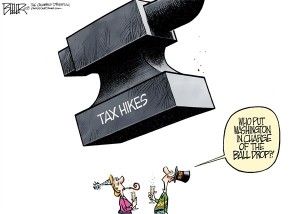

‘Fiscal cliff’ tax increases will slam U.S., CA

By John Seiler

Congress and President Obama just worked out a deal for massive tax increases that will slam Californians. The federal tax hikes hit even the middle class, whose payroll taxes will rise 2 percentage points.

The federal wallop comes on top of the $6 billion of Proposition 30 tax increases voters passed two months ago. The tax increases almost certainly will spark a new recession and increase unemployment.

Gov. Jerry Brown campaigned for his tax increase by appealing to envy. He insisted that the rich must “pay their fair share.” That never was defined. Is it half of income? Or 75 percent, as in France? Why not 100 percent?

And he didn’t care that federal taxes likely would go up, as indeed has happened.

Including the Obamacare and other tax increases, the top federal rate personal tax rate rises from 35 percent to 41 percent.

Add the new top California personal tax income tax rate of 13.5 percent, and the combined top rate here now comes in at 54.5 percent.

However, by moving to Nevada, Texas, Washington, Florida or another state with no state income tax, that rate drops to 41 percent (the federal rate alone), or a 25 percent decline. Plus other taxes would be lower. And real estate is a lot cheaper. Of course, California’s balmy climate also would be gone. But as the Rolling Stones scream on their 50th anniversary tour, “You Can’t Always Get What You Want.”

The Obama-Boehner “fiscal cliff” tax increases could sabotage Brown’s budget plans. In a few days the governor will release his new budget for fiscal 2013-14, which begins on July 1. It will project a strong, growing economy that will bring in oodles of new revenue, in particular from Prop. 30.

But tax increases usually bring economic decline.

Clinton’s 1993 tax increase

Before I cite some examples of decline, let me deal with the tax increase Democrats always bring up: Bill Clinton’s from 1993. The recent “fiscal cliff” tax increases were touted by Democrats as bringing back the top 39.6 percent rate Clinton and the Democratic Congress of 1993 imposed, a rise from 35 percent in 1992. That supposedly supplied the oomph in the economic growth for the rest of the 1990s.

President George H.W. Bush’s 1990 tax increase broke his “Read my lips, no new taxes!” solemn pledge he made at the 1988 GOP national convention. It helped get him elected over Michael Dukakis. The tax increase slammed the country into a recession that led to Bush losing to Clinton in 1993.

Tax policy sends messages. In this case, the message was: “All is hopeless. Not just Democrats, but Republicans favor tax increases. There’s no brake on looting the economy. Get out while you can.”

The 1993 Clinton tax increase was different. The key was this: It passed by just one vote in the U.S. Senate and one vote in the House of Representatives. The message was: “Even Democrats are reluctant to raise taxes, so there aren’t going to be any more. Get back to work making money.”

And that’s just what happened. We haven’t had any major federal tax increases until now.

But notice also what happened after the 1993 Clinton tax increase. In 1994, Democrats lost control of Congress. Republicans were in charge of both houses for the first time in 30 years. Message: “No way are taxes going up.”

Then, in 1996, Clinton agreed with the Republican-run Congress on a tax cut, dropping the top capital gains tax rate from 28 percent to 20 percent. That freed more capital to help fuel the dot-com boom of the late 1990s. Message: “Even a Democratic president wants tax cuts and jobs growth.”

Clinton was a master politician (still is). He actually followed his 1992 campaign slogan, “We must have the courage to change.” In his case, he dumped worn-out Democratic obsessions with envy and tax increases, supported tax cuts and was re-elected in 1996, beating Bob “Tax Collector for the Welfare State” Dole.

Tax increases

Now let’s look at the tax increases that have caused recessions.

In 1968, President Lyndon Johnson imposed a 10 percent income surtax to pay for the Vietnam War and his Great Society welfare programs — his “guns and butter” policy. The result: the 1969-70 recession.

In 1971, President Nixon imposed his infamous “Nixon Shock,” which raised taxes and tariffs and took America off the gold standard. The resulting inflation boosted the economy artificially through 1972, helping Nixon run up a 49-state landslide in the 1972 election. Then a deep recession hit in from 1973-75.

This began the the “stagflation” economy of the 1970s: stagnation plus inflation. Robust recovery began only when Ronald Reagan’s tax cuts dug in with full force in 1983. (Although the tax cuts were enacted in 1981, Reagan later admitted he made a mistake by delaying some of the cuts for two years, which also delayed the recovery.)

Reagan did increase some taxes. But overall, he dropped the top income tax rate from 70 percent to 28 percent by 1986, a major accomplishment.

The Reagan Prosperity ended with the 1990 Bush tax increases, discussed earlier in this article. In California, the Bush recession was made worse by Gov. Pete Wilson increasing taxes $7 billion a year in 1991. Doing so, instead of increasing state revenues, actually decreased them by $2 billion to $40 billion a year. Economic recovery here was delayed until the taxes ended in 1995.

The early 2000s recession probably was caused not by direct tax increases, but by the Federal Reserve Board of Alan Greenspan imposing deflation, as Jude Wanniski described it at the time. That didn’t last long, as the Fed under Greenspan inflated the dollar after 9/11.

The 2007 recession and 2008 economic collapse were caused by tax increases only in the sense that the 2001 and 2003 Bush tax cuts were not permanent, causing uncertainty in the late 2000s. Other factors were larger, including new Fed Chairman Ben Bernake continuing Greenspan’s inflationary policies. Those policies included ultra-low interest rates which, along with too-easy lending rules, caused the housing boom-bust.

The ‘message’ of tax increases 2013

Will the new tax increases be different? Will they continue prosperity instead of sparking a new recession?

Let’s return to the important concept of how polices send “messages.” The message now is: “The Republican leadership, and many GOP senators and representatives, think tax increases are OK. The Republicans no longer have the guts to stand up to the demands for tax increases by Obama and other Democrats. So even more tax increases are likely.”

In California, the “message” is: “Voters just passed two tax-increase initiatives and put supermajorities in charge of both houses of the Legislature. There is no brake on taxing and spending except Brown, who pushed through the tax increases. And if he vetoes a tax increase, the supermajority could override him.”

At both the federal and state level, the “message” is that the appeal to envy works. The call for the “rich to pay their fair share” resonated.

But “the rich” are the entrepreneurs and business owners and jobs creators. Take more money from them, and they have less to invest in business and jobs creation. To avoid paying their unfair share — and in many cases just to survive — “the rich” will leave California and even the United States.

Many of “the rich” are family businesses that now could pay the increased death tax. Which means that when the older generation dies, the younger generation will have to sell the company to pay the death tax, destroying the family ownership that is essential to the success of many such companies.

Within the next few months we’ll see how hard the tax increases have sapped the economy. If history is any guide, it’s going to be bad. The reduced economic activity could end up reducing revenues to all levels of government, ironically making the fiscal and debt crises worse.

Related Articles

Water conservation success backfires on policy-makers

A longstanding truism when it comes to needed goods such as water systems, flood control or catastrophic earthquake insurance

Bad actors, lousy script, in CA budget ‘play’

June 13, 2012 By Katy Grimes California’s budget process has become a charade–it’s like watching a really amateurish play, with

Supreme Court Rebukes Crony Capitalism

The following first appeared in City Journal California. JAN. 6, 2012 By STEVEN GREENHUT On December 29, 2011, the California