SEC commissioner warns of financial crisis

Much of the country, and especially California, has yet to fully recover from the Great Recession, which officially ended in June 2009. But recent federal government actions may be leading us into another financial crisis.

Much of the country, and especially California, has yet to fully recover from the Great Recession, which officially ended in June 2009. But recent federal government actions may be leading us into another financial crisis.

That was the warning from Securities and Exchange Commissioner Daniel Gallagher at a panel discussion last week in San Francisco sponsored by the Pacific Research Institute, CalWatchdog.com’s parent think tank.

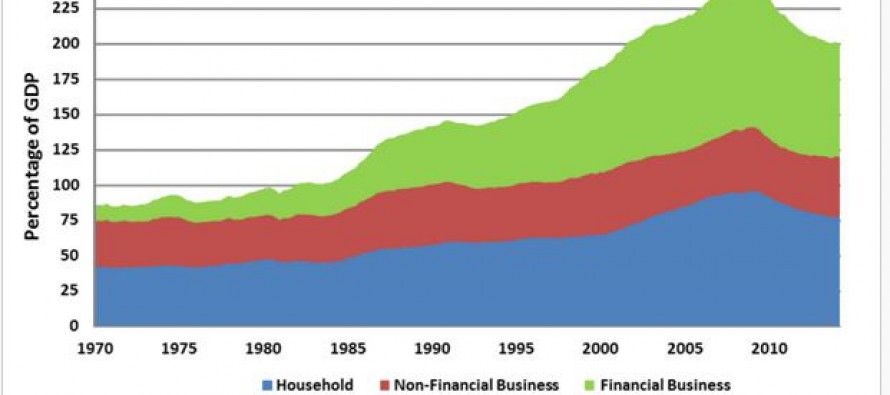

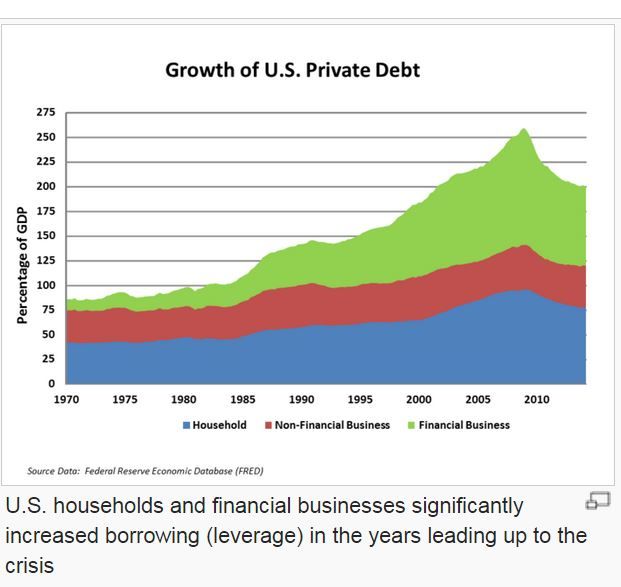

A prime cause of the financial meltdown in 2007-08 was subprime, low-down-payment mortgage lending to marginally qualified borrowers who defaulted when the housing market collapsed, sticking financial institutions with securities full of junk loans.

In the aftermath, lending requirements were tightened.

“In 2011, they proposed a 20 percent down payment, some high loan-to-value ratios, some things that otherwise would have been deemed just prudent lending standards,” said Gallagher. “I know they are the ones that apply to me and that I always comply with in the couple of mortgages that I’ve had.”

Another reform was the credit risk retention provision in the Dodd–Frank Wall Street Reform and Consumer Protection Act.

“It says that when you securitize asset-backed securities that, unless a carve-out applies, unless the exemption applies, you have to hold back 5 percent,” said Gallagher. “You have to have skin in the game if you’re the securitizer. And that will make you do more diligence. That will make you, unlike what we saw happen in the years leading up to the crisis, put better quality assets in [investment] vehicles.”

The tighter lending requirements have resulted in many low-income, credit-risky borrowers no longer being able to obtain mortgage loans. And that resulted in an outcry from the same groups that had pushed for easier lending practices before the subprime mortgage crisis.

“The push-back, bipartisan on the Hill, across the board from community activists, lobbyists for the home builders, was so intense that last year we re-proposed the rule,” Gallagher said.

The proposal was to re-define what comprises a “qualified residential mortgage” for the purposes of the credit risk retention provision.

“I don’t think the government should be mandating risk management, so let me take a step back and say [this] is folly,” said Gallagher. “But if you’re going to engage in it and you have to define QRM [qualified residential mortgage] and if it’s a carve-out from a risk management standard, you’d think you’d want to codify some prudent lending standards.”

