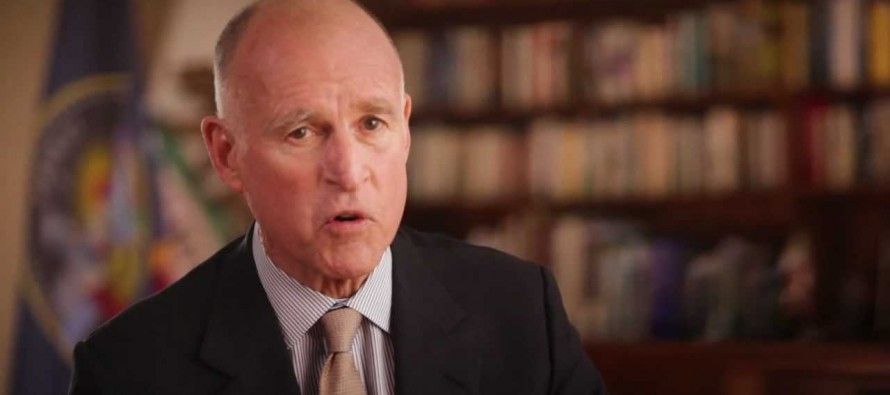

Brown talks taxes at budget press conference

Reading Gov. Jerry Brown’s meaning on some issues, with or without a dictionary and history text, can be tricky. But it was worth looking for signals on tax issues at the governor’s Friday press conference introducing his record, $113 billion general-fund budget for fiscal year 2015-16, which begins on July 1.

Reading Gov. Jerry Brown’s meaning on some issues, with or without a dictionary and history text, can be tricky. But it was worth looking for signals on tax issues at the governor’s Friday press conference introducing his record, $113 billion general-fund budget for fiscal year 2015-16, which begins on July 1.

When Brown was asked about extending the $7 billion yearly Proposition 30 tax increases or making them permanent, he noticeably paused before answering, “I said that’s a temporary tax and that’s my position.”

It may be risky to see meaning in the pause, but it suggested he was responding carefully. That prompts some parsing of the short answer. If the Prop. 30 taxes were extended a specific length of time, in the governor’s mind would it still be considered a “temporary” tax with a new end date as opposed to making the tax permanent?

Therefore, cloaked in the governor’s answer, is there now some wiggle room for discussing a tax extension?

Or is that just imaginary monsters hiding in the shadows?

When asked about tax reform, Brown framed the answer in a skeptical tone, when responding to a reporter, as lowering the tax on the rich and adding it to the middle class and the poor.

He then noted the debate that will be generated by the effort of state Sen. Bob Hertzberg, D-Van Nuys, to reform taxes, including taxing services. Brown highlighted the difficult hurdles to convince people to accept service taxes.

“I think Mr. Hertzberg is going to come up with some great ideas and people ought to listen to him and see where they go,” Brown said. “But I can tell you this, taxing new people is always difficult. So if you tell them that their Pilates class takes a 8.5 percent sales tax, they may not be as yoga happy as they were before.”

Infrastructure

In searching for revenues for transportation infrastructure, one highlighted in his Jan. 5 Inaugural Address, Brown seemed open to the idea of road-usage charges for miles driven. He referenced a four-year study on the gas tax and funding for infrastructure that he intended to accelerate.

He plans to meet with leaders of both parties to see what resources are available for transportation. “Revenue enhancements,” perhaps — the 1980s term for tax increases?

Clearly, the tax question will not go away, even with the governor’s pronouncement of a “precariously” balanced budget. He said California already has a pretty generous tax structure and robust public-sector investment. The promised “investments” will only go up and can be challenging down the road.

The promise of more spending is built into current programs and the pressure from advocates for additional spending, particularly on social service programs, is continuing. So the tax question will hover over this legislative session and in all likelihood will come before voters via the initiative route in the next election cycle.

If that happens, it will be interesting to see where the governor stands.

Related Articles

VIDEO: San Diego mayor discusses whether the Chargers will stay or go

San Diego Mayor Kevin Faulconer describes his plan to keep the San Diego Chargers in San Diego — including the

Paid to protest the president? Bay Area employees get days off for civic engagement

While many conservative claims about paid protesters demonstrating against President Trump have been met with skepticism and dismissal — in

Port of Call for CA’s Crippled Commerce

JAN. 10, 2010 By LAER PEARCE If Gov. Jerry Brown has any chance of draining California’s budget swamp of red