Brown's Job Got Twice as Hard

NOV. 12, 2010

By JOHN SEILER

Less than a month ago, on Oct. 18, Moody’s Investor Service issued a report calculating California’s situation as “at least $12 billion in future budget gaps.”

Now, the nonpartisan California Legislative Analyst’s Office released a report calculating a deficit of $25 billion — double the Moody’s number:

Our forecast of California’s General Fund revenues and expenditures shows that the state must address a budget problem of $25.4 billion between now and the time the Legislature enacts a 2011-12 state budget plan. The budget problem consists of a $6 billion projected deficit for 2010-11 and a $19 billion gap between projected revenues and spending in 2011–12.

Didn’t Gov. Arnold Schwarzenegger race into office seven years ago solemnly promising to “terminate” the “crazy deficit spending“?

The LAO report urged the state government to stop using short-term fixes to the budget deficits, such as those by Davis and Schwarzenegger, and instead look to long-term solutions:

One major reason to stop passing the state’s problems to future Californians is that the state’s long-term fiscal liabilities—for infrastructure, retirement, and budgetary borrowing—are already huge. The costs of paying down these liabilities already are reflected, to some extent, in the state’s recurring deficits, but these costs will only grow in the future. By deferring hard decisions on how to finance routine annual budgets of state programs to future years, the state risks increasing further the already immense fiscal challenges facing tomorrow’s Californians.

Indeed, an October study by the Foundation for Educational Choice and the Pacific Research Institute, CalWatchDog.com’s parent institute, found that:

California’s unfunded pension liabilities—i.e., the gap between existing plan assets and the present value of benefits accrued by participants—actually reach $282.2 billion, a figure that rises to $326.6 billion when current market values are taken into account. On top of that, the California Controller estimates that retiree health benefits are currently underfunded by $51.8 billion. The total of these actuarial obligations thus reaches $378.8 billion.

So what happened?

Is that $24 billion budget deficit number — doubling the earlier number — realistic? And what happened?

“Some of it is not surprising,” Esmael Adibi told me; he’s director of the A. Gary Anderson Center for Economic Research and Anderson Chair of Economic Analysis. He’s working on Chapman’s annual Economic Forecast, scheduled for Dec. 6, which will include their estimate of the budget deficit.

He said that things are different from the last budget, for fiscal year 2010-11, which was passed 100 days late in October. For that, the state had a combination of tax increases, federal bailout funds, borrowing and transfers that may not be available this time.

Revenue is going to increase in the new budget, he said, because of the economy has been better, “but not enough to help the deficit.” Moreover, the “one-time stimulus money won’t be there” next time because the Republican takeover of the U.S. House of Representatives means there’s not going to be another stimulus based on the federal government borrowing money and giving it to states.

Also, in the LAO’s analysis, the $13 billion in tax increases will expire next year. Voters vetoed an extension of the tax increases by defeating Proposition 1A in the May 2009 Special Election.

Payback time

And there’s a kicker, Adibi said. Last year, money to balance the budget was borrowed from state K-12 education funds, and that money still is owed to the education funds.

“Put all of this together,” he calculated, “and you get a deficit of $24 billion or $19 billion or $20 billion, something like that.”

He also expects that the 2009 tax increases will be extended by the Legislature because it will be politically impossible to replace them with $13 billion in spending cuts. That will happen despite the defeat of Proposition 1A in 2009, despite Gov.-elect Brown’s pledge not to increase taxes without a vote of the people and despite the defeat of tax-increase propositions earlier this month on the November 2010 ballot.

The ghost of Prop. 23

California also will be haunted by the ghost of Proposition 23, which lost big on election day. Until state unemployment improved, it would have suspended for a year AB32, the 2006 Global Warming Solutions Act.

“AB32 will impact the manufacturing sector,” Abibi said.

The LAO’s new study on the budget didn’t specifically mention AB 32. But in a different study before the election, the Leg Analyst found, “it seems most likely to us that the implementation of AB32 through the SP [the Scoping plan of the California Air Resources Board] will result in the near term in California job losses.”

Jack Stewart, president of the California Manufacturing and Technology Association, told me of AB32, “It’s going to cost California business a lot of money and California workers a lot of jobs. It’s going to be bad for the California economy. California voters don’t get the fact that California is in the basement.”

Fewer jobs means those newly jobless pay fewer taxes and start using more state services, both of which will increase the deficit.

A 32 begins serious implementation in January. Another factor most people have forgotten is SB375, signed into law by Gov. Schwarzenegger in 2008. It’s an anti-sprawl law that, working with AB32, gives government new powers to reduce traffic and increase population densities.

David Zetland is formerly Wantrup Fellow in Natural Resource Economics and Political Economy at the University of California, Berkeley, and editor of the Aguanomics.com Web site on water policy. I asked him what effect the AB 32-SB375 combo would have on California’s economy. He told me:

So, let’s take AB32 as given, i.e., reduce carbon. The cheapest way to do that is with carbon pricing, e.g., higher prices for gasoline. Say a $1 per gallon tax.

Let’s also assume that the government doesn’t waste that money on projects and rebates it back to citizens (per capita) or by lowering income taxes.

Such a program will have costs in terms of less driving, less convenience and a reduction in house prices in suburbs, but we may not feel it relative to other costs, especially with rebates.

So, the best case is that AB32 needn’t cause a lot of pain and suffering. It may cut high-carbon jobs in California, but there are not many of those left. (But farmers will have to put pollution controls on tractors.)

On the other hand, AB32 and SB375 can create a bureaucratic regulatory command-and-control nightmare. I’m not sure we will avoid that bullet.

That’s another sign that the climate is not improving for taxpaying businesses in California.

Jerry’s rabbit

Perhaps Gov.-elect Brown can pull a fiscal rabbit from a hat and solve the state’s fiscal calamities. But the reality, Adibi lamented, is this: “When you keep pushing the problem down the road, it doesn’t get solved.”

Now the problem is farther down the road than ever.

John Seiler is a reporter and analyst for CalWatchDog.com. His email:[email protected].

Related Articles

Education sector bond spending continues to spike

Schools and universities from the smallest unified school district to the top-tier university systems in the state issued more bonds

Oil tech for CA: From Russia, with love?

On Jan. 1 California’s fracking law drills in – just as the price of oil has dropped to its lowest

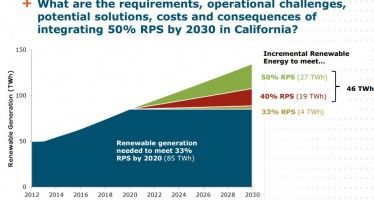

Reaching 50 percent renewable goal won’t be easy

Yesterday Democratic leaders in the California Senate introduced a series of bills to move the state to a goal of 50 percent renewable