The day after the election

By Katy Grimes

With the 2012 election in full swing, everyone’s focus seems to be on the candidates and ballot initiatives.

We are inundated with ludicrous, often irrelevant political advertising. But what happens after the election? What happens if President Obama gets reelected and California passes all of the tax increase ballot measures, along with the 35 local sales tax increase measures?

The presidential race

Should Obama win reelection, he will still be stuck with a Republican U.S. Congress, and possibly even a Republican Senate. Either way, expect to see more of the last four years of gridlock and executive orders.

Obama will continue to “look at how we can work around Congress.” And for that

work-around, expect to see many more executive orders. Obama signed 140 Executive Orders during his first term.

Because of the country’s $16 trillion debt, and the reckless spending habits of the Obama administration, some in the finance world expect that the entire U.S. economy will crash if President Obama is reelected.

If Mitt wins…

If Mitt Romney wins, he has promised to repeal Obamacare on day two, and begin immediately to undo some of the business killing policies put in place by the Obama administration.

But perhaps even more importantly, Romney would eliminate and replace the entire cabinet of far-left extremists that Obama appointed.

Gone will be some of the more notorious statists with unchecked power: Energy Secretary Steven Chu, Secretary of Health and Human Services Kathleen Sebelius, Homeland Security Secretary Janet Napolitano, Secretary of the Interior Ken Salazar, and Secretary of State Hillary Clinton.

What happens to California?

California already levies a 7.25 percent general sales and use tax on consumers, which is the highest statewide rate in the nation, according to the California Taxpayers Association.

California’s statewide gasoline taxes and fees total 48.6 cents per gallon, the second highest in the nation. Many counties add local sales taxes on top of that.

California’s personal income tax has the second-highest top tax rate, at 10.3 percent, and one of the most highly progressive structures in the nation.

Only eight states have a higher corporate tax rate than California’s 8.84 percent flat rate, which CalTax reports is the highest corporate tax rate in the Western states.

Even with Proposition 13, California’s property tax rate is 14th highest in the country. While each tax may or may not be the highest, put them all together, and Californians are living in a very high tax state.

According to the California Taxpayers Association, “California’s business tax climate will worsen and the state will have a tougher time attracting and retaining jobs,” if Propositions 30 and/or 38 are passed by voters.

In the 2013 State Business Tax Climate Index, a new study by the Tax Foundation, “a survey of all 50 states, ranks California’s tax structure 48th — worse than all the other states except New Jersey and New York.”

The study found that, if both Propositions 30 and 38 are approved, the results will “reduce California’s score in individual tax and overall.”

“The evidence shows that states with the best tax systems will be the most competitive in attracting new businesses and most effective at generating economic and employment growth,” according to the report.

Perhaps one of the most important issues to remember is, “States do not enact tax changes (increases or cuts) in a vacuum,” according to the Tax Foundation. “Every tax law will, in some way, change a state’s competitive position relative to its immediate neighbors, its geographic region, and even globally. Ultimately, it will affect the state’s national standing as a place to live and to do business. Entrepreneurial states can take advantage of the tax increases of their neighbors to lure businesses out of high-tax states.”

This will impact business even more, including business decisions, job creation and retention, business location, competitiveness, the transparency of the tax system, and the long-term health of a state’s economy.

“Most importantly, taxes diminish profits,” the Tax Foundation reports. Taxes cut into a business and often prevent the business from reinvesting back into the community.

The Tax Foundation explains, “If taxes take a larger portion of profits, that cost is passed along to either consumers, employees, through lower wages or fewer jobs, or shareholders. Thus, a state with lower tax costs will be more attractive to business investment, and more likely to experience economic growth.”

It’s that simple, and that ugly.

