Redevelopment fallout: Lawmakers impose big new taxes

By Katy Grimes

SACRAMENTO — SB 391 is the California Stamp Act.

The original Stamp Act was imposed in 1765 and helped spark the American Revolution against British tyranny. According to History.org, “The new tax was imposed on all American colonists and required them to pay a tax on every piece of printed paper they used.”

British King George III is long gone. But state Sen. Mark DeSaulnier, D-Contra Costa, author of SB 391, seems to be following in his footsteps. DeSaulnier says his new bill will create a permanent funding source for affordable housing.

SB 391, titled the California Homes and Jobs Act of 2013, is legislation “that will create jobs while building affordable places for Californians to live,” DeSaulnier’s website said. “Senate Bill 391 will get California building again to create 29,000 jobs annually and help businesses attract and retain the talent that fuels California’s economy.”

According to DeSaulnier, SB 391 would:

* Put a small ($75) recordation fee on real estate transactions, excluding home sales. This fee will generate an estimated $500 million in state seed money each year without creating new debt. It would be used to leverage an additional $2.78 billion in federal and local funding and bank loans annually.

* Deploy these dollars in California communities through a successful private/public partnership model.

* Build safe and affordable single-family homes and apartments for Californians in need, including families, seniors, veterans and people with disabilities.

* Reduce homelessness, resulting in significant savings to taxpayers and reducing strain on our health and criminal justice systems.

Tax royalists

SB 391 is a re-do of last year’s SB 1220, authored by DeSaulnier and Sen. President Pro Tem Darrell Steinberg, D-Sacramento. SB 1220 failed to get enough votes in the Senate.

SB 391 would impose a $75 “fee” — really a tax — on every document recorded, unless it is recorded in connection with a sale. According to the County Recorder Association’s opposition last year to SB 1220, the $75 tax would mean more than 300 document types would be subject to the tax, including mining claims, homestead declarations, refinance mortgages, reconveyance documents for paying off a loan, powers of attorney, lien releases, affidavits and a host of other documents requiring legal recording with the state.

The similarity to the 1765 Stamp Act is clear.

The tax royalists in the Legislature also expect to enjoy spending a large new revenue stream. “It is estimated that this bill will generate an average of $525 million per year for the [Housing Opportunity and Market Stabilization] Trust Fund, ranging from $300 million per year in low-volume years to $750 million per year in high-volume years,” the bill analysis for SB 1220 said.

“The author calls this the ‘Homes and Jobs Act.’ Unfortunately, SB 391 will provide little of either,” said David Wolfe, legislative director for the Howard Jarvis Taxpayers Association. “A $75 recording fee on a multitude of real estate documents to provide affordable housing is nothing more than wealth redistribution. It is a clear and inappropriate tax increase to target existing property owners with new fees when the real estate market is just emerging out of the depths of recession. If affordable housing is an important priority to the Legislature, we suggest it be funded out of our record $102 billion General Fund.”

The redevelopment connection

The analysis for SB 1220 explained: “Until 2011, the Community Redevelopment Law required redevelopment agencies to set aside 20 percent of all tax increment revenue to increase, improve, and preserve the community’s supply of low and moderate income housing available at an affordable housing cost. In fiscal year 2009/10, redevelopment agencies deposited $1.075 billion of property tax increment revenues into their Low and Moderate-Income Housing Funds. With the elimination of redevelopment agencies, this source of funding for affordable housing is no longer available.”

Wasn’t the plan behind the elimination of redevelopment agencies to cut state spending to help balance the state budget?

For a deeper understanding of what was involved in “increasing, improving and preserving the community’s supply of affordable low and moderate income housing,” the SB 1220 analysis tells where and how redevelopment money was spent:

“Current law establishes a number of programs at the Department of Housing and Community Development (HCD) and the California Housing Finance Agency (CalHFA) to make housing more affordable to California families and individuals, including the following mainline programs:

“Multifamily Housing Program, which funds the new construction, rehabilitation, and preservation of permanent and transitional rental homes for lower income households through loans to local governments, non-profit developers, and for-profit developers.

“Joe Serna, Jr. Farmworker Housing Program, which funds the development of ownership or rental homes for agricultural workers through grants to local governments and non-profit organizations.

“Emergency Housing Assistance Program, which funds emergency shelters and transitional homes for homeless individuals and families through grants to counties and non-profit entities for rehabilitation, renovation, expansion, site acquisition, and equipment.

“CalHome Program, which funds downpayment assistance, home rehabilitation, counseling, self-help mortgage assistance programs, and technical assistance for self-help and shared housing through grants and loans.

“California Homebuyer Downpayment Assistance Program, which aids first-time homebuyers with down payment and/or closing costs.”

But it’s also worth remembering that redevelopment commonly used eminent domain to seize the property of middle-class homeowners and businesses, then give that property to wealthy developers. Jose’s Muffler Shop was bulldozed, Jose given a fraction of what his property was worth, to build a Big Box store.

Gov. Jerry Brown’s decision in February 2011 to kill redevelopment in California was met with significant resistance from redevelopment agencies and California lawmakers. But it’s like a whack-a-mole game. Every time something is cut from the budget, it pops up under a new name, with a new funding source.

