Trick or Treat? Proposition 31 is reverse of Prop. 13

By Wayne Lusvardi

The California Taxpayer’s Association spotted a provision in Proposition 31 whose importance no one has noticed until now. It appears to prohibit making any cuts or increases to the state budget of $25 million or more. In other words, it appears to freeze 99.999 percent of the state budget at its current funding level.

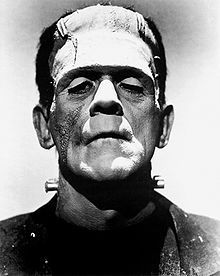

This sounds like the reincarnation of Proposition 13, the 1978 initiative that froze property taxes at the 1975 level until properties were re-sold. But CalTax opposes Prop. 31 because it could be gamed and turned into Frankenstein monster on Nov. 6 — right after Halloween.

The key tax provision of Prop. 31 is Section 4. In effect it would prohibit the Legislature from passing any bill that reduces or increases taxes by $25 million or more — unless the same bill provides for a tax increase or spending cut from some other program. CalTax says that the $25 million threshold is so low that it would apply to any meaningful tax reduction or tax incentive. It also would apply to any tax increase of $25 million or more.

Prop. 31

Under Prop. 31, a revenue reduction would apply to any “tax, fee, penalty reduction, or elimination of any type of incentive, tax exemption or tax deduction,” says CalTax. But CalTax has the following concerns about Prop. 31:

* Any change to an existing job creating tax incentive would be affected.

* It could be gamed by bad budget estimates that may kill its touted tax limitations.

* Past budget reform proposals have only included budget increases, not revenue reductions.

* Prop. 31 has to be taken as a package of reforms with the bad as well as any good.

* Prop. 31 says it is about greater budget transparency. But CalTax is concerned that the Department of Finance, state tax agencies, and the Legislative Analyst’s Office would exercise sleight of hand behind the scenes to create an appearance of new tax revenues or budget cuts where none really exist.

A crucial concern is that the $25 million limit on budget increases or decreases can be gamed in several ways.

One way it can be manipulated is by creating many $24.9 million expenditures. Another way could be by using projected revenues for increasing spending, thus running up more deficits.

Expenditure bills could also be padded. By inflating the budget of a program or project the governor then could use the veto power granted him under Prop. 31 to create the appearance he cut its budget in half.

The $25 million circuit breaker funding clause in Prop. 31 will only work with a responsible Legislature that does not use budget gimmicks. Limiting spending is not likely to happen with a tax-and-spend California Legislature, or with the local “Strategic Action Plan Committees” created under Proposition 31.

No Limits on Big Ticket Funding Items

Another big difficulty with Prop. 31 is that it apparently does not put any limits on using bond financing or voter initiatives for state or local programs and projects. As even the liberal Los Angeles Times wrote:

“But Proposition 31 simply fails to deal with the big-ticket items: bond measures, which add new annual payment obligations, and voter initiatives, which routinely impose new costs without identifying new revenue. Lawmakers thus would have a new incentive to rely ever more often on bonds and the ballot box — to the state’s fiscal detriment.”

A recent example is the city of Pasadena, which is considering using $3 million in state water bond funds under Proposition 84 to re-landscape a flood control basin, expanding recreation facilities and open space, and installing a public bathroom as well as some upgrades to water works facilities. This is a local parks project funded by statewide taxpayers.

Water treatment

The city of Maywood is also planning on using statewide water bond revenues to finance a new water treatment plant under the guise of cleaning toxins from groundwater. Statewide taxpayers would end up paying for local public works projects wearing the mask of an environmental project.

Under the mechanism of bonds, the financing of local parks, open space acquisition, public recreation, and local water and sewer projects are being regionalized. The “user pays” principle is being abrogated and the financing of projects and programs is becoming socialized.

Under Prop. 31, this regionalization of public financing would be expanded. The stated purpose of Prop. 31 in its own wording is:

“To improve results, public agencies need a clear and shared understanding of public purpose. With this measure, the people declare that the purpose of state and local governments is to promote a prosperous economy, a quality environmental and community equity. These purposes are advanced by achieving at least the following goals: increasing employment, improving education, decreasing poverty, decreasing crime, and improving health.”

In other words, Prop. 31 would be used to transfer funds from a large state or county taxpayer base for local prisons, public schools, and health and welfare programs. What regionalization — or socialization — does is create the image that everything that politicians can promise can be had for nearly free, or for a pittance of taxes. It would do this by spreading the financing base over a wider tax base than city governments. But the reality is that taxes would then become out of control.

A major concern about Prop. 31 is its silent “tax sharing” component. It provides for the creation of regional government committees that would transfer taxes from suburbs to big cities and big-city school districts that are broke.

Prop. 31 is the opposite of Prop. 13. It is a Frankenstein monster wearing the tax fighter mask of Howard Jarvis or the Jerry Brown mask of a monk. Prop. 31 is an after-Halloween trick, not a treat.

Related Articles

Taxation Without Representation?

SEPT. 22, 2010 By ANTHONY PIGNATARO If you’re a politician, pundit or just political junkie, chances are redistricting is on

Gubernatorial Debate "Truth Squad"

Katy Grimes: I took pages of notes during tonight’s debate, but one question kept popping up in my mind when

Could this man beat Jerry Brown?

Odds are, Gov. Jerry Brown will be with California until 2019. Consider the political situation. It’s no secret that Brown,