Definition

The definition of a qualified residential mortgage was proposed to be the same as that of a “qualified mortgage,” as defined by one of the new Dodd-Frank regulatory agencies, the Consumer Financial Protection Bureau. That definition requires mortgage lenders to make a good faith effort to ensure borrowers can repay their loans, but it does not require a down payment.

“So basically we outsourced a definition to a group where it’s held by agencies overseen by one person, unaccountable to Congress, it’s within the Fed [Federal Reserve System],” said Gallagher. “And their definition says no money down. So our QRM that was made final today, the federal government has said you are making qualified mortgages even if there is zero down.

“In a 3-2 vote of the commission – you can guess where I came out – we were one of the six agencies that codified this rule. This is probably, of the nine 3-2 dissents I’ve had to endure in three years [on the SEC], this one hurts the most.

“Because I really do think this was the cause of the financial crisis. And the SEC is an agency that’s sort of on the edge of some of these systemic risk issues. This was our chance to play the hero and say, ‘No, no, no, we are not going to go along with this.’ The mandate says we all have to do this at once. If we don’t do it, then no one does it and we can never put something in the code of federal regulations that says a qualified mortgage can be a zero-dollar-down mortgage. And guess what? They succumbed to pressure. The president called them all in to the White House a month ago to impart upon them how important it was.”

Planned

That prompted panel moderator and former U.S. Rep. Chris Cox to joke, “The good news is that you can now just take out your cell phone and call 1-888-NODOWN.”

Gallagher laughed along with about 100 people at the Oct. 22 luncheon in the Omni Hotel in San Francisco. But he’s seriously concerned about the return to loose mortgage lending practices.

“At the same time we did this rule-making, and believe me it was planned this way, [it was] announced last week that Fannie [Mae] and Freddie [Mac] will now be loosening their standards to provide more credit,” Gallagher said. “They only control right now 80 percent of the mortgage market. When you add Ginnie Mae … you get to 99-plus percent of the mortgage markets. There is no private mortgage in the United States right now, and we codified it today.”

Former SEC Commissioner Paul Atkins agreed that it’s looking like mortgage crisis déjà vu: “So we are hurtling down again for a repeat of ’08, of course. Just like leading up to that, between Fannie and Freddie they held far and away the majority of the Alt-A and the subprime mortgages at the time. So that’s a repeat of it obviously.”

Potentially adding to economic turmoil is a long-delayed but inevitable interest-rate hike by the Federal Reserve. That would be a boon to small investors currently earning 0.5 percent interest or less on their savings accounts, but it threatens to roil the stock market and will explode federal debt payments.

“Like many, this year I had hoped to see the first interest rate rise,” said Gallagher. “What we saw when [Ben] Bernanke was still [Fed] chairman last summer, when [he] mentioned the potential for an interest rate rise at some point in the future, the markets dropped 700 points that day, big swoon, scared the heck out of the administration.

“That caused them to walk so far away from potentially raising rates in a prudent manner in the near term. Then, of course, Bernanke leaving and [new Chairman Janet] Yellen being much more dovish, I don’t expect [interest rate hikes] any time soon. They are indicating next summer.

“Until we get to that point, we will have this irrational activity in the markets where folks are seeking out yield, taking on risks that they might not understand, and a distortion in the markets that shouldn’t exist because the government shouldn’t be there.”

National debt

Cox noted that the artificially low interest rate has also caused a distortion in how the national debt (currently $17.9 trillion) is being perceived and handled.

“From a fiscal policy standpoint just looking at the federal government’s finances, even at today’s interest rates, interest on the debt is the number one entitlement program,” said Cox. “And it’s a lot of taxation. It represents almost the entirety of individual income taxes. We just take that money, light it on fire and it pays the interest carry on our currently extant debt, which has grown rather rapidly every year.

“If interest rates climb, then very quickly – it doesn’t take much – you find that at today’s level of spending you can account for the entirety of the federal budget with just interest on the debt. Within the parameters that we’ve experienced, you don’t have to go back to the ’70s to have those kind of rates to get you there. So [there’s] a lot of cost in raising those rates. The Fed is going to be looking at any way not to do that. But they don’t control interest rates entirely. The market still has account.”

The panel also focused on warnings about the potential over-reach of another Dodd-Frank agency, the Financial Stability Oversight Council. The panelists are concerned that FSOC regulations will hurt the competitiveness of the capital markets. Currently three companies are in its cross-hairs – AIG, GE Capital and Prudential Financial – with Met Life likely next in line.

Related Articles

UC Regents approve tuition increase despite Gov. Brown objecting

A University of California Board of Regents committee voted to increase tuition at least 5 percent every year for five

Republicans raise concern of voter fraud in Orange County, statewide election

Top Republicans have questioned the integrity of the California’s election results in recent days, forcing the state’s top election official