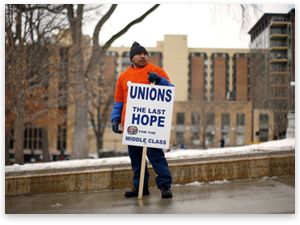

Ending union dominance in CA

Proposition 32 would prohibit corporations and public employee unions from making direct contributions to political campaigns. And, it would ban automatic payroll deductions by corporations and unions of employees’ wages to be used for politics.

Should Prop. 32 pass, it would level the political playing field and give grassroots organizations and voters a political voice in California once again.

Labor union leaders call Prop. 32 a fraud, and claim that its backers have exempted themselves from the new rules. But with most of the Democratic state legislators handily assisted into office by the state’s public employee unions, it is no wonder labor leaders are in a frenzy.

This should make every working man and woman in California ecstatic. If Prop. 32 passes, union employees will get to keep more of their pay, and unions will no longer have such a huge financial influence in elections.

Real reforms?

Proposition 31 is packaged with some real reform measures in it, but there are too many flaws in the measure for the reforms to really matter. However, if it passes, expect another layer of government bureaucrats added to California’s already top-heavy system. Prop. 31 would also prohibit future legislation on reducing taxes.

According to CalTax, Prop. 31 would “effectively prohibit legislation (including the state budget) from reducing taxes by $25 million or more unless the same legislation included a tax increase or spending cut.”

Prop. 39: Another corporate tax

Proposition 39 would require businesses headquartered out of the state to use the “single sales factor method,” in which their tax liability is based solely on their amount of sales in the state.

Prop. 39 is backed by wealthy hedge fund manager Tom Steyer, who stands to benefit from the passage of the measure. While the state stands to collect about $1 billion in added revenues each year, half of that money must be used on the Clean Energy Job Creation Fund for the first five years. After five years, all of the additional tax revenue would go to the state’s General Fund.

Steyer, who is pushing hard for passage of Prop. 39, is the co-chairman of the Clean Energy Job Creation Fund, and is heavily invested in green, clean-tech businesses, which many have said potentially stand to benefit somewhat from the $1 billion of additional tax money.

The measure is written to sound as if big business has a sweetheart deal with the state. But anything designed to squeeze more taxes out of any business right now could devastate California’s economy even worse.

Should Prop. 39 pass, expect to see more business shrinkage, jobs lost, and multi-state businesses pulling operations out of California.

Local tax increase measures

Thirty-five California cities have tax increase measures on the ballot, totaling a whopping 241 tax and bond measures. Of the 2012 local tax elections, the majority are school bonds.

There are nine local ballot measures proposing a 1 percentage-point increase in the sales tax, which would increase the tax on gasoline significantly. That would be on top of the 7.25 percent state sales tax levy, plus any local sales taxes already on the books. Cha-ching.

Final blow to California economy

Some cynics suggest that we should just allow everything to pass in order to speed up California’s demise. The more optimistic folks believe that California could be turned around, but only if unions are no longer running the state’s Democrats.

If these ballot measures pass, there will be much higher unemployment, and businesses large and small will not reinvest. Some businesses will shrink even more, some will close and even more will move, if possible. Taxpayers will be squeezed even more, shrinking everyone’s take home pay.

However, on a lighter note, Californians have rejected the last eight tax increases on the ballot. While another rejection of tax increases sends a loud message to Gov. Jerry Brown, he and the Democrat-controlled Legislature have demonstrated that they are not beholden to voters; their constituency is the unions.

However, if Prop. 32 passes, California voters and taxpayers just might get the ear of the Democrats.

Related Articles

Moorlach to seek O.C. state Senate seat

Termed-out Orange County Supervisor John Moorlach — who until recently seemed to be preparing for an exit from active politics

Sexual ‘assault’ or ‘harassment’? Filner could be on last legs

July 13, 2013 By Chris Reed San Diego Mayor Bob Filner’s attempt to fight off the push to force him

Pension crater bigger than thought

APRIL 12, 2010 A new report from Stanford University’s well-respected economic policy institute has revealed that those of us who