‘Inflation Tax’ Already Striking CA

JAN. 9, 2011

By JOHN SEILER

Californians won’t have to wait for tax increases, such as the several that could be put before voters in the November election. One proposal is Gov. Jerry Brown’s $7 billion tax increase.

Tax increases already are hitting the state because of inflation, which itself is a tax. The recent numbers show that inflation is much higher than the official 3.4 percent increase in the consumer price index (CPI) for 2011.

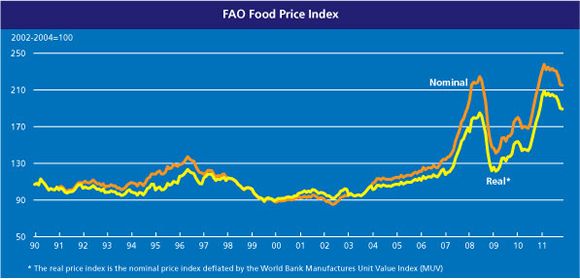

Consider how much the Global Food Index has risen in recent years:

As you can see, food has more than doubled in price in recent years. We’ve only seen some of that in California. Most of the increase is slamming economies overseas. It’s a major reason behind last year’s Arab Spring protest that brought down governments.

But it’s still hitting us, as you can see by comparing your grocery bills to those you ran up in previous years.

For example, two years ago I remember buying Target’s Market Pantry brand of bacon, cheap but good, for about $1.39 a pound. Now it’s about $3.25.

The above graph was from a recent UN Report on the World Food Situation.

The U.S. Department of Agriculture also is predicting that food prices will keep rising:

“For 2012, food price inflation is expected to abate from 2011 levels but is projected to be slightly above the historical average for the past two decades. The all-food CPI is projected to increase 2.5 to 3.5 percent over 2011 levels, with food-at-home prices increasing 3 to 4 percent and food-away-from-home prices increasing 2 to 3 percent. While many inflationary pressures that drove prices up in 2011 are not expected to intensify and may even decrease in 2012, retailers have been slow to pass on cost increases to date. Price levels in 2012 will hinge significantly on several macroeconomic factors such as weather conditions, fuel prices, and the value of the U.S. dollar (an indicator of global demand). An end-of-year surge in prices has increased the starting point for 2012 prices, which may reflect more moderate inflationary figures for 2012.”

Actually, I think they’re underestimating the inflationary pressures during an election year. Have to protect the Boss, you know. The quasi-recovery we’re enjoying also could push up prices as people buy more food of better quality.

As ABC News reported last week, a lot of items are increasing in cost, including water, gas, shipping and Starbucks coffee.

Real Inflation Rate

In past articles I’ve cited ShadowStats.com, which compiles more realistic data than the government on unemployment and inflation. The government changed its inflation calculations 20 years ago to reduce perceived inflation, thus letting it cut annual COLAs (cost of living allowances) for Social Security. It was a sneaky way to reduce the impending crisis in Social Security funding.

One of the things they did, for example, was to figure that when the price of something rose, people would switch to a cheaper equivalent. Thus, people would switch from steak to hamburger. But that’s just fudging the numbers to make the government look better.

Today’s official rate of 3.4 percent yearly inflation is shown by the red line, below. But the real rate of inflation, calculated they way they did in 1990, is about 6 percent, shown by the blue line.

If this 6 percent inflation rate continues for California, it means we already will be paying a 6 percent “inflation tax” by November. On top of that, Gov. Brown would impose another $7 billion tax. That would increase state spending from $86 billion to $92 billion, or 7 percent.

It would be a double-tax whammy for Californians: first prices would increase from inflation, then the Brown tax — or some other tax — would slam the state. It’s hard to escape dollar inflation so long as the source of inflation, the Federal Reserve Board, keeps printing too much money.

But people and businesses could keep fleeing California to avoid the high taxes, in the process getting a break from inflation by heading for cheaper areas of the country. For example, moving to Texas not only means avoiding California’s high state income tax rate, which tops out at 10.3 percent, while enjoying Texas’s zero state income tax rate. It also means cheaper gas and beef because Texas Tea and longhorns are two commodities the Lone Star State produces in abundance.

For California businesses and citizens, it’s another nail-biting year of wondering if the great weather really makes up for all the detriments of staying here.

Related Articles

May Revise preview

May 13, 2013 By John Seiler Tomorrow Gov. Jerry Brown will release the May Revise to his January budget proposal

Shutdown casts shadow over CA races for U.S. House

The partial government shutdown is now in its second week. Throughout the duration of the shutdown, national and local media

LAO report: $1.3 billion state building plan lacks oversight

The $1.3 billion first phase of a project to build and modernize 11 state office buildings lacks adequate accountability and oversight and