County Recorders oppose tax increase

The County Recorders Association of California Legislative Committee is opposing this bill, just as it opposed SB 1220. According to the County Recorders, the current recording fees vary by county.

“Purchasing a home is often one of the biggest financial decisions people will make in their lifetimes,” said Kammi Foot, Inyo County Recorder. “For the average Californian, there are several documents that may need to be recorded after they purchase their home. Imposing a $75.00 fee on each document would add to the already substantial expense. The Legislature should carefully weigh the significant financial burden that that this fee would place on ordinary Californians.”

SB 391 would weaken the integrity of the land records system, the cornerstone of our free enterprise system, Foote said. “Any impediment or disincentive to record documents would diminish the public’s ability to prove certainty of title.”

Foote explained mining claims are a great example of how this bill would negatively affect the public. “To hold a claim for mineral rights located on public land, the claimant is required to record certain notices annually. If a person cannot afford to record this document every year, they lose their claim. An increase of the fee from $14.00 to $89.00 is an increase of over 600 percent.

“SB 391 requires County Recorders to collect fees for a function their office does not perform,” Foote added. “If a Californian cannot afford to pay a recording fee, they may lose the ability to prove ownership to their own property, one of the mainstays of our free enterprise system.”

Is it a jobs bill? Where did DeSaulnier get 29,000 jobs?

DeSaulnier’s website claimed, “California business and housing advocates join forces to get California building again.” And, “Sen. Mark DeSaulnier’s SB 391 [would] create 29,000 jobs annually and build affordable homes for Californians.”

SB 391, Section 1, (i) of the bill reads, “Many economists agree that the state’s higher than average unemployment rate is due in large part to massive shrinkage in the construction industry from 2005 to 2009, including losses of nearly 700,000 construction-related jobs, a 60-percent decline in construction spending, and an 83-percent reduction in residential permits. Restoration of a healthy construction sector will significantly reduce the state’s unemployment rate.”

SB 391 “will create jobs while building affordable places for Californians to live, and get California building again to create 29,000 jobs annually and help businesses attract and retain the talent that fuels Californias economy,” DeSaulnier claims on his website.

But it was just such artificial inflation of the housing market by federal, state and local programs that produced the mid-2000s bubble, which burst and damaged much of the California economy.

There is no formal legislative analysis of SB 391 yet. But one Senate staffer, who asked to remain anonymous, told me the 29,000 jobs apparently are a “loose assumption” and “not scientific,” and was provided by the California Department of Housing and Community Development.

The bill language requires that “the fees, after deduction of any actual and necessary administrative costs incurred by the county recorder in carrying out this section, shall be sent quarterly to the Department of Housing and Community Development for deposit.”

Federal funding

Apparently another significant aspect of the motivation for SB 391 “is the billions in federal and private funding needed for affordable home construction,” said Gary Toebben, president and CEO of the Los Angeles Area Chamber of Commerce, on DeSaulnier’s website.

“Millions of Californians are caught in a perfect storm where mortgages remain out of reach, home financing is more restrictive than ever, and the foreclosure crisis has driven more people to the rental market, pushing rents to record levels,” said Shamus Roller, Executive Director of Housing California. “The California Homes and Jobs Act will build safe and affordable single-family homes and apartments for Californians in need, and provide stable living environments for families, seniors, veterans, people with disabilities and those experiencing homelessness.”

“There is an affordable homes shortage in our state, and we cannot turn our back on the millions of Californians without a stable living environment,” said DeSaulnier. “SB 391 will not only create jobs now, it will provide long-term benefits to our state.”

But at what cost? How many jobs will the fee-tax kill? Would another real-estate bubble be popped in a few years, repeating the folly of the mid-2000s? How are poor people helped if they take out mortgages they can’t afford, then a couple of years suffer through foreclosure?

But at what cost? How many jobs will the fee-tax kill? Would another real-estate bubble be popped in a few years, repeating the folly of the mid-2000s? How are poor people helped if they take out mortgages they can’t afford, then a couple of years suffer through foreclosure?

SB 391 is co-authored by state Senators Lou Correa, Jerry Hill, Mark Leno, Ted Lieu and Fran Pavley; and by Assembly members Toni Atkins, Raul Bocanegra, Tom Ammiano, Richard Bloom, Susan Bonilla, Rich Gordon, Kevin Mullin, Sharon Quirk-Silva and Norma Torres.

The 1765 Stamp Act was so onerous that it was lasted only a year before it was repealed. If passed, the California Stamp Act, SB 391, might meet a similar fate.

Related Articles

What Budget Crisis?

Mar. 19, 2010 I spend my days attending state Assembly and Senate committee hearings, trying to follow proposed legislation. Most

Public ‘onslaught’ stopped union PLA bid

July 1, 2013 By John Hrabe If you’re jaded about politics and question whether elected officials listen to their constituents,

Are you ready for another Revolution?

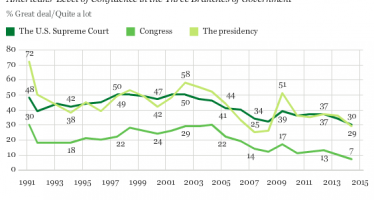

Here’s some good news for Independence Day: Americans are losing confidence in all branches of government, perhaps a portent of