Democrats resolved to gut Prop. 13 for businesses

By Dave Roberts

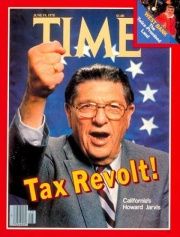

California Democrats are seeking to weaken the protection for business property in Proposition 13, the 1978 tax limitation measure passed by voters. If the Democrats are successful, it could result in an annual $10 billion business tax hike, and over five years a loss of nearly 400,000 jobs and a $72 billion hit to California’s economy, according to one study.

AB 188, by Assemblyman Tom Ammiano, D-San Francisco, requires that commercial properties be reassessed whenever there’s a 100 percent change in ownership of those properties.

Currently, business partners who purchase a property can avoid reassessment as long as none of the partners owns more than 50 percent of the property. Democrats consider that a loophole — and a potential cash cow for the state treasury if the loophole is closed.

Democratic resolution

One of the resolutions passed at last weekend’s state Democratic Convention in Sacramento pledges to revise Prop. 13:

“Whereas, Proposition 13, passed in 1978, is unfair in that it allows commercial property owners to avoid paying their fair share and has shifted the tax burden to residential property and away from business, including everyday homeowners and working families; and

“Whereas, the state of California continues to face chronic budget crises in large part because Proposition 13 has forced the state to rely on more volatile revenue sources than the property tax, like income taxes and sales taxes paid by working families that move in tandem with economic cycles, causing deficits and requiring cuts to vital services that grow our economy and thereby worsening economic downturns;

“Whereas, regularly reassessing non‐residential property would, according to an analysis of data provided by the California Board of Equalization, generate at least $6 billion in additional revenue for California, and shift the tax burden from homeowners, renters, and working families to corporations and commercial landholders;

“Therefore be it resolved, that the California Democratic Party supports commercial property tax reform that will require commercial properties to be reassessed regularly while maintaining residential property owners’ protections under Prop 13 ….”

Ammiano echoed those themes as he introduced his bill to the Assembly Committee On Revenue And Taxation on Monday.

“While teachers and police are being laid off and children are being denied access to critical medical care and struggling families are being forced to bear a larger tax burden, it is appropriate that we close loopholes such as this which benefit major corporations at the expense of both small businesses and the average Californian taxpayer,” he said.

Ammiano was backed by Lenny Goldberg, executive director of the liberal California Tax Reform Association. He said E&J Gallo used the loophole to avoid a property reassessment when it bought the Louis Martini winery in St. Helena in 2002.

“The Napa County assessor came out and said to the Assessors Association, ‘Shouldn’t we deal with this problem?’” Goldberg said. “And that’s what this bill does.”

Great Recession

Also supporting AB 188 was Christie Bouma, representing California Professional Firefighters. Many fire district budgets were hit hard by property tax reductions during the Great Recession.

“We protect homes and businesses,” she said. “In grandma’s home, she can’t sell her bathroom to someone and the living room to someone else and her family room to someone else, and avoid 100 percent change of ownership, but must instead suffer the assessment. I would suggest that since many fire protection agencies in the state and fire districts are almost 100 percent funded by property tax, they are getting choked off by these sorts of [commercial property] transactions. It’s a very small change that will allow them to not only protect these business properties that need to remain viable in their communities, but also grandma’s house.”

Exactly how much revenue would be raised by more frequent reassessments of commercial properties remains to be seen. It could be far less than the $6 billion annually that Democrats are salivating for. The Board of Equalization estimates that the annual property tax revenue increase associated with the new “change of ownership” rule would be $77 million per year, according to the bill’s analysis for the committee hearing.

“However, BOE acknowledged that estimating the revenue increase with any degree of certainty is difficult,” the analysis states. “Additionally, it does not know the number of such transactions that would be covered under this new definition in California.”

