Is local tax measure success a sign of things to come?

As usual, Michael Coleman’s California City Finance website has an excellent recap of local tax measures and how they fared in the recent election. Local ballots contained 268 revenue measures — tax increases, tax extensions or bonds — of which 189 passed, or 71 percent.

The two largest categories of revenue instruments were:

- General-fund city taxes requiring a majority vote. Of them, 61 of 88 passed, or 69 percent.

- School bonds requiring a 55 percent vote. They fared even better, with 90 of 112 measures passing, or 80 percent.

In addition, school parcel taxes requiring a two-thirds vote were perfect on Election Day, with all eight passing.

With pro-spending groups making no secret of their desire to raise many different state taxes, does the success of so many local taxes auger well for them?

State and local tax campaigns are fought in different environments. The governments closer to the people have a better connection to local voters and generally are held in higher regard than governments farther away.

Local tax measures and school bonds usually don’t face well-funded opposition campaigns.

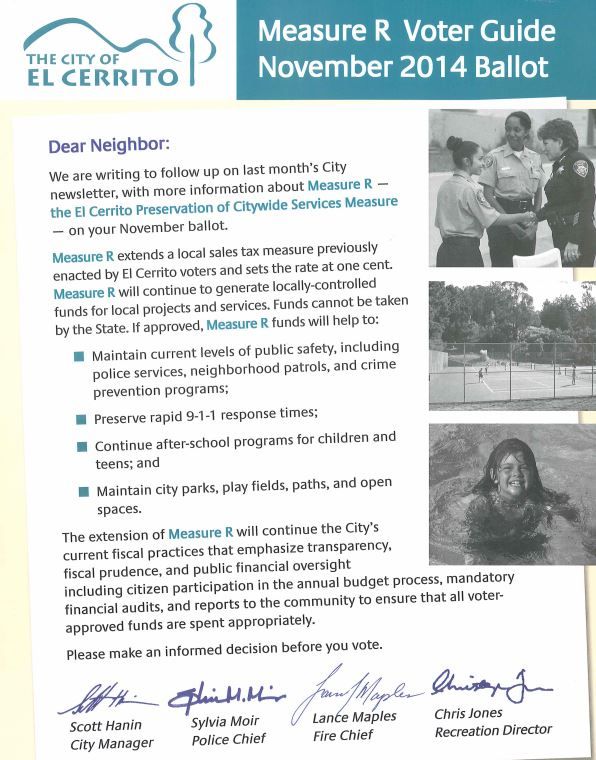

In addition, local government support for tax measures skate the line of impartiality. One example cited by the California Taxpayers Association was a 1 percentage-point sales tax in El Cerrito, Measure R. According to CalTax:

“Typical of many cities, El Cerrito mailed a campaign-style ‘Measure R Voter Guide‘ to residents, filled with photos of smiling children and police officers, and providing one-sided ‘information’ about the tax measure. The city’s taxpayer-funded mailing referred to Measure R as the ‘El Cerrito Preservation of Citywide Services Measure.’”

Pay more

At the Capitol Weekly’s election post-mortem conference, it was often pointed out that California’s electorate is made up of two-thirds progressive voters and two-thirds fiscally conservative voters. Obviously, there is an overlap and the election campaign struggle occurs in the overlapping area.

Voters locally showed a willingness to pay more. If they get their fill contributing to local government budgets, will they draw the line with efforts to raise state revenue?

The success of the local measures will encourage those who want to raise state taxes. The battle will be drawn.

The question is: When will the California voters hit their breaking point? We may find out in the 2016 election.

Related Articles

Secession fever: Don’t catch it

Nov. 19, 2012 By Steven Greenhut SACRAMENTO — Psychiatrists talk about the progressive stages of grief people experience after suffering

Steinberg’s side job raises ethics questions

Senate President Pro Tem Darrell Steinberg, D-Sacramento, has tried in vain to distance himself from the FBI’s ongoing investigation into

CA Supreme Court decision not full victory for high-speed rail

On Wednesday, the California Supreme Court declined to review of an appellate Court decision regarding the project. The case commonly is