Bonds Could Sink Split-Roll Tax Increase

By WAYNE LUSVARDI

California’s convoluted finances, ironically, could preclude a split-roll property tax increase. Such a tax increase would alter Proposition 13 to keep property taxes on homes the same (allowing increases of just 2 percent a year), but permit unlimited tax increases on commercial property.

Involved are what are called “conduit bonds,” which are “marketed by public entities such as states, counties and cities on behalf of a private entity.” The “conduit bonds” could help a private company finance a new stadium or low-income housing.

Conduit bonds were involved in the recent controversy over the Sacramento Kings basketball team potentially moving to Anaheim.

Conduit bonds — to refine the definition — are “corporate bonds disguised as municipal bonds,” said Michael Lissack in an article in the Los Angeles Times.

Conduit bonds typically provide tax-exempt interest rate financing for large private profit-making corporations such as Apple or GM, or for a non-profit hospital chain, for economic development purposes. That would include such things as building a manufacturing plant, a non-profit hospital or affordable multi-family housing.

Conduit bonds should not be confused with municipal general obligation bonds that finance public works projects. Conduit bonds are revenue bonds that are not backed by the taxpayers if the bonds are defaulted on. Conduit bonds must serve a public purpose such as the creation of jobs in an economically depressed area.

By overusing and possibly abusing industrial development “conduit bonds,” California has probably shot itself in the foot on the split-level tax issue. Commercial property prices are already down 40 percent in value from their peak, and a wave of conduit bond defaults will depress the market even further. The chickens are just starting to come home to roost when it comes to industrial development conduit bonds in California.

Damage Control

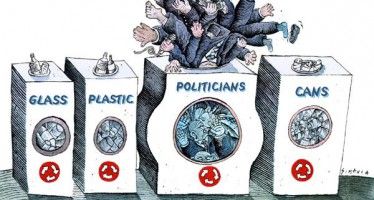

As a result, California state legislators are scrambling for political damage control to the news of a wave of expected defaults of industrial development conduit bonds that would adversely affect holders of such bonds.

An advisory committee of the U.S. Congress today, June 15, is releasing a report to the Internal Revenue Service on alleged exorbitant bond issuance fees, conflicts of interest and questionable tax exempt status of conduit bonds issued by private bond firms on behalf of state economic development authorities. But the California legislators’ reaction to the expected congressional report thus far has been like convening a den of thieving foxes to talk about how to avoid henhouses.

To provide apparent political cover from the congressional report, California Sen. Gloria Negrete McLeod, D-Chino, is concurrently presiding over the California Senate Local Government Committee to conduct hearings regarding the transparency of bond fees and other problems of issuing conduit bonds. In 2007, McLeod sponsored a failed bill, SB 188, which would have allowed the Statewide Communities Development Authority (CSCDA) to finance out-of-state bonds.

There are five major statewide development agencies that authorize the issuance of industrial development conduit bonds: the California Statewide Communities Development Authority, the Municipal Finance Authority, the California Health Facilities Financing Authority, the League of California Cities and the California Association of Counties. The last two reportedly issue the most conduit bonds in the state, mostly through a private issuer BP Capital Resources, Ltd. According to The Bond Buyer online, some of these bonding authorities have gotten the reputation for politicization of the bond issuance process.

As reported in The Bond Buyer online, one of the more notable cases was when a worker’s union at Sutter Health, a nonprofit hospital chain, influenced members of the California Health Facilities Financing Authority (CHFFA), headed by then-State Treasurer Phil Angelides, to hold off on a planned bond issue. The bond issue went through in 2007 after Angelides left state office and assumed the job of treasurer of the CHFFA.

A new book by Gretchen Morgenson of the New York Times, Reckless Endangerment: How Outsized Ambition, Greed, and Corruption Led to Economic Armageddon, explains much of what has happened. The villain of the Bank Meltdown of 2008 was a cartel including: the Democratic Party, community organizing groups such as ACORN and La Raza and politicians such as Barney Frank, Nancy Pelosi, Henry Cisneros and ex-California Treasurer Phil Angelides. Pelosi reportedly got a job and layoff protection for a son. Phil Angelides got subprime loans to fill up new California housing developments with unqualified buyers.

