Hertzberg proposes $10 billion sales tax on services

An influential state lawmaker is proposing a $10 billion sales tax on services that would include everything from accounting to yoga classes.

An influential state lawmaker is proposing a $10 billion sales tax on services that would include everything from accounting to yoga classes.

State Sen. Bob Hertzberg, D-Van Nuys, says the changing global economy requires a reevaluation of what’s considered subject to sales and use taxes. That’s why he’s introduced Senate Bill 8, a massive tax overhaul that, he contends, will help avoid “the state’s boom-and-bust tax structure.”

“During the past 60 years, California has moved from agriculture and a manufacturing-based economy to a services-based economy,” said Hertzberg, a former speaker of the State Assembly, who is considered one of the state’s most effective lawmakers. “As a result, state tax revenues have become less reliant on revenues derived from the Sales and Use Tax on goods and more reliant on revenues derived from the Personal Income Tax.”

“Something more,” he added, “something visionary, is needed.”

BOE member George Runner criticizes $10 billion tax on services

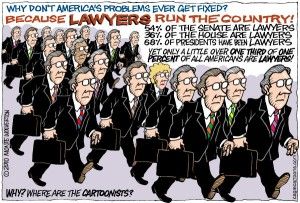

“Something visionary,” in Hertzberg’s view, is for state government to take “something more” from the state’s service workers. That means you’ll be paying “something more” every time you get a haircut, visit your accountant for tax help or call your lawyer.

Board of Equalization Member George Runner, who serves on the state board responsible for administering sales and use taxes, says Hertzberg’s plan is a massive tax increase masquerading as tax reform.

Board of Equalization Member George Runner, who serves on the state board responsible for administering sales and use taxes, says Hertzberg’s plan is a massive tax increase masquerading as tax reform.

“Some California lawmakers want yet another $10 billion from the people,” said Runner, a former Republican state senator. “They want a broad tax on services. Everything from bank transactions to haircuts to movie tickets, and everything in between. This will not work.”

Runner says “California’s hard-working families cannot afford higher taxes,” a view that is supported by the state’s leading taxpayer organization.

“‘Tax reform’ which imposes a net tax increase of $10 billion isn’t tax reform at all,”

says Jon Coupal, president of the Howard Jarvis Taxpayers Association. “It is an insult to working Californians.”

Revenue for schools, local government

Hertzberg believes California needs a permanent solution to raise revenue when Proposition 30, a temporary sales and income tax increase of $7 billion passed by voters in 2012, begins to expire next year.

“We must once again provide Californians with the opportunity to thrive in the 21st century global economy beyond temporary solutions like Prop. 30,” he said.

SB8 would allocate:

- $3 billion to K-14 education, which would go toward rebuilding classrooms and saving for teachers pension fund demands;

- $2 billion to higher education, which would be split between the University of California and the California State University systems;

- $3 billion to local governments, which could go towards “additional public safety, parks, libraries or local development” but will be left to “local governments to best meet the specific needs of their particular communities”;

- $2 billion to low-income families in the form of a new earned income tax credit to “offset the burden of proposed sales and use tax on services”

It also opens the door to “altering” the corporate and personal income tax codes, possibly cutting their tax rates. However, in addition to providing few specifics, Hertzberg says those changes would be delayed.

“The latter provisions would be phased in when it is clear that new revenue from the service taxes is sufficient to replace revenue that would be lost by those changes — and is sufficient to provide low-income workers with an Earned Income Tax Credit,” Hertzberg wrote in a piece co-authored with Edward D. Kleinbard, a USC law professor, and Laura Tyson, a business school professor at the University of California, Berkeley and chair of the U.S. President’s Council of Economic Advisers.

Most small businesses won’t be spared

Unlike past attempts to tax services, Hertzberg has embraced an expansive tax base with limited exclusions for health care and education services as well as businesses with less than $100,000 in gross sales.

“Small businesses, like plumbing contractors, auto repair shops, and restaurants account for more than 90 percent of the state’s businesses and well over a third of all jobs,” Hertzberg said. “They are a key rung on the ladder of upward mobility.”

“Small businesses, like plumbing contractors, auto repair shops, and restaurants account for more than 90 percent of the state’s businesses and well over a third of all jobs,” Hertzberg said. “They are a key rung on the ladder of upward mobility.”

Yet, those small businesses are likely to be hit with the new sales tax on services. According to the U.S. Small Business Administration, the two most widely used size standards are “500 employees for most manufacturing and mining industries and $7.5 million in average annual receipts for many nonmanufacturing industries.” Other industry specific size-standards are:

- Legal services — $11 million in average annual receipts;

- Accounting and related services — $20.5 million in average annual receipt;s

- Architectural services — $7.5 million in average annual receipts;

- Engineering, surveying and mapping services — $15 million in average annual receipts;

- Specialized design services – $7.5 million in average annual receipts.

According to a 2011 policy paper published by the California Budget Project, which generally favored expanding the sales tax to services, “[A]t the height of the Great Depression, policymakers feared taxing services, viewing it as a tax on labor that would discourage employment.”

SB8: Chance of passing?

What are the bill’s chances of advancing?

As with most other bills, the first hearing on SB8 has yet to be scheduled. CalWatchdog.com reached out to half a dozen Republican state lawmakers for their reaction to the $10 billion tax increase, several of whom had yet to read the bill. None was willing to comment.

“To be clear, this is not tax reform,” stressed Runner, the former GOP state lawmaker now at the state tax agency. “It is a massive tax increase.”

Related Articles

Brown’s Budget Blockbuster

MARCH 22, 2011 By WAYNE LUSVARDI (Satire) Gov. Jerry Brown may have learned in Jesuit school how to put the

Moody’s warns of mass Calif. municipal bankruptcies

Aug. 18, 2012 By Chriss Street The klaxon horn went off Friday evening for California municipal bondholders when Moody’s Investors

Legislature passes record $117 billion budget

On Monday, the California Legislature passed a $117 billion state budget on a 52-28 vote, meeting the June 15 deadline