Federal Reserve warns, Calif., other municipal bonds very risky

By Chriss Street

Last week, we first reported first that “Permanent Link to Calif. sales tax revenue nosedives 33.5%,” then that “Moody’s warns of mass Calif. municipal bankruptcies.”

During the Great Recession of the last four years, the California private sector was forced to slash employment and infrastructure spending, but the public sector made only modest cutbacks. Much of this state and local spending was funded by selling municipal bonds to elderly investors who were told the “muni market” was safe because the default rate is very low.

Now a new Federal Reserve Board study, “The Untold Story of Municipal Bond Defaults,” debunks the belief that municipal bonds are safe investments and blames the Moody’s and S&P credit rating agencies for deceiving the public. This is sure to fan the flames of the growing panic among holders of California municipal debt. According to the August 15 report:

“The $3.7 trillion U.S. municipal bond market is perhaps best known for its federal tax exemption on individuals and its low default rate relative to other fixed-income securities. These two features have resulted in household investors dominating the ranks of municipal bond holders.”

Individuals own three quarters of all municipal bonds; with $1.879 billion held directly and another $930 billion through investments in mutual funds. The Fed report emphasized that the perception of a low historical default history of municipal bonds has played a key role in “luring investors” to buy huge amount of municipal debt.

The Fed specifically points out that the perception of low default rates is due to widely advertised reports of low default rates by credit-rating agencies. But the Fed determined the credit-rating agencies have not told the whole story about the level of municipal bond defaults.

Default records

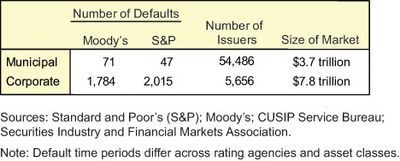

Moody’s Investors Service and Standard and Poor’s (S&P), the two largest bond rating agencies, provide annual default statistics for the municipal bonds. S&P reported that its “rated” municipal bonds defaulted only 47 times from 1986 to 2011. Similarly, Moody’s indicated that its “rated” municipal bonds defaulted only 71 times from 1970 to 2011. This compares much more favorably to the record of thousands corporate bond defaults during the same period:

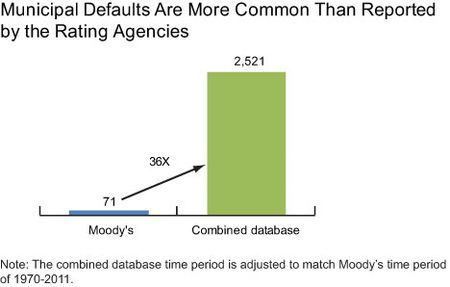

But when the Fed tracked default listings from 1970 to 2011 through the Mergent and S&P Capital IQ data bases available to institutional investors, the municipal default rates during the same periods skyrocketed from 71 to 2,521 for Moody’s and 47 to 2,366 for S&P. The Fed calculated that there were a total of 2,527 municipal bonds that defaulted from the late 1950s through 2011 — confirming that the real rate of municipal bond defaults was 36 times higher than Moody’s and S&P reported to the public.

The Fed warned that information regarding municipal bonds tends to be “self-selected.” Issuers stop seeking an annual rating from Moody’s and/or S&P, if their bonds are likely to not receive an “investment grade” rating.

The Fed also determined that “the municipal market is bifurcated into general obligation (GO) bonds and revenue bonds.” GO bonds carry a full faith and credit pledge of a state or local government, but revenue bonds are backed by a pledge of revenues raised from a specific enterprise, such as an airport, hospital, or school. According to the Fed, over the past 16 years, 60 percent to 70 percent of newly issued municipal bonds were revenue bonds. Many of these projects appear to be politically justified to bankroll crony capitalist “sustainable” investments as industrial development bonds. IDB financings often involved new technologies or projects with no historical track record. The Fed wrote:

“the services offered by an alternative energy plant, pollution control facility, or other corporate-like entity may not be considered essential, because of the availability of other energy sources. Thus, these enterprises may have less potential to generate revenue.”

Culpable

The bottom line of the Fed report is Moody’s and S&P are culpable for understating the risks to investing in the municipal bond market. Within 48 hours of the release of the Fed report, Moody’s acknowledged 10 percent of California cities have declared fiscal crises and disclosed that “across-the-board rating revisions are possible following a review of our ratings on California cities over the next month or two.” Based on the Fed report and Moody’s reaction, California and other municipal bondholders should be panicked.

Chriss Street and Paul Preston Co-Host

“The American Exceptionalism Radio Talk Show”

Streaming Live Monday Through Friday at 7-10 PM

Click Here to Listen: http://www.mysytv.net/kmyclive.html

Related Articles

California Budget: Austerity or Audacity?

JULY 7, 2011 It’s not over. Even though Gov. Jerry Brown signed the budget on June 30, lawmakers are churning

Officials’ foolishness slams cities

July 23, 2012 By Steven Greenhut SACRAMENTO — First, Vallejo, in 2008. Next, Stockton, then Mammoth Lakes and, now, San

Brown meanders, but sticks to taxes

JUNE 2, 2011 By STEVEN GREENHUT Gov. Jerry Brown’s talk to the California State Association of Counties was more meandering