Suicidal California Amazon Tax

By JOHN SEILER

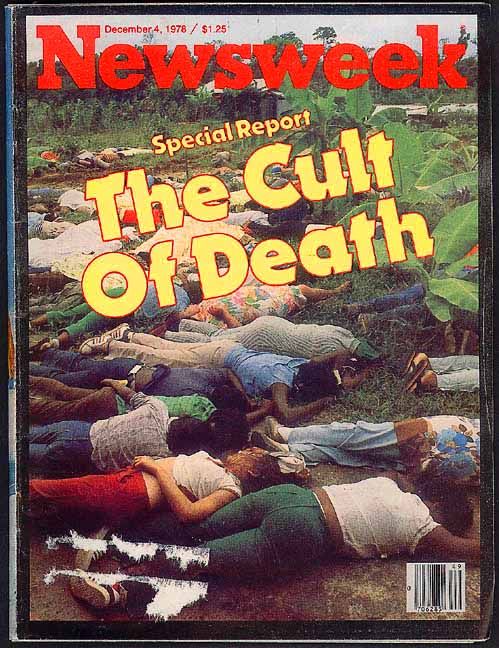

Sometimes I wonder if the politicians, special interests and most media in California have a suicide pact among themselves — with 37 million Californians forced to go along. It’s an updated version of the Jim Jones cult, in which the “Rev.” Jim Jones (actually a non-religious con man) hypnotized or forced 918 followers to drink Kool-Aid laced with cyanide at the 1978 Jonestown Massacre in Guyana.

Jones and his Peoples Temple cult followers were mostly Californians.

This year’s Kool-Aid is a proposal by the Peoples Tax Cult to tax sales on Amazon. As tax-increase cheerleader George Skelton explains today, Amazon doesn’t have to charge taxes on purchases. That gives it an advantage over Walmart, Target and other stores that operate here in bricks-and-mortar buildings.

Skelton writes:

It is a growing national problem that several recession-plagued states — New York, Illinois, Texas and Colorado, among others — have been fighting.

Federal law requires e-tailers and mail cataloguers to collect sales tax only if they have a physical presence in the state — a nexus — such as a traditional brick-and-mortar store or a warehouse.

New York found a way around the law, and so far it has survived court tests. Skinner’s bill, which on Monday cleared its first committee, is patterned after New York’s law. It would redefine physical nexus to include a dot-com’s “affiliates” — website operators that provide a link to the e-tailer — in return for a commission on sales.

Unfortunately, Skelton doesn’t note the reason Amazon and other out-of-state businesses don’t pay taxes here is that they don’t get any benefits here. Their workers live in other states, and so don’t benefit from California’s schools (ranked 49th in the nation), roads (crumbling) and other state services. So why should they pay for them?

The Interstate Commerce Clause of the U.S. Constitution stipulates that only the federal government can pass laws concerning commerce that crosses state borders. That’s a key reason for America’s prosperity the last 220 years: there are no tariffs among the 50 states. It’s a vast, free-trade area with 310 million producers and consumers.

Expanding the Tax Definition

One way some states are trying to get around this is to expand the definition of the “nexus” of business location a state. California has about 25,000 Internet “affiliates” of Amazon and other companies. These can be big stores. But commonly, they are small, Mom & Pop operations that work out of their homes.

Skelton backs AB 153, a bill by Assemblywoman Nancy Skinner, D-Oakland, that would tax affiliate sales in California. He writes that “her bill would net between $250 million and $500 million annually for the bleeding state general fund.” (Yeah — bleeding because of the immense pension burden the governor and Legislature refuse to reform.)

It’s not just Amazon that benefits from the lack of tax collection. Skelton quotes George Runner, a Republican member of the Board of Equalization (tax collectors). Runner said:

There are as many as 25,000 Internet affiliate businesses in the state that could be wiped out by this bill. The bill simply won’t work. Out-of-state retailers will cut ties with their California affiliates and continue selling to California consumers.

Runner also says that, in 2009, affiliates paid $124 million in state income taxes. It’s probably more now that the economy has recovered a little (at least outside Taxifornia).

