Tag "gas tax"

Back to homepageLegislators propose differing plans to fund state-wide highway repair

There is consensus that California’s roads and highways must be fixed. There is no consensus how the fix should be paid for. A Special Session legislative meeting Friday was called a first step in finding agreement to the funding problem.

Read MoreCA’s road funding plans ‘stuck in traffic’

More than a month after Gov. Jerry Brown called for lawmakers to hold a “special session” on transportation funding, California still doesn’t have a plan for how to close its annual $5.7 billion shortfall for road, bridge and highway repairs.

Read MoreRoad repair bill would raise transportation taxes, fees

California motorists will each be paying an extra $900 over the next five years for road maintenance if Senate Bill 16 is approved by the Legislature and signed by Gov. Jerry Brown. But that $18.4 billion increase in transportation taxes

Read MoreSacramento hits the gas on driving taxes

Within a few years, California may choose to tax drivers by the mile. Taking up a controversial idea floated by the federal government and embraced by Oregon, Sacramento legislators recently passed a bill that could lead to a new “road usage

Read MoreMileage tax advances in Legislature

California drivers could be just a few years away from having “black boxes” in their cars tracking their travel and taxing them for every mile driven. Senate Bill 1077 is by Assemblyman Mark DeSaulnier, D-Concord, and would require a mileage

Read MoreGovt. gasbags silent on gas tax boon

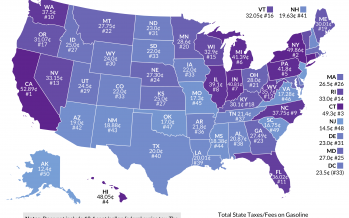

Nov. 1, 2012 By Katy Grimes While nearly every politician in America publicly decries the high cost of gasoline and fuel costs, most are also strangely silent about the soaring gas tax revenues that states are currently enjoying. Californians always

Read More