U.S.-Calif. Stuck in Stagnation Spiral

BY JOHN SEILER

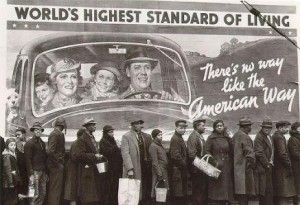

Welcome to the desert of economic and jobs growth.

I keep reminding people that California actually still is part of the United States of America. That we are not the “eighth largest world economy,” or whatever the ranking is that state politicians always boast about.

State politicians still fail to accept that, aside from whatever problems the state has, national economic follies affect them as well. If the U.S. economy doesn’t grow, then the state economy isn’t going to grow. And if that happens, then the state tax base won’t grow enough to support larger state and local government budgets, including for government-worker pensions.

Another problem is that people don’t realize that the dollar is manipulated by the U.S. government, specially by the quasi-private Federal Reserve Board. The way to see what’s happening is to look at the price of gold.

When the price of gold goes up, that means the price of the dollar is going down. And when the dollar’s price falls, then inflation is inevitable. That’s why the prices of oil, gas, food and other commodities have risen so much in recent years.

Even housing, despite the recent crash, in California costs more than twice what it did just a decade ago.

The reason stems from the rise in gold from $275 in 2001 to just above $1,600 in recent weeks. That means the dollar has lost more than 80 percent of its value in the last decade.

Now, we can see how the economy really has done by looking at how well the Standard & Poors 500 Earnings index has done compared to gold. Earnings are crucial because they provide the funds for future investment and growth. No earnings, no growth.

The following chart was ginned up by ChartoftheDay.com:

Post-9/11 Panic Syndrome

As you can see, the current recession began not in 2007, as commonly believed, but in 2001. This happened, I believe, because of what I call “Post-9/11 Panic Syndrome.”

After the 9/11 attacks, Fed Chairman Alan Greenspan panicked and began inflating the dollar as had not been done since 1971-80. Greenspan’s action also destabilized the world currency system, which from 1981 to 2001 had depended on the Fed keeping the dollar’s price at around $350 an ounce of gold.

Also after 9/11, President Bush panicked and began vastly increasing spending on both domestic programs and the military. Doing so ended the sensible budget surpluses that had begun three years earlier under President Clinton, during his “gridlock” with the Republican Congress.

Looking again at the chart, you’ll notice that S&P Earnings improved somewhat in the mid-2000s, as President Bush’s 2003 tax cuts took hold. But then the number starts dropping again later in the decade, as the tax-cuts’ 2011 termination date approached, and as the Bush deficits got larger and turned into the even larger Obama deficits of recent years. The 2007 crash dropped S&P earnings almost to zero.

No Recovery in Sight

Nor are things getting better. And they won’t be getting better any time soon. Current Fed Chairman Ben Bernanke has extended and deepened the inflationary policy of Greenspan. And President Obama has continued and enlarged the unsustainable spending and budget deficits of Bush.

The current period (2001 to 2011-plus) is only the second prolonged period that the U.S. economy has not been anchored to some sort of gold standard, however weak. The other period was the 1970s, beginning in 1971 when President Nixon (a California native) took America off the gold standard — and ending in 1981 when then-Fed Chairman Paul Volcker and President Reagan established, unofficially, a quasi-gold standard at $350 an ounce. That quasi-standard lasted, as seen, until 2001.

The upshot is that there will be much more economic, budget, tax and spending-cut pain in California and the rest of the United States for years to come.

Gov. Brown and the Democrats who run the Legislature will have no choice but to make even more budget cuts. If they manage to raise taxes somehow, business will flee this state at an even faster pace than they already are.

When the national economy fails to grow, especially for long periods of time, then competition among the states becomes fierce to grab every last business and job.

As the whole saying has it, a rising tide lifts all boats. But the opposite is true, too: a receding tide forces all boats to seek deeper waters.

Coming years should see California’s unemployment rate — currently 11.8 percent for June, second worst in the nation after Nevada’s 12.4 percent — rise even higher.

Related Articles

Calderon Pushing Hinky 'Gut-Amend' Bill

JULY 11, 2011 By KATY GRIMES A bill just signed into law by Gov. Jerry Brown is apparently being reincarnated

SB 365 aims at limiting tax credits

The California Tax Code is a monster. Just the first 136 sections of the code fill up 202 pages with

State auditor will review how $30 billion in Local Control Funding Formula grant money was spent

New reports show that six years after Gov. Jerry Brown and the Legislature approved a sweeping overhaul in how school