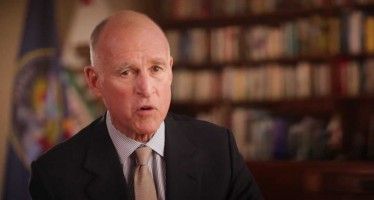

Calif. default risk turns Gov. Brown into a capitalist

By Chriss Street

There is nothing like the threat of insolvency and a downgrade to junk bond status to motivate traditionally liberal politicians to abandon the environmentalists who heavily fund their campaigns. Last week, Gov. Jerry Brown of California tossed one of his core campaign-bundling constituencies under-the-bus at a bill-signing event in downtown Los Angeles.

As Brown signed his third measure this year that dramatically narrows the “sustainable” crowd’s ability to use litigation to delay or kill capital projects, the governor said it is time for “big ideas and big projects,” especially ones to “get people working.” With the pace of public insolvencies and Chapter 9 municipal bankruptcy fillings accelerating across the United States, Brown is the vanguard for high-profile progressives willing to bet that capitalism can pull them back from the precipice of disgrace and potential recall.

For most of Edmund G. “Jerry” Brown Jr.’s first tour as governor from 1975-1983, Gray Davis served as his Chief of Staff. When Brown was campaigning for president in those years, Davis ran California in Brown’s absence. In 1998, Davis was elected governor by an overwhelming 20 percent margin.

In the next 1,778 days, Davis went on a liberal borrow-and-spend blitz by signing 5,132 bills, including huge pension spikes for public employees, public control of electricity purchasing, substantial increases in school spending and the nation’s first state law requiring automakers to limit auto emissions. He even tried to pass gun control.

But when the economy turned down after 9/11 and the credit rating agencies’ downgrades sent California into a financial crisis, Davis became only the second governor in American history to be recalled by voters.

The recall of Davis sent a scare through politicians across the nation about the need to control spending and become more pro-business. But with real estate prices skyrocketing, state and local government revenues exploded to the upside. Spending accelerated even faster than rising revenues as governments borrowed heavily on the hope of an endless rise in property and sales taxes.

Borrowing

When the Great Recession hit in 2008, state and local governments kept borrowing and spending, because they enjoyed huge “stimulus” transfers from the Obama Administration and a two-year lag before tax revenues began to fall. But In 2011, state and local spending fell for the first time since 1946. This year, government entities face steep budget deficits and are struggling to pay off debts accumulated over prior years.

The Moody’s and S&P credit rating agencies provided the “investment grade” credit ratings encouraged investors to buy many dicey municipal bonds. Those agencies now fear they may have liability and are actively slashing many ratings. As ratings levels have hit “junk bond” status, 26 municipalities filed for bankruptcy since 2010. Three California cities have filed bankruptcy over the last 60 days and Fresno, Duarte, Compton, San Jose and other cities have acknowledged they are in financial crisis.

More ominous, for 60 years municipal debt increased annually, but this year for the first time the municipal bond market will face the “August Cliff”. This is an event where more money will flow out of government coffers to pay off maturing debt than will come in from expanding new bond sales. With credit ratings falling and media-driven fear rising about the “Mounting Muni Meltdown,” it is only time before conservative investors become reluctant to put their cash back to work in municipal bonds.

Development

Brown is on a pro-development tear. He shocked the “greens” last week by joining U.S. Department of the Interior Secretary Ken Salazar in announcing plans to build two massive tunnels under the California Delta at a cost of $23.7 billion to carry water from the Sacramento River to connect to the California Aqueduct to quench Southern California’s thirst for new land development, while generating more property and sales taxes. The next day he dedicated the 117-mile Sunrise Powerlink transmission line that can carry 1,000 megawatts of energy from the Imperial Valley to San Diego — the first major new power lines to connect to San Diego in more than 25 years.

Brown is painfully aware that California already has the second lowest state municipal bond rating in the United States, and that Moody’s recently warned it plans to issue California a downgrade soon, possibly to junk. My analysis indicates that approximately 20 percent of cities, 30 percent of redevelopment districts and a number of counties in California may file for bankruptcy in the next two years.

Jerry Brown’s father, former California Gov. Pat Brown, first ran for state Assembly as a Republican in 1928, but lost and later joined the Democratic Party. Pat Brown’s two terms as governor were marked by working closely with the pro-growth private sector to build the enormous California Aqueduct, enact the California Master Plan for Higher Education and found the California Commission for Economic Development.

Jerry Brown seems to have re-embraced his father’s belief in building infrastructure to support private-sector growth to rehabilitate California. When Jerry Brown was asked why he has signed three bills this year to limit challenges to major infrastructure projects by the state’s restrictive California Environmental Quality Act, Brown responded, “I’ve never seen a CEQA exemption that I don’t like.”

Chriss Street will be in Studio with Paul Preston on “The Inside Education,” Streaming Live Monday August 6 through Friday August 10, 7-10 PM

Click here to listen each night: http://www.mysytv.net/kmyclive.html

Related Articles

State budget: Governor, lawmakers expected to finalize deal

State lawmakers reached a tentative agreement on the state budget Thursday, after Gov. Jerry Brown caved to Democratic lawmakers’ demands

Hiltzik ignores massive debt

Aug. 15, 2012 By John Seiler Los Angeles Times business writer Michael Hiltzik is an excellent reporter. But when he