Angelides is also named as one of the central players in the national financial meltdown in 2008 in the book, “The Great American Bank Robbery: The Unauthorized Report About What Really Caused the Great Recession” by Paul Sperry, former Washington Bureau Chief for Investors Business Daily.

Angelides is a disinformation specialist who has chaired his own self-serving National Commission and issued a so-called blue ribbon panel report on the causes of the national financial meltdown, which was funded by a Democratic-controlled Congress. Again, the fox convenes a self-serving committee to write a report on how subprime loans resulted in the foreclosure of proverbial henhouses.

California Treasurer Bill Lockyer

Not to be outdone is California State Treasurer Bill Lockyer. Reported Bond Buyer online:

“We have long believed that CSCDA (California Statewide Communities Development Authority) is a private business being run out of a government agency,” Lockyer spokesman Tom Dresslar said recently. “A thorough scrubbing of their books and their operations is long overdue.”

But this seems duplicitous when the Treasurer’s Office uses several conduit bond issuers, including the politicized California Health Facilities Financing Authority. While Lockyer decries the lack of transparency and incestuous relationships of state bonding authorities, it would seem to be his job to mandate standards for bond issuers’ fees and relationships.

According to the Bond Buyer, the California Statewide Communities Development Authority and joint power bond authorities did not require bond issuers to file audited financial statements until the Legislature mandated it in 2009. But the state now has a minimum disclosure format that doesn’t require the actual disclosure of bond issuer fees charged.

Los Angeles County has recently pulled out of using the California Statewide Communities Development Authority in order to bring bond issuance operations in house. But Gov. Jerry Brown’s efforts to close down local redevelopment agencies statewide will have no apparent impact on the state’s industrial development bonding authorities. Local redevelopment agencies may be disbanded, but the state, the California League of Cities, and the California Association of Counties have no intention of winding down their own statewide industrial development bonding authorities.

Private bond issuers are not the cause of bond defaults anyway, even if they charge exorbitant fees or issue questionable tax exempt bonds. It is the economic development bonding authorities, whether local or state, which declare areas “blighted,” authorize the taking of private property for the use of private retailers, industrialists and developers, and authorize the issuance of tax-exempt development bonds for use by profit-making entities. Finding a fall guy in private bond issuers that exact exorbitant fees is only symbolic reform.

Defaults Coming

Legislators are in the process of enacting reforms before an expected wave of defaults of conduit bonds hits the markets. California is the largest conduit bond issuer and conduit bonds have a 70 percent default rate, even though they only reflect 20 percent of the entire municipal bond market. Thus, 14 percent of all municipal bonds can be expected to default (20 percent X 70 percent).

But the credit markets are anticipating a 7 percent annual municipal bond default rate, and that 30 percent of such bonds will have defaulted through 2014. This forecast is based on the MCDX Index of 50 municipal bond credit default swaps — or insurance for short. The MCDX 5-year index interest rate spread is up 100 percent since November 2009 to reflect the risk of defaults.

Two researchers at Harvard University have issued a report, “Why Fears About Municipal Credit Are Overblown,” which documents that the impacts of conduit bond defaults will be localized to each specific project, and that the bond market has already absorbed the losses in future higher bond interest and insurance rates.

In other words, due to self-correcting measures in the bond markets, there is no apparent need to take over the business of private issuers of such bonds other than to control fees. The market has already absorbed any default losses in advance and will be passing the cost of defaults on to new beneficiaries of revenue bonds.

This is not good news, however, to holders of defaulted conduit bonds that may lose their proverbial shirts. As Mark Twain once wrote: “You can put all your eggs in one basket, but watch that basket.”

Any conduit bond defaults will not affect taxpayers, but may force the sale of any commercial or industrial real estate serving as collateral for such bonds. However, bondholders probably won’t want the burden of managing facilities financed with conduit bonds.

Related Articles

Moving California forward?

APRIL 20, 2010 By KATY GRIMES In one of the most relevant legislative hearings held recently, the Assembly Budget Committee

Referendum threat ties CA bag ban in knots

California’s tug-of-war over the legality of single-use plastic bags will get another twist in 2015. Thanks to a determined signature collection campaign

California’s ‘Mullet budget’ – Conservative in front, but liberal in back

June 14, 2013 By Katy Grimes SACRAMENTO – The Assembly and Senate Republicans should have registered their ‘no’ votes on