Fed Debt Default Imperils CA Budget

By WAYNE LUSVARDI

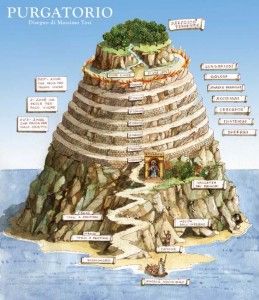

Purgatory is a temporary place of agony, torment and suffering between heaven and hell. that is apparently where California’s state budget might be headed if the federal government, by failing to raise the federal debt ceiling, technically defaults on its fund transfers to state governments

California Treasurer Bill Lockyer announced Wednesday that the state is working on borrowing up to $5 billion in short-term loans if the federal government fails to meet the August 2 deadline to raise the federal debt ceiling. At issue is the federal government failing to fund its share of California’s education and health care costs.

Lockyer pulled the state out of the bond markets in the middle of last year because of a poor response by the markets to buying more government bonds. Another factor in his decision was states and local governments’ fears that buying too many bonds would pump up bond interest rates so much that the additionally owed interest would start crowding out essential government services from their budgets.

But Lockyer’s plan to stay out of the bond markets may blow up if the federal government pinches state government budgets by failing to make fund transfers.

Last year Lockyer assured Californians that the state would not default on its bonded indebtedness. Gov. Jerry Brown recently patched together a so-called balanced state budget with $4 billion in fictional future tax revenues. But what will be the condition of the state budget if federal funds transfers are postponed?

Bank Loans to Replace Bonds?

Where will California get $5 billion if the federal government is in default and can’t sell more T-Bills? Apparently the money will come from commercial banks.

The Wall Street Journal reported that the Orange County (Florida) School Board recently had a variable-rate $105 million bond come due. The only way to roll over the debt would have been to absorb a higher bond rate and $15 million in penalties — enough money for 250 teacher’s salaries. Wells Fargo’s Government Finance Group had to step in to offer bank loans.

The Wall Street Journal also reported that over the last year municipal debt held by commercial banks rose from $1.2 billion to $18.5 billion. So commercial bank loans to states and municipalities appears to be a rising trend.

The State of New Jersey has already arranged a $2.25 billion line of credit from J.P. Morgan to cover cash shortages.

Bank Loans

Bank loans are attractive to states and local governments because there is less documentation required. But because the terms and conditions of bank loans are confidential, bondholders may not know if such loans are raising the risk of governments failing to make existing bond payments.

Rising bond interest rates could result anyway as bond markets react to the uncertainty of undisclosed loan deals. The result could be that essential education and medical service costs in state budgets are going to get crowded out anyway by rising bond interest costs.

New, stricter capital reserve requirements reportedly make holding municipal loans more attractive to commercial banks than in the past. But commercial bank loan acceleration clauses are of concern to bondholders. Such clauses require the borrower to pay off the loan faster than scheduled in the event of an unforeseen event.

How would you like to know as a bank depositor that your money is now being invested in the California state budget or your city’s budget with unmet pension obligations?

Remember way back in 2008-09 when taxpayers bailed out banks? Banks in turn are now ironically investing in school districts, states and cities to get a return on investment. For California taxpayers, it’s called purgatory, which is a place where government just muddles through near budget insolvency.

Related Articles

California politicians love to tax like the French

Nov. 4, 2012 By Chriss Street Support for Proposition 30, the income and sales tax increase touted by Gov. Jerry

Bankruptcy Series: Cities on a future spending spree

Editor’s Note: This is the eighth in a CalWatchDog.com Special Series of in-depth articles on municipal bankruptcy. Nov. 9, 2012 By Wayne

CA GOP convention reached ‘whole new level’ of inclusiveness

At last weekend’s spring convention in Burlingame, California Republicans promised an effort to “Rebuild, Renew, Reclaim.” “We’re pushing the party