29685532.html

- summed up: http://www.laweekly.com/news/marijuana-businesses-can-now-use-banks-but-maybe-not-in-california-4440965

Source URL: https://calwatchdog.com/2015/08/04/ca-mulls-state-pot-bank/