Study: significant, detrimental impact on economy

A Pepperdine University study released a year ago is closer to the Democrats’ estimate, predicting that a split-roll tax system that treats business properties differently from residential properties could bring in an extra $4-10 billion, with a best guess at $6 billion. If that occurs, it would be another devastating blow to California’s struggling economy, the study concludes:

“Increasing the taxes of businesses by $6 billion would result in lost economic output and decreased employment. The cost to the California economy of this property tax increase would total $71.8 billion dollars of lost output and 396,345 lost jobs over the first five years of a split roll property tax regime. These losses would be even greater in succeeding years.

“The introduction of a split roll property tax valuation system would result in increased instability for local government finances, as they would become more directly susceptible to the value gyrations of the real estate market. For example, in 2008‐09 when California property values faced the traumatic decline in the wake of the sub‐prime crisis and the market collapse (industrial and commercial values fell 6.5 percent), property taxes collected from these same properties actually rose 5.0 percent.

“A split roll property tax valuation system would also further undermine the attractiveness of the business climate in California. Because small businesses typically lease properties where the cost of property taxes is passed through to the lessee, this research concludes that the employment losses described above would be disproportionately concentrated in small businesses, and especially those owned by women and minorities.

“Overall, this study finds that a split roll property tax regime would have a significant and detrimental impact on the state’s economy, especially at a time when the California economy is struggling.”

Gina Rodriguez, representing the California Taxpayers Association, expanded on those points to the committee.

“The bill represents an erosion to the Prop. 13 protections that voters approved for all Californians almost 35 years ago,” she said. “This is inconsistent with the philosophy of Prop. 13, which is taxpayers’ collective response to dramatic increases in property taxes and which passed with 65 percent of voter.

“Beside capping the property tax rate, limiting the annual assessment increase and establishing vote thresholds, Prop. 13 also converted the property tax base from a market value system to an acquisition value system. With the acquisition value system, Prop. 13 removed much of the fluctuation of property tax revenue, creating a more stable revenue source for local government.

“Prop. 13 has been successful at what it promised to do. It prevented people from being taxed out of their homes and their businesses. And for the first time it gave all taxpayers a measure of certainty over their property tax.”

Response to Democratic arguments

Rodriguez responded to the Democrats’ arguments that Prop. 13 has hurt government revenues and shifted the tax burden from businesses to homeowners.

“Under Prop. 13, property taxes have been the most reliable tax in California, growing steadily year after year,” she said. “In fact, property taxes have exceeded growth in inflation and population combined. From 1979 to 2012, the average annual growth of assessed value for locally assessed businesses has outpaced the growth of homeowner-occupied properties 7.5 to 7.2 percent.”

One of the few bright spots in California’s sluggish economy has been the revival of the high-tech industry. But Kelly Hitt, representing Tech America, said that could be in jeopardy if AB 188 passes.

“The technology industry was born in California and we want to stay in California,” she said. “Our industry faces extreme competition and rapid technological advancements that result in compressed research cycles and product lives. In today’s fiscal climate, technology companies must compare their operational costs with other locations globally. Companies take several things into consideration when choosing where to expand. And Proposition 13 is one of the few certainties technology companies in California have when doing so. The technology industry is a bright spot in California’s economy. And we need to start playing offense to keep these companies and jobs here.”

AB 188 was sent to the committee’s suspense file, and will likely be voted on in May.

Related Articles

The ‘nut graph’ you’ll never see in a state government story

Oct. 1, 2012 By Chris Reed On Sunday, as I read iconoclastic pollster Pat Caddell‘s sharp, persuasive tirade documenting the

Gov. Brown's Hypocrisy Over Tax Votes

This article first appeared in the San Francisco Examiner MARCH 11, 2011 By STEVEN GREENHUT Republican efforts to trade a

Redevelopment 2.0 won’t rejuvenate ‘old factory belts’

This is Part One of a two-part series. Part Two is here. March 28, 2013 By Wayne Lusvardi Redevelopment 1.0