Already, Amazon has fired its affiliates in Illinois and Colorado after those states imposed taxes similar to those in AB 153. And Amazon has threatened to do the same to New York if that state’s tax prevails in court.

Skelton contends, “Barnes & Noble, which does collect the sales tax, has offered to pick up some of the Amazon affiliates. Other online retailers could, too.”

How does he know? Does he run a small business in which the burden of changing to a new affiliate sponsor might mean the death of the business?

And how about Skinner? According to the biography on her Website, she’s spent her whole life as a Berkeley environmental activist. She doesn’t know what it’s like to be a small, Mom & Pop outfit trying to pay the family bills as the state bears down on its business with higher taxes and regulations.

Skelton also quotes a study saying the real loss to the state in lost Internet taxes is $1.7 billion. But that would include taxing all such sales, not just the affiliates affected by Skinner’s bill. And there’s no way the Republican-controlled U.S. House of Representatives is going to let that happen.

Whatever their many faults in other areas, Republicans at the national level are allergic to any new taxes. If they forget that, the Tea Party activists will remind them. And last December, even President Obama considered it prudent to extend the Bush tax cuts.

Static Thinking

Moreover, the Legislature’s own analysis of AB 153 found:

In a purely static world with full retailer compliance, BOE [Board of Eqalization] estimates increased state and local revenues of $152 million in fiscal year (FY) 2011-12 and $317 million in FY 2012-13. These estimates are based on the combination of (1) the amount of revenues currently being collected in New York, adjusted for California’s larger economy, and (2) increased revenues associated with out-of-state retailers that sell to California consumers on eBay that would have a use tax collection obligation under this bill.

So, instead of the up to $500 million Skinner says might be collected, it might be just $152 million. And notice the key word “static.” That means the estimate assumes Amazon won’t fire its affiliates; and the affiliates won’t be hurt and many of the shut down, or move to more accommodating states.

Let’s do the math: If only $152 million is collected, but $124 million in income taxes are lost (as Runner says), then the net would be just $26 million. That’s less than $1 per Californian.

Another California Suicide Attempt

Now, here’s where the California suicide attempt comes in.

Despite its many problems, California remains the world center of Internet technology. Apple, Intel, Facebook, Google and many others dominate software and hardware from Silicon Valley.

And down in Orange County, Conexant and Broadcom dominate the crucial Internet switching systems that send “packets” of bits and bytes around the globe.

California’s policy on the Internet should be: frictionless Internet activity. The more activity on the Internet, not just in California but around the country and the world, the more people everywhere will buy Apple computers, Intel microchips, Facebook advertising, Google advertising and Conexant and Broadcom switches.

The more all those things are bought and used, the more jobs are created in California. And the more all those things are made in California, the more income, sales and property taxes will be paid by our workers and businesses.

Moreover, if Skinner’s tax goes through, that will just be the beginning of more taxes imposed on the Internet. Not just in America, but around the world.

Soon, the Internet will slow down to the crawl suffered by drivers on California’s underbuilt, clogged roads and expressways.

It’s impossible to calculate the amount of business, and tax revenue, that would be lost should the Internet get bogged down in more taxes and regulations. But California, as the epicenter of Internet innovation and evolution, would be hit as hard as Japan just was by the Tohoku earthquake, tsunami and nuclear crisis.

It would make as much sense as Detroit favoring higher gas taxes. Or Hollywood backing a new, $5 tax on movie tickets. Or George Skelton favoring a special tax on political pundits.

That is, California pushing an Internet tax would be suicidal. The state doesn’t need to drink the Kool-Aid of another tax increase, but to start making California once again a friendly place for business, jobs creation and innovation.

Related Articles

CA drops the hypodermic on Obamacare implementation

On Tuesday, the health care exchanges opened for businesses, and the Obamacare implementation began in earnest. As expected, the rollout

CalWatchdog.com story spurs San Diego lawmakers to introduce bill

Two San Diego legislators are calling on the federal government to end the practice of paying people with disabilities less than

FPPC Investigates Ex-DMV Staff

DEC. 29, 2010 By ANTHONY PIGNATARO It’s always fun to watch one government agency investigate another agency. Or, recently departed