CA not enjoying TX-sized boom in revenues from oil

California increased its revenues last year by $8 billion a year, through passing the Proposition 30 and Proposition 39 tax increases.

California increased its revenues last year by $8 billion a year, through passing the Proposition 30 and Proposition 39 tax increases.

Texas has added even more to its revenues, but did so a different way. The fracking boom added $28.6 billion in revenues to the Texas state budget during the last three years, or $9.3 billion a year.

Yet it’s a Los Angeles-based oil company, Occidental Petroleum, which owns 1.2 billion barrels of oil (or its equivalent) in Texas’ Permian Basin. Sixty percent of Oxy’s oil and gas extraction comes from carbon dioxide flooding, which is used when water injection and pumping no longer works.

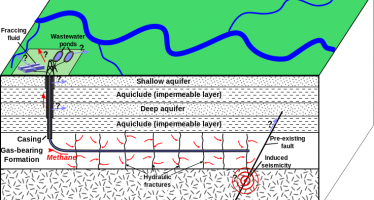

Oxy has successfully used C02 hydraulic fracturing of rock — called fracking — in the Permian Basin in Texas since 2011, when the West Texas Intermediate benchmark crude oil price went over $100 per barrel. Currently, that price is $97 a barrel.

Monterey

But since 2011, Oxy has not enjoyed similar success back here in the Golden State with its development of the Monterey Shale Formation. Oxy has suffered tough permitting delays, environmental opposition, threats of a permanent fracking ban and a lengthy 10-month delay in passing the SB4 fracking law.

Oxy reports that its Monterey Shale production of a piddling 370 barrels of oil per day can’t compare to its 45,000 barrels per day from other shale oil fields in California.

A big boost to drilling in California is that many wells can be drilled vertically and stimulated with cheaper hydrofluoric acid, rather than by the horizontal drilling and hydraulic fracturing of rock. This is why SB4 specifically regulates hydrofluoric acid flushing. Technically, matrix hydrofluoric acid stimulation is not fracking, but fracture acidizing is. Occidental found that fracking was not economic in the Monterey Shale several years ago.

Both state and local politics aren’t the only impediments to Occidental and other oil producers in California. Those holding shallower deposits have lower costs and potentially higher profits, according to Mike Edwards of Venoco Oil.

An Oct. 28 Bloomberg story, “Occidental Plan to Split Off California Seen as Early,” reports that Venoco has drilled 29 wells in the Monterey Shale Formation from 2010 to 2012. Of these 29 wells, Venoco did not realize any oil or gas production through June 2013. According to Bloomberg, Venoco is presently reducing spending in California.

Santa Maria Energy has recently obtained approvals from Santa Barbara County to drill 136 new wells in its Orcutt Field, which is inland from the coast. They will use conventional steam injection to extract oil and gas and use reclaimed sewer water from a 10-mile pipeline. So no fracking or local water would be used in the new Orcutt Field oil and gas play. The Orcutt Field is where the Monterey Formation was first discovered.

Stock market not ready to invest yet

Occidental is proposing to split off the California portion of its business into a separate subsidiary company. But stock shareholders are not too interested yet.

Shareholders are concerned about Occidental separating its more profitable holdings in the Permian Basin in Texas that is 55 percent of its oil production. The Wall Street Journal cites Texas’ quicker permit process and in-place pipeline infrastructure as the reasons that Occidental expanded into Texas during the economic recession. However, in 2014 Occidental plans to spend $500 million on drilling in Texas, and the same amount on California.

Investors are looking for more provability and more data before Occidental offers an Initial Public Offering of stock for the proposed new separate California enterprise. The price of Occidental stock was $95 a share as of Oct. 30, up from $79 a share last year.

Another problem is drilling costs for horizontal wells are $5 to $15 million. Thirty million dollars would only drill out two wells. It can take 10 wells to “prove up” an oil play. Because of the high costs, major oil companies develop new fields and the junior companies tag along or, if lucky, get bought out by a major.

So the market needs to sort itself out in California between the “majors” like Occidental and the “juniors” like Venoco and Santa Maria Energy as all firms find ways to “prove up” the Monterey oil play.

“Development of the Monterey Shale probably will follow the same pattern as most other shale plays in the United States” predicted Don Clarke, a Los Angeles-based consulting geologist. “Sooner or later, one company will figure out the right approach to drilling, hydrofracturing and production.”

California has frittered away three years. Now the technological “code” as to how to tap the Monterey Formation still needs to be found and the oil exploration and stock markets need to sort themselves out.

Related Articles

Industry confronts new CA computer energy regs

California’s massive computing industry faced the prospect of sweeping changes at the hands of Golden State regulators worried that

CA Democrats pass pro-fracking bill

Editor’s note: Some corrections have been brought to our attention, and are appended at the end of the body of

As consultant, bullet-train boss helped write doomed business plan

A lengthy Comstock’s profile of Jeff Morales, the former Washington D.C. and Chicago political operative brought in to save the