CA state and local spending rises to nearly $400 billion a year

California’s state and local spending, in total, has risen to nearly $400 billion a year.

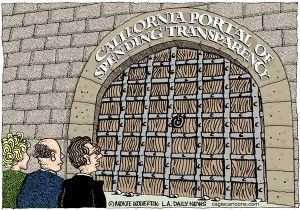

That is, if anyone can actually compile accurate financial information. The state controller hasn’t produced a consolidated financial report for K-12 school districts and community colleges since 2000. The most recent data available from the state controller’s office, “Consolidated Annual Financial Reports,” for cities, counties, special districts and redevelopment agencies, concern the fiscal year ended June 30, 2011, more than two years ago. And if you want to match revenue coming from funding agencies — such as the federal and state government to local cities and counties — don’t expect the reported disbursements on the reports from the funding agencies to match the reported receipts from the receiving agencies.

These are among the findings of a new study released yesterday by the California Public Policy Center, where I am executive director, after several months of wading through virtually every official source of consolidated financial data produced by state agencies, and after talking with dozens of financial professionals working in those agencies.

If you read the study, “How Big Are California’s State and Local Governments Combined?,” you will note the extensively footnoted calculations put California’s total state and local government spending at $365 billion per year. You will see that, in the fiscal year ended June 30, 2011, California’s taxpayers paid an estimated:

* $48.7 billion for direct state operations, including higher education;

* $67.4 billion for K-12 public schools and community colleges;

* $57.4 billion for the county governments;

* $55.8 billion for the city governments;

* $40.5 billion for special districts;

* $8.9 billion for redevelopment agencies;

* $86.3 billion for medicaid, welfare, and unemployment compensation.

How much?

Who knows how much we spent in the fiscal year just ended, on June 30, 2013? The informational website, USGovernmentSpending.com, reports, “California State & Local 2013 Spending by Function” at $477.8 billion!

The only takeaways here are:

(1) Evidently, the CPPC did not make any extrapolations that might invite accusations of trying to inflate the numbers to make a point;

(2) The data are so fragmented, so contradictory, so overwhelming in volume and so abundantly lacking in clarity, that it should come as no surprise that a separate independent study might produce a number so much higher. Or perhaps California’s state and local government spending has actually increased 30 percent in two years.

Not easily found in any official report, not even in the many individual city and county financials that the CPPC team spot-checked, was any attempt to produce tables showing personnel costs as a percent of the total budget. It’s an interesting exercise — perhaps too revealing to find its way into the practices and procedures of public agency financial accounting staff.

Workers

For example, according to U.S. Census Bureau data for California’s state and local

From CPPC studies of local government payrolls in California, we know that the average overhead for employer-paid benefits is as follows (please note the CPPC hasn’t yet officially released their payroll analyses for Newport Beach and Fullerton):

* San Jose = 55 percent;

* Anaheim = 51 percent;

* Costa Mesa = 35 percent;

* Irvine = 50 percent;

* Newport Beach = 49 percent;

* Fullerton = 42 percent.

Based on this evidence, it is safe to assume the average state or local government worker in California enjoys employer-paid benefits equivalent to 45 percent of their average base salary, plus overtime. This would mean the average state government worker in California earns total compensation of $102,000 per year, and the average local government worker in California earns total compensation of $107,000 per year.

In other words, if you take out of that $365 billion the $86 billion passed through in the form of medicaid, welfare and unemployment compensation, and if you include as compensation the additional $12 billion spent for part-time government workers (no benefits), a whopping 60 percent, or $166 billion, went to pay personnel costs. And remember, these are direct costs — actual pay and benefit costs — and don’t include the cost for a desk, a chair, an office, etc.

It’s hard to get these numbers. That’s the big story. Because in the private sector these days, instant access by management to data like this is taken for granted. In any major corporation, financial performance data is perpetually updated and can be rapidly formatted to highlight any significant category of spending, certainly including personnel costs. Why are state and local governments still catching up?

Cuts

The other big story is just how significant personnel costs are as a percentage of total government spending. Rather than raising taxes, why not implement cuts to total compensation of 20 percent, and total headcount reductions of 20 percent? The furlough era, when state and local employees all had to take a day per week off without pay, proved the government could still run with a 20 percent reduction in headcount, and it proved that government employees could survive with 20 percent reductions to their compensation.

The impact of a 20 percent reduction in headcount would be to reduce the $166 billion that California’s taxpayers spent on their public servants by $33 billion, to $134 billion.

To then impose a 20 percent reduction to the total compensation on the 80 percent of employees who remained would save an additional $26 billion.

In all, Californians would save $59 billion per year. With these savings, California’s state and local governments could begin to pay down debt instead of continuing to borrow. They could begin to invest in rebuilding infrastructure. They might even be able to lower taxes and amass rainy day funds.

And if government employees made less, maybe they’d use their influence to push for prosperity oriented government policies that would break up monopolies to facilitate competition, encourage land and energy development, welcome emerging new businesses, and lower the cost of living.

But to know these options, we must first have good data.

* * *

Ed Ring is the executive director of the California Public Policy Center and the editor of UnionWatch.org.

Related Articles

Dems on Budgetary Hot Seat

NOV. 3, 2010 By ANTHONY PIGNATARO Five of the nine ballot measures on Tuesday’s ballot dealt with taxes or the

CalPERS' Ailing Long-Term Care Plan

Editor’s note: A new article on this controversy, published Feb. 20, 2013, is here. It concerns the recent 85 percent

Split-roll tax bill strikes at Prop. 13

Almost every year in the California Legislature Proposition 13 becomes a target for those seeking higher taxes. The 1978