California Democrats take aim at company tax savings with surcharge proposal

Print this article

Font size -16+

Democrat Assemblymen Kevin McCarty and Phil Ting recently introduced Assembly Constitutional Amendment 22, a piece of legislation that calls for a 7 percent surcharge on companies that have net earnings over $1 million, in addition to the current state corporate tax rate of 8.84 percent.

Democrat Assemblymen Kevin McCarty and Phil Ting recently introduced Assembly Constitutional Amendment 22, a piece of legislation that calls for a 7 percent surcharge on companies that have net earnings over $1 million, in addition to the current state corporate tax rate of 8.84 percent. “It is unconscionable to force working families to pay the price for tax breaks and loopholes benefiting corporations and wealthy individuals,” Ting reportedly said in a statement. “This bill will help blunt the impact of the federal tax plan on everyday Californians by protecting funding for education, affordable health care and other core priorities.”

Under the GOP’s tax law the corporate tax rate dropped from 35 percent to 21 percent, with Republicans arguing that the move will spur economic growth and lead to increased job opportunities.

However, Democrats argue that it amounts to a tax cut for the wealthy at the expense of middle and lower-class Americans.

“Proud to joint author #CaLeg #ACA22 w/@PhilTing. At a time when reckless federal tax policy favors billionaires over middle class workers, ACA 22 will help support middle class families & ensure that CA can continue to grow. #MiddleClassTaxJustice,” Assemblyman McCarty added on Twitter.

Business groups in the state are already coming out against the bill, arguing that the Golden State is already a challenging tax and regulatory environment.

“Many large employers, including California-based companies, have announced bonuses or pay increases as a result of the recently enacted tax reform, putting more money in the pockets of hardworking Californians,” Rob Lapsley, president of the California Business Roundtable, said in a statement. “Imposing tens of billions of dollars in new taxes on employers will be a major step backwards that will only hurt middle-class Californians struggling to make ends meet.”

If the bill is approved by a two-thirds majority of the state Legislature, it will go to the voters for final approval.

The move is just the latest effort by liberal lawmakers in California to push back against the Trump agenda in Washington. While recent actions have largely focused on the issue of immigration and climate change, legislators now appear to be expanding their so-called “resistance” into other policy matters.

President Trump is the first president in decades to not visit California during his first year in office.

Related Articles

‘Three California’ plan won’t appear on November ballot, California Supreme Court rules

The California Supreme Court on Wednesday blocked the controversial initiative aimed at dividing California into three states from going to

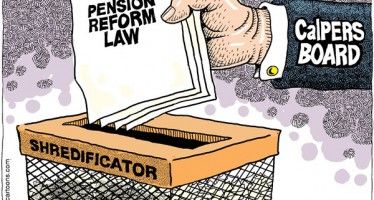

Brown hits CalPERS on pension spiking

A bad month for CalPERS has gotten worse. On the heels of unfavorable news surrounding its investment strategy and leadership, the California

CA farmers finally win on federal water bill

California’s beleaguered farmers had their hopes for a better 2017 rekindled as landmark water legislation delayed for years finally passed