4 or more tax measures likely on crowded fall ballot

by Chris Reed | January 6, 2016 8:46 am

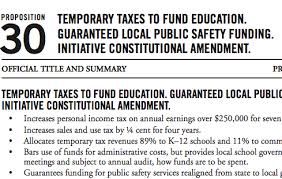

With low state turnout in the 2014 election making it much easier than normal to qualify a ballot measure for elections this year, Californians may see their most overloaded ballot yet. The glut includes several proposals to raise taxes or extend expiring levies — starting with Proposition 30, a 2012 ballot measure that voters were assured would only raise taxes on a “temporary” basis. The San Francisco Chronicle offered this overview[1]:

With low state turnout in the 2014 election making it much easier than normal to qualify a ballot measure for elections this year, Californians may see their most overloaded ballot yet. The glut includes several proposals to raise taxes or extend expiring levies — starting with Proposition 30, a 2012 ballot measure that voters were assured would only raise taxes on a “temporary” basis. The San Francisco Chronicle offered this overview[1]:

A measure backed by the California Teachers Association would extend Prop. 30’s higher tax rates on the wealthiest Californians until 2030, with an estimated $7.5 billion each year going to public schools and community colleges.

Another measure, this one by the California Hospital Association and the Service Employees International Union-United Healthcare Workers West, makes those higher tax rates permanent and sends half the annual estimated $10 billion to public schools, colleges and universities, 40 percent to Medi-Cal for low-income health care and 10 percent for early childhood development programs. It also imposes a new, higher tax rate on those who make more than $1 million annually. …

[Negotiators] for the teachers group and the hospital association have been talking about a third option, which would extend Prop. 30’s higher tax rates and split the money between schools and health programs. That measure is awaiting approval from the state Attorney General’s Office, and a decision about whether to aim that initiative for the ballot won’t be made until later this month. …

“We’d prefer one measure, especially on a crowded ballot,” said Gale Kaufman, a political consultant working on the teachers’ measure. “My instincts say less is better always, but it’s difficult to have any hard and fast rules.”

The focus isn’t just on income tax ballot measures, though they have gotten the most early attention. The Chronicle notes that the Making Poverty History initiative “would add a surcharge to the tax bill for land and buildings with an assessed value of $3 million or more. The $6 billion raised annually would go toward programs to reduce poverty in the state, including prenatal services, expanded child care, tax credits and job training grants.”

Steyer follows Schwarzenegger strategy

Tom Steyer, the billionaire environmentalist who is exploring a 2018 run for governor, also is looking to make a political name for himself with a ballot measure, as Arnold Schwarzenegger did in 2002 with Proposition 49[2], a successful ballot measure funding after-school programs, a year before the recall election that ousted Gov. Gray Davis.

Tom Steyer, the billionaire environmentalist who is exploring a 2018 run for governor, also is looking to make a political name for himself with a ballot measure, as Arnold Schwarzenegger did in 2002 with Proposition 49[2], a successful ballot measure funding after-school programs, a year before the recall election that ousted Gov. Gray Davis.

Steyer is behind the Save Lives California[3] campaign, which would use a $2-a-pack tax on cigarettes to shore up state Medi-Cal funding and to pay for health-promotion and anti-smoking programs.

A previous ballot measure that successfully raised cigarette taxes was also sponsored by a non-politician believed to be interested in running for governor. Championed by Hollywood producer-director-actor Rob Reiner, Proposition 10[4] added a 50-cent levy on a pack of cigarettes, with proceeds used mostly to fund early childhood education programs.

But Reiner, unlike Schwarzenegger, never ran for state office.

- overview: http://www.sfchronicle.com/politics/article/4-competing-tax-measures-to-split-voters-6734446.php

- Proposition 49: http://journalism.berkeley.edu/projects/election2002/stories/000176.html

- Save Lives California: http://www.savelivescalifornia.com/

- Proposition 10: https://ballotpedia.org/California_Proposition_10,_%22First_5%22_Early_Childhood_Cigarette_Tax_%281998%29

Source URL: https://calwatchdog.com/2016/01/06/4-tax-measures-likely-crowded-fall-ballot/