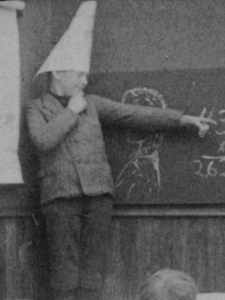

Senate pushing nutty new school-finance scheme

By John Seiler

The state supposedly “balanced” its budget only with the Prop. 30 tax increase. Three California cities declared bankruptcy last year. Businesses keep streaming out to greener pastures. So what does the California Legislature do? Road trip!

Steven Greenhut writes in Bloomberg:

“the state Senate advanced an ill-defined new ‘bond’ plan to provide schools with a fresh source of cash.

“The Dropout Reduction and Workforce Development Bond Act of 2013 is based on social-impact bonds, a creative financing mechanism popularized first in the U.K. as part of the Conservative Party’s ‘Big Society’ effort to use market discipline to improve public services.

“Typically, financing for social-intervention projects is obtained from investors, not taxpayers, and government contracts with nonprofit institutions to do the work. Government gets to borrow money for social programs and shift the risks to investors, who get paid back only if the programs reach certain performance and cost-saving goals.

“But leave it to California’s dominant Democrats to turn a concept designed to apply some measurable standards to hard-to- measure social programs into a shameless effort to grab more money for existing government agencies.

“The legislation promises to ‘revolutionize public education’ by offering three tools. First, businesses can buy bonds ‘and earn a rate of return tied to performance measures.’ Second, those businesses receive tax credits for their investment. Third, the bill creates trust funds in every school district to collect those business investments and other funds to finance expanded career programs.”

Any business “investing” in such an idea should face a shareholder rebellion.

However, the obvious intent is to tie businesses into school financing, providing an incentive for them to support tax increases for schools.

But as with anything in any government budget nowadays, state or local, any new funds only would go to pay for the spiked pensions. This plan truly is “revolutionary” — as in the Bolshevik Revolution, Mao’s revolution, or Pol Pot’s revolution in Cambodia.

Read the rest of Greenhut’s article here.

Related Articles

‘Anti-tax Demagogues’ Smashing CA?

John Seiler: Los Angeles Times columnist George Skelton is worth reading because he’s almost always wrong. His latest column blames

5 bills target consumption of sugary drinks

The California Legislature’s determination to lessen the amount of sugary drinks consumed by state residents may never have been greater

CA public sector: Laws? We don’t need no stinking laws

May 12, 2013 By Chris Reed In the private sector, there are all kinds of laws that govern employment, conduct,