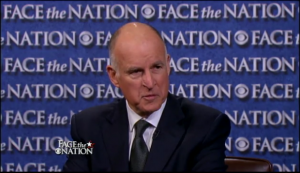

New Brown budget pushes tax increases

By Brian Calle

Gov. Jerry Brown and his allies, in predictable fashion, are using California’s latest $16 billion budget black hole as a tool to justify big tax hikes. Brown did so today in presenting the May Revise of his 2012-13 budget proposal.

And, they argue, the consequences for rejecting the governor’s November ballot proposition to raise taxes would be damage to public education. Their approach should backfire.

In a statement about the state budget deficit ballooning from $9 billion in January to $16 billion, Brown made the case for more taxes: “We can’t balance the budget with cuts alone; that would just further undermine our public schools.” Joining the same chorus, California Teachers Association president Dean E. Vogel said that the news makes “it all the more crucial that voters pass the governor’s tax measure in November.”

Don’t be fooled by the smoke and mirrors though. “Everything Governor Brown does between now and November is designed to convince voters to tax themselves more,” former California Assemblyman Chuck DeVore told me. “Look for draconian budget cuts but no real government reform. The governor needs billions of dollars to, at the very least, keep government retiree pension plans solvent.”

Brown’s announcement of the state’s enhanced fiscal woes and his proposed fix is paradoxical—if not patently absurd. “The budget I am proposing will boost funding for education, protect public safety and prevent an even deeper round of trigger cuts,” he said. While acknowledging the state is dangerously cash-strapped, he is also seeking to increase spending for education by 16 percent; follow a plan that follows the same failed policies of the last decade; and spend more money than the state takes in, offering no changes to the system.

Union power

If nothing else, the budget situation points to the power teachers’ unions have within the Brown administration and California government in general. This is particularly true of the juggernaut CTA, which was recently dubbed by City Journal as the “Worst union in America” because of the lopsided influence it has on public policy in California.

Education spending is perhaps the Holy Grail of politics in the Golden State. So it is no surprise Brown’s administration is using education as a justification for increasing taxes. Improving education is popular with voters. But money is not the major problem facing California’s education. Instead, the state is in need of structural reform.

Jon Coupal, president of the Howard Jarvis Taxpayers Association, in an email exchange argues that because the governor has failed to produce any meaningful reform proposals, his tax initiative will be “toast.” It is not so much the new budget numbers that will affect the governor’s tax measure “as it is the abject lack of any reforms” he has proposed, Coupal argues.

Claremont McKenna College political science professor Jack Pitney may have stated it best when he told the Los Angeles times that, in light of the budget news, the reaction to Brown’s tax initiatives could be something like this: “You can’t even handle the money we’ve already sent you. Why should we send you more?”

Californians should not be duped by the rhetoric. The new state budget shortfall illustrates why taxpayers ought not send more money to politicians in Sacramento — not, as the governor argues, why more money should be sent to the Capitol. Sacramento lawmakers have badly stewarded taxpayer resources for far too long.

Related Articles

Teams spared to promote equality

July 12, 2010 By LAURA SUCHESKI Add “gender inequality” to the growing lists of frivolous objections to cuts in state-funded

Deadbeat California Needs a Payday Loan

JULY 15, 2011 By CHRISS STREET For the State of California and its counties and cities, tax collections tend to

Video: Election watch: Props. 30 & 38

Oct. 9, 2012 Both California Governor Jerry Brown and the Teacher’s union put a tax hikes on the ballot. What