The Establishment killed cig tax Prop. 29

By John Seiler

The backers of the Proposition 29 cigarette tax increase finally snubbed out the butt of their vigil over the June 5 vote. It lost by just 28,000 votes.

Proponents blamed the $47 million spent by the Big Tobacco companies to defeat the measure. Lance Armstrong, the bicycle champion still fighting doping allegations from his racing days, said, “Big Tobacco lied to voters to protect its profits and spent $50 million to ensure it can continue peddling its deadly products to California kids.”

Actually, what really defeated the measure was the state’s political Establishment, led by the Los Angeles Times and the California Budget Project. The Establishment realized that jacking up cig taxes $1 a pack to raise $735 million a year and give it to an new unaccountable cancer research bureaucracy only would worsen the state’s fiscal mess.

The Establishment understands that California is paddling toward Greek fiscal territory and any extra tax money that can be scrounged up has to go to solving the budget mess. Indeed, on June 8, the Times even ran an extra editorial, “The wrong cigarette tax,” reiterating its opposition to Prop. 29 but calling for a new cigarette tax dedicated just to the budget:

“We urged voters to cast ballots against Proposition 29 because at a time when the state cannot afford to fulfill its most basic responsibilities, the initiative would have put most of the new revenue — more than $500 million a year — toward an entirely new agency and a new state function: the funding of disease research that already is relatively well funded by the federal government….

“But our objections to the specifics of Proposition 29 do not mean that we don’t support a new cigarette tax. We do….

“As Proposition 29 would do, part of the money should go toward smoking prevention programs, as well as for smoking cessation treatments. The rest could productively be spent on treatment for smoking-related diseases, so the people who pay the tax receive the direct benefit and the state budget gets some relief.”

The value of Establishment support or opposition, especially a Times editorial, is worth an unknowable exact amount, but probably many tens of millions of dollars. So expect a new initiative, as the Times suggested, on the November 2014 ballot along the lines indicated. It might raise taxes $1 a pack to fund lung cancer and other smoking-related treatments, relieving the general fund of spending on such treatments through Medi-Cal.

California Budget Project

Another major Lucky Strike against Prop. 29 was a study by the influential liberal think tank, the California Budget Project. Its longtime executive director, Jean Ross, recently became the head of the Ford Foundation, a pillar of the Eastern Establishment. Usually the CBP looks favorably on tax increases. But a May Budget Brief found, in particular, that Prop. 29 would slam poor people:

“Increasing the cigarette tax would have a disproportionate impact on low-income Californians because they spend a larger share of their incomes on tobacco products. National data show that in 2009, individuals with incomes in the bottom fifth of the distribution spent an average of 0.9 percent of their incomes on cigarette taxes, compared to an average of less than 0.1 percent for those in the top 1 percent. In part, this disparity stems from the fact that the cost of a single pack of cigarettes makes up a larger share of the incomes of low-income individuals.

