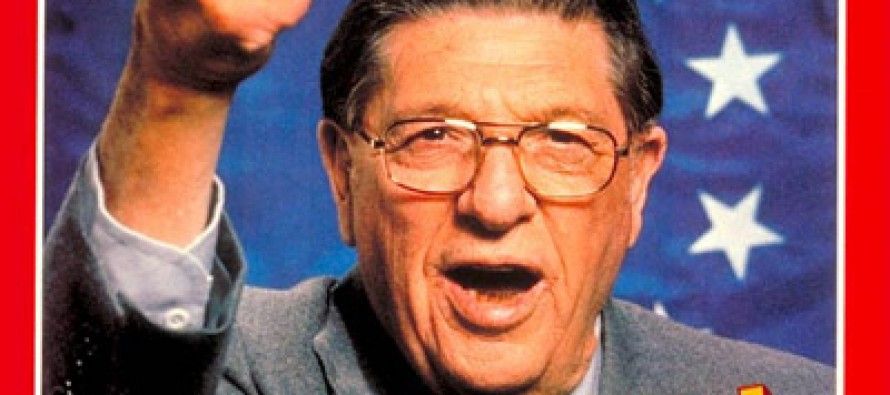

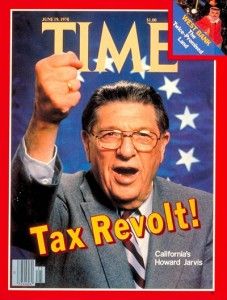

Why Prop. 13 is more crucial than ever

Every year brings attempts to gut Proposition 13, the 1978 tax limitation measure. It limits yearly increases in property taxes to 2 percent of the assessed value, beginning when the property was purchased. The original rate is 1 percent of assessed value.

Every year brings attempts to gut Proposition 13, the 1978 tax limitation measure. It limits yearly increases in property taxes to 2 percent of the assessed value, beginning when the property was purchased. The original rate is 1 percent of assessed value.

Thus, someone buying a $300,000 condo this year would pay $3,000 in taxes this year, but at most $3,060 next year.

New Jersey didn’t have an equivalent until recently. Here’s what’s happening:

The average property-tax bill in New Jersey, which already has the highest in the U.S., rose 1.7 percent last year, Governor Chris Christie said.

More than 80 towns, school boards and other local governments saw their taxes drop, while about 160 had increases of less than 1 percent, according to an e-mail from the governor’s office.

New Jersey’s property taxes, which are collected by local governments, increased about 7 percent annually in 2004, 2005 and 2006 before the rate began to slow. Christie, a second-term Republican, has controlled the growth after enacting a 2 percent annual cap. Still, the tax climbed to a record of more than $8,000 per household, from the previous high of $7,885 in 2012, according to calculations by Bloomberg.

“This is the lowest rate of growth in 24 years in this state,” Christie said yesterday at a town-hall meeting in Mount Laurel.

That’s only because home price increases slowed after the earlier peaks. But the taxes remain sky high. And you’re living in Jersey!

Related Articles

Education Secretary DeVos explicitly OKs controversial state school evaluations

A nearly year-long fight between the Trump administration and the California state government over school accountability ended with an unexpected

State Printer Decides Election Date?

SEE RESPONSE FROM DGS AT END OF STORY. Katy Grimes: While speaking with Republican Sen. Bob Huff yesterday about budget

No More Double Dipping

Katy Grimes: State employees that plan to retire and enjoy the benefits of a state retirement, but then get another