Taxing the ‘rich’ is in the air

By John Seiler

“Tax the rich” is a mantra not only in America, but globally. In California, Gov. Jerry Brown is insisting that anyone making $250,000 or more a year is “rich” and should pay more. At the national level, President Obama also is insisting that some making $250,000 or more is “rich” and should pay “their fair share.”

In France, new President Hollande wants to impose a 75 percent tax on those making more than $1.2 million a year.

Hey, why not? The rich just rob from everybody else and splurge on yachts and Rolls Royces. They never re-invest their money in business and jobs creation. Instead, it’s governments that wisely spendsthe tax money taken from the rich, re-investing it in the education of workers, crucial research on new products and economic stimulus packages.

The Financial Times noted on the international climate (may be a pay wall on the link):

“Pierre Moscovici, the country’s finance minister, told Le Monde: ‘This is not a punitive measure, but a patriotic measure.’ The rich, he explained, are being given an opportunity to make ‘an exceptional contribution’ to solving France’s financial problems….

“The truth is that the new French government is at the extreme end of a new global trend: an international backlash against the wealthy that is reshaping politics from Europe to the US to China.”

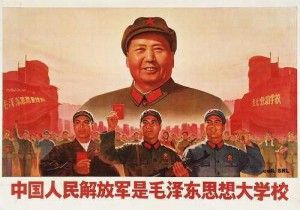

China, of course, had long experience under Mao Zedong with punishing the rich for their sins, such as the Great Leap Forward (1958-1961) and the Great Proletarian Cultural Revolution (1965-71). Unfortunately for the Chinese, after Mao died in 1976, his successors, especially Deng Xiaoping, unleashed greed and rich people started creating companies and exporting gizmos to the shelves of Walmart in America. But Mao still is featured in their currency, the yuan, so perhaps they can return to a time when the rich didn’t exploit the poor. The FT:

China, of course, had long experience under Mao Zedong with punishing the rich for their sins, such as the Great Leap Forward (1958-1961) and the Great Proletarian Cultural Revolution (1965-71). Unfortunately for the Chinese, after Mao died in 1976, his successors, especially Deng Xiaoping, unleashed greed and rich people started creating companies and exporting gizmos to the shelves of Walmart in America. But Mao still is featured in their currency, the yuan, so perhaps they can return to a time when the rich didn’t exploit the poor. The FT:

“The lifestyles of the rich and powerful is now the most sensitive and dangerous topic in Chinese politics. The website of Bloomberg News was recently shut down in China, apparently as punishment for the publication of an article on the family wealth of Xi Jinping, soon to be China’s new president.”

It’s also unfortunate that, while countries such as France and America and California are punishing the “rich,” other countries are taking advantage of this policy. The FT:

“David Cameron, the British prime minister, has offered to roll out the red carpet for French tax exiles.”

There always are reactionaries. Both countries are part of the European Union, which makes it easy to cross borders for work and residence. Fortunately, wiser heads may prevail even there:

“But even in Britain, where the top tax rate is 45 per cent, there is a new mood of antagonism towards the rich. Even conservative politicians dare not defend bankers’ pay….

“If this new mood hardens, it could mark the end of an era of lower taxes, deregulation and rising inequality that began in the late 1970s, with the rise of Margaret Thatcher and Ronald Reagan in the west and of Deng Xiaoping in China When Lady Thatcher came to office in 1979, Britain’s top tax rate was 83 per cent. She cut it, first to 60 per cent and then to 40 per cent — where it stayed until the financial crisis. Reagan inherited a top income tax rate of 70 per cent and cut it to 50 per cent and finally to 28 per cent. In China, Deng Xiaoping captured the spirit of the times when he remarked: ‘To get rich is glorious.’”

The new theme is: “To be taxed is glorious.”

Currently in California, the “rich” pay a top federal income tax rate of 35 percent and a top California state tax rate of 10.3 percent. Total: 45.3 percent.

If all the tax increases go through, those numbers would go, respectively, to 38.6 percent and 13.3 percent. Total: 51.9 percent.

Actually, an even better idea would be to restore the 91 percent federal level from the 1950s. Combined with the 13.3 percent California top tax rate, if Brown’s tax increase is passed, the top rate here then would be 104.3 percent.

A tax rate of 104.3 percent would benefit the rich the most because their money would be ploughed back into the economy on the construction of infrastructure projects such as the California High-Speed Rail Authority, thus generating more wealth for them and everybody else.

The 104.3 percent income tax rate: It’s an idea whose time has come.

Related Articles

Gov. Brown: No new spending

Gov. Jerry Brown on Friday repeatedly warned against new spending programs as he introduced his revised budget, heeding advice from Moody’s and

Water conservation success backfires on policy-makers

A longstanding truism when it comes to needed goods such as water systems, flood control or catastrophic earthquake insurance

Another View On Urban Consolidation

FEB. 7, 2011 Professor Fred Smoller, director of Brandman University’s public administration program in Irvine anda Calwatchdog advisory board member,