Obamacare glitch previously covered by CalWatchdog

March 27, 2013

By Katy Grimes

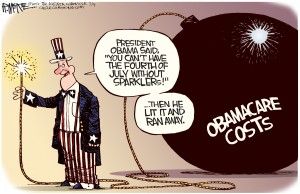

There are huge news stories all across the country today about the latest discovery in the Obamacare law. I have been writing about these cost increases long before this latest hysteria.

And now, well after the election, a new report was published showing just how high medical costs will increase. It’s going to be ugly and price most families right out of the health insurance market.

Media reports

“Some people purchasing new insurance policies for themselves this fall could see premiums rise because of requirements in the health-care law, Health and Human Services Secretary Kathleen Sebelius told reporters Tuesday,” the Wall Street Journal reported today.

“The secretary’s remarks are among the first direct statements from federal officials that people who have skimpy health plans right now could face higher premiums for plans that are more generous.”

The Associated Press reported yesterday, “Medical claims costs — the biggest driver of health insurance premiums — will jump an average 32 percent for Americans’ individual policies under President Barack Obama’s overhaul, according to a study by the nation’s leading group of financial risk analysts.”

The national average is a 32 percent increase in medical costs. Estimated increases in California are 62 percent, and costs in Ohio are estimated to increase 80 percent. Both California and Ohio voted overwhelmingly to reelect President Barack Obama. Had this study come out before the election, I wonder just how well Obama would have done, even in liberal bastions like California and Ohio.

“While some states will see medical claims costs per person decline, the report concluded the overwhelming majority will see double-digit increases in their individual health insurance markets, where people purchase coverage directly from insurers,” the AP reported.

Special exemptions

But what most of the media is still largely silent about are the many exemptions, and exempted groups.

“HHS regulations also provide that the hardship exemption will be available on a case-by-case basis for individuals who face other unexpected personal or financial circumstances that prevent them from obtaining coverage.”

“The shared responsibility payment (IRS penalty) should not apply to any taxpayer for whom coverage is unaffordable, who has other good cause for going without coverage, or who goes without coverage for only a short time.”

IRS allowable exemptions

The proposed regulations also catalog the statute’s nine categories of individuals who are exempt from the shared responsibility payment:

* Individuals who cannot afford coverage;

* Taxpayers with income below the federal filing threshold;

* Members of Indian tribes;

* Hardship;

* Individuals who experience short coverage gaps;

* Religious conscience;

* Members of a health-care sharing ministry;

* Incarcerated individuals; and

* Individuals who are not lawfully present.

These exemptions leave only the working middle class, and those who pay income tax to pick up the tab. And now we are finding that most of the middle class will not be able to afford the insurance, and their children will not be covered.

Who doesn’t pay?

The half of Americans who do not pay federal income taxes will not be required to pay the “mandatory” IRS fine if they do not buy government health insurance.

Illegal immigrants will not be fined.

And just in case anyone else was missed in the exemption list, the last paragraph was added to cover any other vulnerable group:

“The HHS regulations also provide that the hardship exemption will be available on a case-by-case basis for individuals who face other unexpected personal or financial circumstances that prevent them from obtaining coverage.”

In February, I wrote about the penalties to spouses and children in Obamacare in “Obamacare grants exemptions for everyone but taxpayers:”

“…the federal health care law has been manipulated. The law now says that, as long as an employer keeps the employee’s portion of his single health care premium below 9.5 percent of the employee’s annual salary, such a portion is deemed “affordable.” However, according to Gottwals, many employers in California only contribute to the employee’s portion of the health plan premium, not for dependents who may also be on the company health plan.”

Obamacare unfriendly to spouses

Craig Gottwals, an attorney and health insurance expert with BB&T–Liberty Benefit Insurances Services, Inc. explained the issues: “The question for employers and the insurance industry became, ‘What about a family of five?’”

Without being included in the employer’s contribution, the family health-care insurance coverage will be off the chart, leaving the spouse and kids to fend for themselves, Gottwals explained.

He added, “Furthermore, if the employee’s premium is deemed ‘affordable’ because it is below 9.5 percent of the employee’s W-2 wages, the non-working spouse and children will be denied access to federal subsidies to buy healthcare in the Exchanges. Hence, if the employer offers ‘unaffordable’ coverage to the spouse and kids, the spouse and kids are precluded from federal assistance.”

In a peculiar twist, earlier Obamacare regulations mandated that employers offer coverage to children, but declined to mandate that spouses be offered dependent coverage. For employers unwilling or unable to contribute to spousal healthcare, a family will be better off if the employer does not even offer healthcare to spouses at all. This is because, if the spouse is not offered healthcare, he or she can actually get a federal subsidy to buy coverage in an Obamacare exchange. Whereas, if the spouse is offered “unaffordable” coverage by an employer, the spouse is denied federal subsidy assistance. Employers are not mandated to cover spouses on insurance under Obamacare.

What next?

Obamacare is a disaster, and California’s Legislature and Gov. Jerry Brown are embracing it with open arms. With high-speed rail, cap and trade, higher taxes, increasing business regulations and Obamacare implementation, this recipe for disaster is sure to sink California.

Related Articles

Low taxes bring CA high tech to Luxembourg

Luxembourg is a small, low-tax duchy that’s attracting European centers for high-tech firms from California and elsewhere. FT reported: In

Pressure grows for CA $15 minimum wage

The California Legislature this year boosted California’s $8 per hour minimum wage to $9 in July 2014 and $10

$4.4 billion headache solved. How? Chronicle has no explanation

Members of the media's aversion to math — especially to explaining how numbers work when explaining spending decisions in public