State Property Sale Off, Again

Katy Grimes: The highly questionable sale of 11 state-owned properties hit another snag on Monday after being given the go-ahead last week. A California Appeals Court halted the sale yesterday after a Superior Court Judge just last Friday, had approved the sale.

The lawsuit was brought by three former state building authority members terminated by Governor Schwarzenegger after questioning the controversial properties sales and the long term cost to the state. Jerry Epstein, Don Casper and A. Redmond Doms have said that not only are the sales a waste of taxpayer money, the sale of the properties is unconstitutional.

In my April CalWatchdog story about Jerry Epstein’s termination, I quoted Epstein’s Los Angeles Times column about the sale and his termination: “With little study and without public hearings or input from the real estate experts who serve on the relevant state building authorities, Gov. Arnold Schwarzenegger and the Legislature agreed to sell 11 state office building complexes,” describing the property sales as a “fire sale” during one of the biggest real estate slumps in California history.”

Epstein, a 30-year appointee of the Los Angeles State Building Authority, wrote, “Neither my colleagues on the authority nor I were consulted before this dubious scheme was hatched, though the authority’s cooperation is necessary for the execution of the sale of the Reagan and Serra buildings. In late February, at my direction, counsel to the Los Angeles State Building Authority asked the Department of General Services to provide a market study and to clarify the terms proposed by the Schwarzenegger administration. We asked for a comparison of the projected net proceeds from the sale and the projected rental and other costs associated with a 20-year leaseback of these same buildings.”

Three weeks after his objection, Epstein was unceremoniously terminated by the DGS Director Dietrich, in a tersely worded, two-sentence letter. Earlier in the month, two other Building Authority appointees were terminated, who also questioned the administration’s plan to sell the properties.

And even though DGS Director Ron Diedrich was requested to appear before the Assembly Accountability and Administrative Review committee shortly after the termination, in a hearing to answer questions surrounding the 11 state properties for sale, he did not. At that hearing, several committee members expressed concern over what appeared to be a violation of Proposition 58, by trying to raise immediate funds to pay off current state debt, but obligating more long term debt in doing so – an issue that has not been discussed since.

The Fresno Bee reported on Monday, “Louise Renne, who represents Casper, said the appeal was filed in the First District Court of Appeals in San Francisco but was transferred to the Sixth District Court of Appeals in San Jose because the San Francisco court is housed in one of the buildings to be sold. “In effect, the escrow that was to take place on Dec. 15 has been stayed,” Renne said. “This is very good news for the taxpayers of this state.”

Renne said there was no reason why the escrow had to close so soon when the state fiscal year ends June 30. The state faces no immediate cash flow problems if the sale is delayed.

The Legislative Analyst’s Office reported that the sale will end up costing taxpayers at least $1.4 billion over 35 years. The state will pay an effective interest rate of 10.2 percent to rent back the buildings it now owns, about double what the state pays on existing bonds used to build its offices.

Opponents also questioned how the bidding process went down. During a recent deposition of state Treasurer Bill Lockyer, it was revealed that the winning group of investors arranged for a $500,000 “finder’s fee” for Santa Ana Mayor Miguel Pulido if the sale was successful.

But many are asking if Pulido used inside information that came to him as a public official for personal financial gain.

The question at the heart of the sale has been who are the buyers and how are they benefitting? The Voice of OC reported that the buyer, California First, a consortium buying the properties, “a politically well-connected investment arm of two other firms, Hines and Antarctica Capital Real Estate. Antarctica’s managing partner is Richard Mayo, who also is a partner in another investment firm, Spyglass Realty Partners.”

Mayo’s Spyglass biography reported he was “an appointee of former Governor Pete Wilson, and responsible for overseeing the privatization of the State of California’s 35-million-square-foot real estate portfolio. He directed all surplus land dispositions, leasing, acquisition, planning, construction and asset management activities.”

“Another Antarctica executive is Grover McKean, who was chief deputy state treasurer when Jess Unruh, one of the most powerful figures in California political history, was state treasurer in the 1980s.”

OC Weekly reported that Belgravia Capital, one of the 10 firms listed as investors in California First, is owned by Orange County’s R.J. Brandes, a donor to Pulido’s political campaigns. The Weekly also reported that Pulido had earned between $10,000 and $100,000 working for other Brandes companies.

“Rumors have been circulating in Orange County political circles for weeks that Pulido was likely to get a state appointment from the incoming governor, Jerry Brown,” according to the Voice of OC.

Eric Lamorureax, a spokesman for the state Department of General Services, said the state’s lawyers were still determining their options.“Our singular focus all along has been to finalize this transaction … to raise revenues that are desparately needed by the state,” he said. The sale, if completed, would generate $1.2 billion for the cash-strapped state this year,” The Fresno Bee reported.

Read all of the CalWatchdog stories about the state property sales:

Critics slam state property sale

Fired official slams state ‘fire sale’

LAO report: Evaluating the Sale-Leaseback Proposal

Chris Thornberg, founding principal of Beacon Economics and chief forecaster for the state controller prepared a report on the sales: Chris Thornberg’s report on the property sales: A Bad Deal

DEC. 14, 2010

Related Articles

From L.A. to San Diego, short-term rentals stoke fury

The Internet-fueled rise of short-term vacation rentals is stoking fury in coastal Southern California communities and cities that attract lots

Dems Scare Voters, Protect Unions

Steven Greenhut: Sen. Bob Huff, R-Diamond Bar, the vice chairman of the Senate Budget Committee, issued a statement today blasting

Chapman Forecast: Steady CA growth

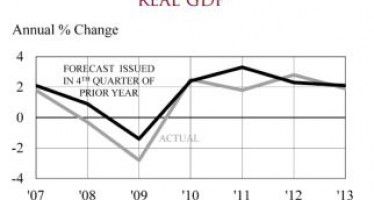

Chapman University’s new economic forecast projects steady but not spectacular economic growth for California and the nation. Real U.S. GDP