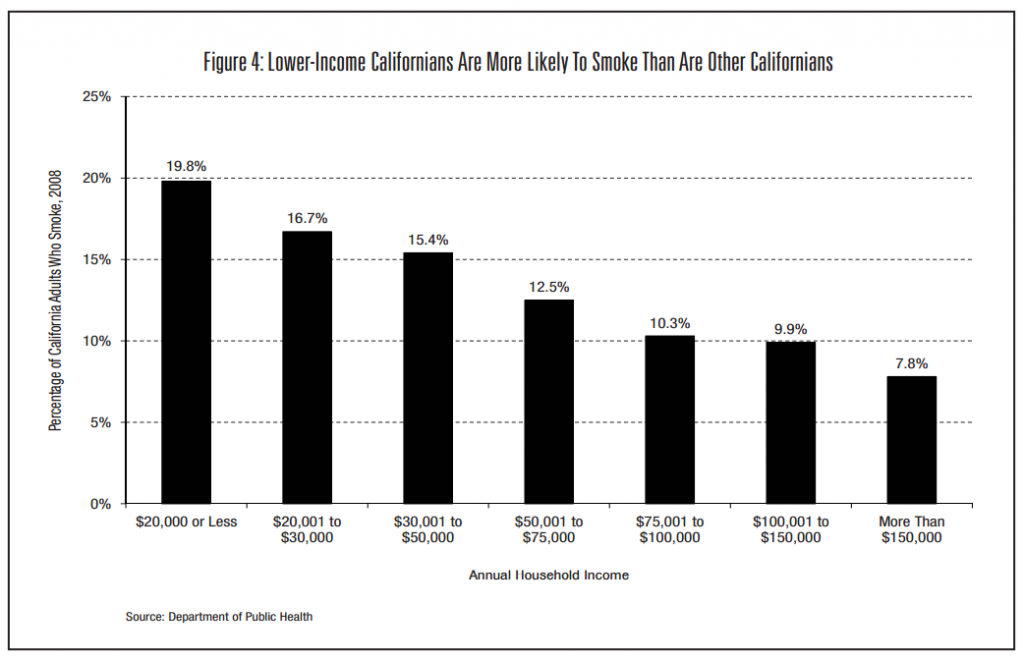

“It also reflects the fact that low-income individuals are more likely than others to smoke. In 2008, for example, nearly 20 percent of California adults with household incomes of $20,000 or less were smokers, compared to fewer than 10 percent of those with household incomes of more than $100,000 (Figure 4).”

The implication is clear: Poor people will have less money because of the cigarette tax. They then will have to depend more on state services. Which will put even more pressure on the general-fund budget. The state’s deficit will get even worse.

The Budget Project looked at the big budget picture:

“Programs funded by Proposition 29 would be “locked in,’’ limiting the ability of the Legislature to modify spending in response to economic, budget, and demographic changes or other health-related research needs that may emerge in the future. In addition, these revenues would not be available to support other programs or to help close future budget gaps.

“Finally, to the extent that voters approve new revenues for a specific purpose through an initiative, such as Proposition 29, lawmakers or voters may feel less inclined to subsequently approve additional revenues regardless of the purpose.”

That’s a key concept. The Establishment’s push now is for Gov. Jerry Brown’s $8.5 billion tax increase on the November ballot. Had Prop. 29 passed, voters might consider that they already had performed their socialist duty for 2012 in June, and didn’t need to do so again in November.

Black market

There’s also strong evidence that a hefty tax increase, such as Prop. 29’s $1 a pack, would make much worse already worrisome black market activity. When New York was boosting smoke taxes a couple of years back, the Huffington Post reported:

“NEW YORK — The big cigarette tax increases that many states are instituting to balance their out-of-whack budgets are raising fears that the trend will make black-market smokes more profitable and lead to more cigarette smuggling.

“Cigarette smuggling has been going on for generations and already costs states untold billions in lost tax revenue.

“Criminal gangs stock up in low-tax states like Virginia and Missouri, truck the cigarettes north and illegally resell them in high-tax states like Michigan and New Jersey. Other buy cartons and cartons of tax-free smokes on Indian reservations and sell them elsewhere. Buyers order untaxed cartons of murky origin on the Internet. And ships arrive from China carrying cargo containers filled with counterfeit cigarettes.

“Law enforcement officials and others worry that the widening price spread between taxed and untaxed cigarettes will only make the situation worse.”

California is too far from Virginia and other states in the Tobacco Belt to worry much about smuggling from there. But there are many local Indian reservations with low-tax cigs. And our Los Angeles, Long Beach, San Diego and San Francisco ports are among the largest in the world, daily unloading billions of dollars of goods.

Those born in America generally don’t have much of a taste for foreign cig brands. But they might acquire such a taste if the price of U.S.-made smokes is high. And California, of course, has a large immigrant population, whose smokers picked up the habit puffing brands from other lands.

For now, at least, a new cigarette tax has been defeated. But the demise of Prop. 29 clears the ash tray for the big push for Brown’s tax increase in November.

Related Articles

Lawmakers take step toward retirement fund for all Californians

State policy makers on Monday inched closer to a state-run retirement system for workers who don’t have access to employer-run

Looking Back At Absurd State Budget

This article was first published in City Journal. OCT. 28, 2010 By STEVEN GREENHUT Smoke and Mirrors in Sacramento: California’s

Is high speed rail unstoppable?

Mar. 12, 2010 Sometimes, being a legislator can be a very lonely job. Just ask Assembly member Diane Harkey, R-Dana