CA governments need caution on fracking investments

By Wayne Lusvardi

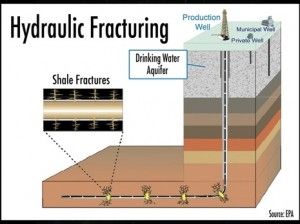

Being the home of Hollywood and Disneyland, news in California always has an element of political theater and Fantasyland. This is certainly so for all the contradictory headlines about fracking — the hydraulic fracturing of deep underground rock formations to extract oil and gas using untappable pressurized water that is miles underground.

On the one hand, news headlines indicate fracking is about to be banned statewide in California. On the other hand, there are reports that fracking could generate $25 billion of new tax revenues per year for the state and boost the economy 14 percent.

But as with everything in the man-made social world, there are multiple levels of reality depending on one’s social location.

The anti-frack pack

On the one hand, there’s a good deal of opposition in the environmentalist community, with such headlines as, “Nearly Half of Fracking Happens in Places Short on Water.” Yet, fracking doesn’t use fresh water near the ground surface but otherwise untappable underground water over a mile deep.

And the environmenalist group Earthjustice, whose motto is, “Because the earth needs a good lawyer,” described its actions:

“As hundreds of California oil and gas wells undergo dangerous hydraulic fracturing without government oversight, environmental advocates, represented by Earthjustice, are in court to force the agency responsible for regulating the oil and gas industry to abide by the state’s foremost law that protects public health and the environment.

“The lawsuit, filed in Alameda County Superior Court, charges that the California Department of Conservation, Division of Oil, Gas, and Geothermal Resources (DOGGR) has failed to consider or evaluate the risks of fracking, as required by the California Environmental Quality Act. Although DOGGR is the state agency charged with regulating all oil and gas well activity in California, the agency admits it has not permitted or monitored its impacts and has never formally evaluated the potential environmental and health effects of the practice, even as it continues to approve new permits for oil and gas wells.”

Nonetheless, the anti-frack pack is unlikely to totally ban fracking as much as to regulate, tax, delay and sue the fracking industry at every opportunity imagined and real. The delays could cost the California economy, and the state treasury, billions a year.

Fracking boomers

On the other hand there are the fracking boomers. These are the oil companies, universities, oil patch economic development commissions, economists and chambers of commerce that see fracking as a huge new source of economic growth and jobs.

They get fewer headlines or favorable press coverage. But headlines that fracking could generate 2.5 million jobs in California by 2020 do grab everyone’s attention.

Fracking fractures?

Yet is there another reality level of fracking that is not as apparent as that described by the fracking doomers and boomers? California-based free market economist John Tamny thinks so. Tamny says the excitement over fracking is “overdone,” even though he says government should get out of the way of the private sector fracking industry.

As Tamny explains it:

“That’s the case because contrary to the widely held belief that oil is scarce at the moment, the greater truth is that oil isn’t expensive as much as the dollar is cheap. Measured in the constant that is gold, an ounce of the yellow metal buys roughly the same amount of oil today as it did in 1971 when a barrel of oil traded for around $2.50. Far from an energy crisis rooted in a short supply of oil, we have at present a dollar crisis that is creating the false illusion of energy scarcity.”

Tamny’s fear is that the U.S. self-created weak value of the dollar is resulting in “some very stupid money chasing an oil illusion that will end in tears.” Tamny also infers that public pension systems that heavily invest in the fracking revolution may end up in another investment bubble popping. As we found out during the 2007-09 Great Recession, taxpayers ultimately are on the hook for any shortfalls in pension-fund investment returns.

If Tamny is right, fracking is a game played in a gambling casino card room. It is likely that it will not last much longer after the Federal Reserve stops “quantitative easing” that potentially dilutes the value of the dollar. Bloomberg recently reported that the Fed could end quantitative easing later this year.

If Tamny is right, then the potential end of the energy boom could be bad news for the California economy, public pension funds, local oil patch economies and the state budget. Instead of growing government, or relying on fracking, Tamny believes California should be devoting its resources to creating a more hospitable long-term business climate.

Related Articles

Gov. Brown boosts energy-policy leverage

Gov. Jerry Brown believes it will take “pragmatic caution” and “active collaboration” to achieve his goal of seeing half of the state’s

Electric car sharing program rolls out in L.A.

As many as 7,000 low-income Los Angeles residents could eventually take part in a state-funded electric car sharing program that