Will Calif. end double taxation of businesses?

April 10, 2012

By Katy Grimes

For more than 100 years, California was known as a great manufacturing state. It could be again if a new bill passes.

For decades, businesses clamored to come to the Golden State, and entrepreneurs armed only with a great idea built fabulous businesses.

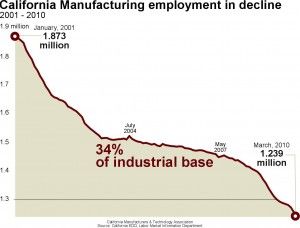

But the last decade in California has seen manufacturing disappear faster than the Cuckoo bird.

“A robust manufacturing industry is an indicator of a nation’s ability to foster innovation and drive broad, sustained economic growth, and no state has been more important to U.S. manufacturing competitiveness than California,” the Milken Institute wrote in 2002.

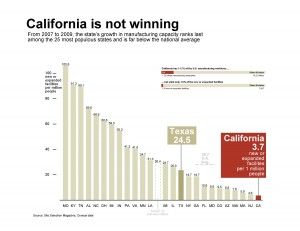

From 1997-2000, California had 5.6 percent of all manufacturing investments in the country. By 2001, it dropped to 1.9 percent, when a sales tax on equipment became a barrier to new investment.

Through increasingly invasive and expensive taxes, California politicians have killed off the taxpaying goose that laid the golden egg, leaving very little manufacturing left in the state.

What Is Killing Off California Business?

Increasing costly regulations and hefty business-killing taxes have caused many businesses with little or no profits to close, or move to other states.

For many years, California has been double-taxing manufacturers through a sales and use tax on equipment. Any time a business purchases equipment in California, the equipment seller must collect the sales tax, paid by the purchaser.

However, Assemblywoman Alyson Huber, D-El Dorado Hills, has introduced AB 1972, which seeks to provide a tax exemption to businesses for the purchase of manufacturing equipment, or for research and development. Tax consideration such as this goes a long way toward stimulating business investment, resulting in job creation.

“California has struggled to attract or retain jobs in the manufacturing sector as many of the state’s manufacturers have struggled to keep their doors open here,” an analysis of AB 1972 found. “From 2001 to 2011, California has lost 613,000 jobs in this sector according to EDD statistics cited by the California Manufactures and Technology Association.”

There is no doubt that California’s tax and regulatory climate is a direct contributor to these job losses. According to the Milken Institute Report, Manufacturing 2.0, the key reasons for the state’s loss in manufacturing jobs are the harsh regulatory climate, tax burden and business-unfriendly reputation. This report compares California to seven states — Arizona, Indiana, Kansas, Minnesota, Oregon, Texas and Washington — that saw an increase in their share of the nation’s manufacturing jobs.

During a Revenue and Taxation hearing Monday, Huber said that other states recognize that taxing the input as well as the final manufactured product is double taxation and discourages investment. But double taxation does even more than just discourage investment—it prevents manufacturing businesses from making necessary investments back into equipment so they may stay competitive and grow. Double taxation also renders California businesses unable to compete with even our closest states, which do not tax business equipment purchases.

The current policy has resulted in less production in California. Out-of-state companies elect to grow elsewhere and in-state companies continue to shift workers or facilities to other regions that do not burden capital investments with excess taxation.

Huber also warned that, with AB 32, California’s Global Warming Solutions Act of 2006, currently being implemented, businesses will be required to purchase new equipment and make expensive retrofits.

On The Endangered Species List

The Milken Institute recommended:

• Streamlining the regulatory procedure for manufacturers, increasing transparency and accountability in the regulatory process and encouraging long-term investment through new policy tools—all of which can be achieved without relaxing or changing a single regulatory standard.

• Enhancing public incentives for manufacturers through better planning, coordination across government agencies and partnering with the private sector.

• Launching an industry-led campaign to encourage Californians to pursue careers in manufacturing, highlighting the attributes of modern manufacturing, its importance to the economy, its record of environmental stewardship and its high wages.

• Creating a network of education, training, research, and business incubation centers around the state to develop a highly qualified manufacturing work force, to invent and commercialize advanced manufacturing techniques, and to assist start-up businesses.

• Creating a public-private initiative to conduct research, develop new technologies and processes, and commercialize more efficient and environmentally sustainable manufacturing practices with incentives to facilitate adoption of new standards.

However, there is one outstanding flaw in the bill’s analysis: “Any sales and use tax paid by a business will, however, be factored into the price it charges for goods, which in turn, may be subject to taxation.” This is an assumption regularly used at the Capitol by people unfamiliar with business. Businesses can only charge what the market will bear, including equipment manufacturers. Sometimes added costs can be passed on, but many times they cannot. It isn’t always the end consumer/purchaser who picks up the increase.

With California continually adding taxes onto the backs of businesses, the very reason so many are leaving and closing up for good is because so many of the state’s costs cannot be passed along. Double taxation renders California businesses uncompetitive.

Huber said that while initially this tax exemption will decrease state revenues, it has been proved time and time again that within a few years the state not only recovers the revenue, revenues increase. Once manufacturers have had the time to reinvest in new equipment and the new jobs which come from equipment purchases, California’s economy may have a chance. But this bill needs to be passed first.

Related Articles

Sac Bee Flip Flops on AB 32

Katy Grimes: I always like to get right to motive during a heated issue or debate. Over the weekend, the

Covered California continues to benefit from cheerleading media

Monday’s “deadline” for signing up for the Affordable Care Act triggered bad headlines for the federal health exchanges, which had

Brown fuels incentives for alt-energy cars

Convinced carbon emissions pose an “existential threat” to the human race, Gov. Jerry Brown just signed a set of bills designed to